AMEC Expects Double-Digit Growth in FY 2012, But JP Morgan Cazenove Cuts Rating

AMEC Plc is expected to recommend a final dividend of 20.3 pence per share as it anticipates double-digit underlying revenue growth for the FY 2012, but JP Morgan Cazenove cuts its recommendation on the firm to "Neutral" from "Overweight" in a review of the European oil services sector and raises price target to 1,344p from 1,252p.

The dividend is payable to shareholders on July 2, 2012 bringing the total dividend for the year to 30.5 pence per share, a 15 percent increase over 2010. AMEC is scheduled to release its interim management on April 16, 2012.

"Several oilfield services companies are already booked out for most of this year, and oil companies are signaling early concerns that a lack of the assets, that are so critical to fulfilling their exploration and field development ambitions, could start to cause delays," JP Morgan Cazenove said in a note to its clients.

The provider of consultancy, engineering and project management services continues to look for other suitable acquisitions which facilitate it to expand its geographical presence in line with its Vision 2015 objectives. The group's priority remains to deliver consistent and excellent services to its customers.

JPMorgan Cazenove says it sees risks and opportunities for AMEC and cuts rating as it sees relatively little pricing benefit through the cycle. Regardless of the economic and political climate, the group remains focused on what it is good at. The board has decided to commence a share buyback programme of £400 million, which is expected to be completed over the next 11 months.

"We are seeing increasingly definitive signs that a lack of available supply for oilfield equipment and services will lead to a tightening in the market and a return to the inflationary cycle that was so evident in 2005-07," JPMorgan Cazenove added.

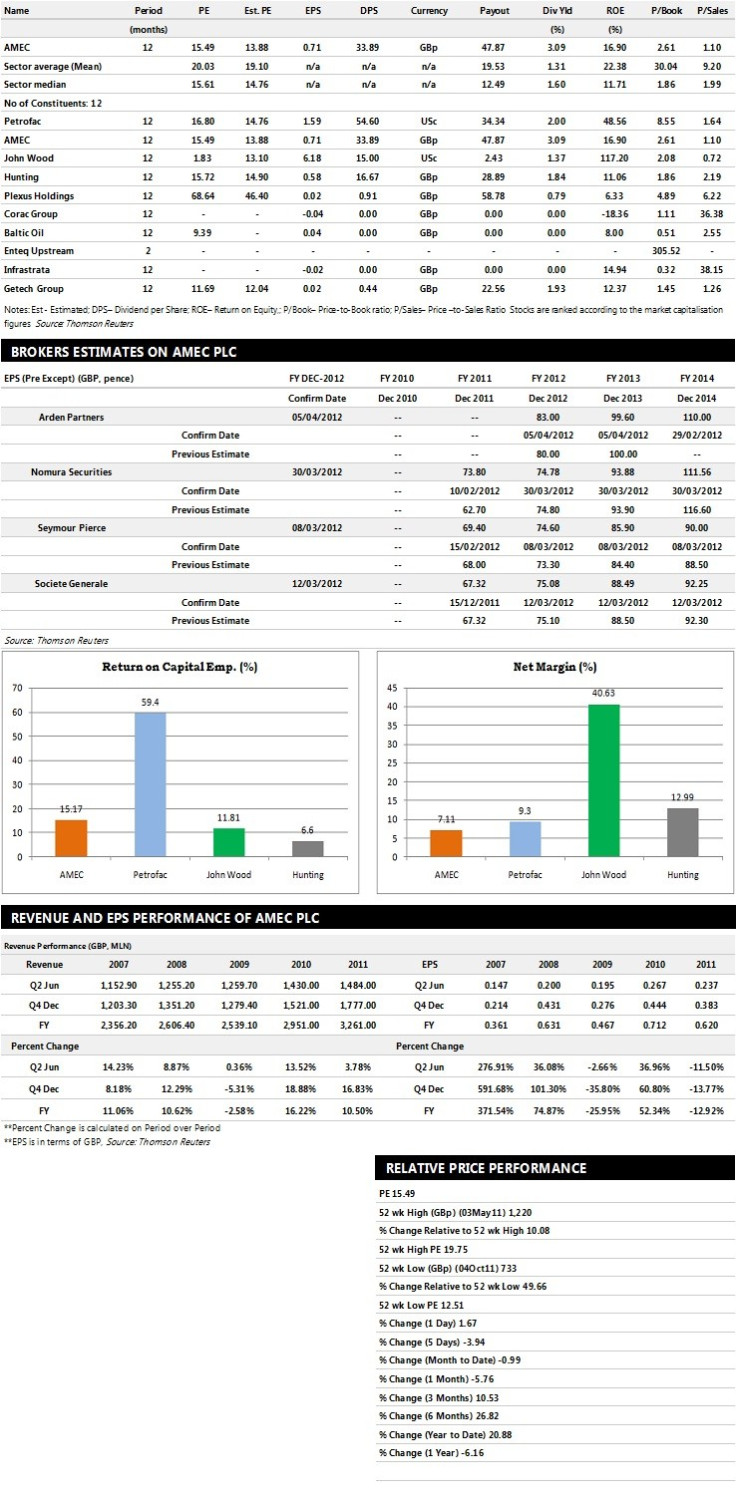

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Arden Partners recommends 'Buy' rating on the stock

- Nomura Securities recommends 'Outperform' rating with a target price of 1240 pence per share

- Charles Stanley assigns 'Outperform' rating with a target price of 550 pence per share

- Societe Generale assigns 'Outperform' rating with a target price of 1320 pence per share

- Seymour Pierce assigns 'Buy' rating with a target price of 1250 pence per share.

Earnings Outlook:

- Arden Partners estimates the company to report revenues of £3,766 million and £4,198 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £350 million and £386 million. Earnings per share are projected at 83.00 pence for FY 2012 and 99.60 pence for FY 2013.

- Nomura Securities projects the company to record revenues of £3,822 million for the FY 2012 and £4,377 million for the FY 2013 with pre-tax profits (pre-except) of £312 million and £367 million respectively. Profit per share is estimated at 74.78 pence and 93.88 pence for the same periods.

- Societe Generale expects AMEC to earn revenues of £3,818 million for the FY 2012 and £4,022 million for the FY 2013 with pre-tax profits of £326 million and £359 million respectively. EPS is projected at 75.08 pence for FY 2012 and 88.49 pence for FY 2013.

© Copyright IBTimes 2024. All rights reserved.