Admiral Group FY Profits May Rise by 10%, Keen on Regaining Market Confidence

Admiral Group, the private motor insurance and related products company, expects to report a rise in pre-tax profits around 10% for the full year 2011 as it is scheduled to deliver its preliminary earnings on 7 March, 2012.

With insurance coverage of over 3 million vehicles, Admiral's UK vehicle count has grown by more than 20% during 2011. This provides the group a good base to sustain its long term business growth and profitability. The international insurance business of Admiral also achieved strong growth and improved operating results.

If Q4 insurance claims are the same as in Q3, it is expected by Admiral that there would be a small improvement in the aggregate projected ultimate loss ratios for the back years (2000-2009) at the end of the year. The occurrence and anticipated cost of new large personal injury claims are above historical levels for the group though consistent with the trend in first half of 2011.

This is expected to result in an unfavourable full year on the projected ultimate loss ratios for 2010 and 2011 followed by adverse reserve movements and profit commission.

The Admiral board is confident that with the group's enlarged customer base and significant combined ratio advantage help the group to have a strong position for sustained long-term growth and good news in 2012 and beyond. During the six months ended 30 June, 2011, Admiral reported another record half-year profit before tax of £160.6 million, 27% ahead of H1 2010, while the group's turnover rose 53% to £1.1 billion.

Credit Suisse forecasts Admiral's full-year 2011 pretax profit to be 295 million pounds, up 11 per cent year-on-year, and in line with the circa 10 per cent growth guidance provided in the company's third-quarter interim management statement.

"We expect FY11 results on 7 March to represent the first step for Admiral towards regaining market confidence that bodily injury (BI) challenges are being resolved, with improved clarity expected to provide upside risk to earnings expectations," Credit Suisse said in a note.

In January, Admiral announced make-shift plans to lease a new 77,000 sq ft office building for 20 years in Newport city centre as part of its continued commitment to south Wales. The new building will form part of Scarborough Development Group's redeveloped Cambrian Centre in Queensway. The group will occupy the new premises by the end of 2013 and it has capacity to accommodate around 1,200 staff members.

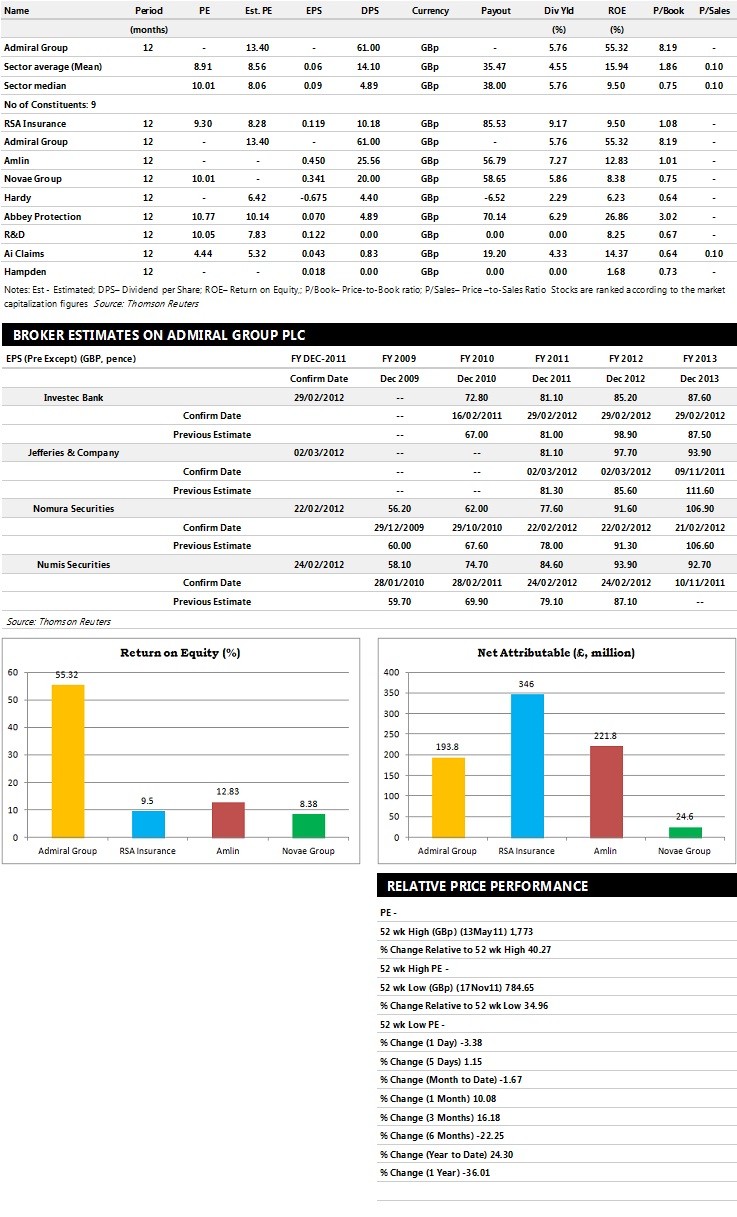

Brokers' Views:

- Jefferies recommends 'Buy' rating on the stock with a target price of 1269 pence per share

- Investec Bank assigns 'Sell' rating

- Numis Securities gives 'Hold' rating

- Nomura Securities assigns 'Outperform' rating with a target price of 1100 pence per share

- Credit Suisse recommends 'Outperform' rating with a target price of 1300 pence per share.

Earnings Outlook:

- Jefferies estimates the company to report revenues of £429.70 million and £505.60 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £300.20 million and £364.30 million. Earnings per share are projected at 81.10 pence for FY 2011 and 97.70 pence for FY 2012.

- Investec Bank projects the company to record revenues of £312.90 million and £325.20 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £297.90 million and £313.20 million. Profit per share is estimated at 81.10 pence and 85.20 pence for the same periods.

- Numis Securities expects Admiral to earn revenues of £2095.40 million for the FY 2011 and £2400.40 million for the FY 2012 respectively with pre-tax profits of £290.30 million and £316.30 million. EPS is projected at 84.60 pence for FY 2011 and 93.90 pence for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents nine companies based on market capitalisation.

© Copyright IBTimes 2024. All rights reserved.