Barclays in Crisis: Bank of England Implicated in Libor Rigging

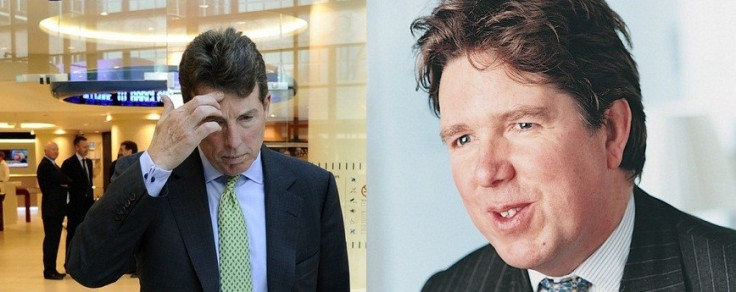

One of the most senior policy makers at the Bank of England, Paul Tucker, was dramatically implicated in the Libor-rigging scandal after Barclays officials unveiled an internal memo sent by outgoing CEO Bob Diamond to his predecessor John Varley.

The memo, dated 29 October, 2008, reads: "Further to our last call, Mr Tucker reiterated that he had received calls from a number of senior figures within Whitehall to question why Barclays was always towards the top end of the Libor pricing. Mr Tucker stated the levels of calls he was receiving from Whitehall were senior and that, while he was certain that we did not need advice, that it did not always need to be the case that we appeared as high as we have recently."

The explosive suggestion that a senior Bank of England figure implicitly suggested that Barclays file misleading submissions in the setting of the benchmark London Interbank Offered Rate, or Libor, is likely to have far-reaching implications for Tucker, Diamond, Governor Mervyn King and the recently established parliamentary inquiry announced Monday by Chancellor George Osborne.

Tucker, deputy governor for financial stability, has long been considered one of the favourites to succeed King when he tenure at the Central Bank comes to an end next year and has worked at Threadneedle Street for more than three decades.

Barclays Chief Executive Bob Diamond quit his job Tuesday, the biggest scalp in a financial markets scandal that has also seen the chairman announce his intention to resign and sown the seeds for another investigation into Britain's banking sector.

Jerry del Missier, appointed only in June as chief operating officer at the bank, resigned hours after Diamond left.

Documents released by Barclays say that del Missier was responsible for ordering others to report lower than actual borrowing rates.

The bank released a memo by Diamond recounting a conversation with a Bank of England official. Barclays said Diamond discussed the call with del Missier, who wrongly concluded that the Bank of England had instructed Barclays to keep its submissions lower.

The resignations, which took effect immediately, come a day after chairman Marcus Agius fell on his sword, too. However, Agius will leave the company only after a new chairman is found and will lead the search for a new chief executive. He will take on Diamond's responsibilities until a new CEO is appointed.

Diamond will appear before the UK's Treasury Select Committee on Wednesday.

© Copyright IBTimes 2024. All rights reserved.