RIM's Last Chance: Can BlackBerry 10 Succeed?

RIM is launching BlackBerry 10 this week along with two smartphones. It's seen as the last hope for the Canadian manufacturer - but can it succeed? Technology editor David Gilbert investigates.

Must Read:

Five Reasons BlackBerry 10 Will Succeed

Five Reasons BlackBerry 10 Will Fail

In an article published on 18 August, 2009 Fortune magazine named Research in Motion as the fastest growing company in the world. The opening paragraph of the article shows just how big the company was seen then, but gives a prophetic warning of the challenges to come:

"Locked in an epic battle with Apple's iPhone, Research in Motion has managed to grow bigger and more dominant than ever. But the competition is about to get tougher."

And how the competition has gotten tougher. Two days ahead of the launch of BlackBerry 10, Strategy Analytics has released its latest smartphone research, which suggests that iOS and Android between them share 92 percent of the market - leaving very little room for anyone else. According to IDC research, RIM currently has 4.6 percent of the smartphone market.

First

RIM, it could be argued, produced the first ever smartphones back in the early years of the millennium. The early BlackBerrys, such as the 850 and 857, were a revelation, with support for push email, internet faxing and web browsing.

While they were a world away from the app driven eco-systems of Apple and Android we have today, the BlackBerrys offered for the first time, the ability to truly stay connected while on the move.

With its truly secure platform and iconic physical QWERTY keyboard (which is where the phones got their name by the way) BlackBerrys became a vital tool for many businessmen and women around the world.

By the beginning of 2009, RIM had captured 20 percent of the smartphone market, making it the second biggest player in the world behind Nokia, and well ahead of Apple which had launched the iPhone two years previously.

It had a three year average earnings-per-share growth of 84 percent and revenue growth of 77 percent.

At that stage BlackBerrys had grown from being a business tool, to being a more consumer-friendly device. In 2008 RIM began its first TV campaign aimed at non-business users with BlackBerry Messenger the big selling point for teenagers, giving them free messaging to everyone else on the BlackBerry platform.

During his 2008 presidential election campaign Barack Obama used a BlackBerry which analysts claimed was worth up to $25 million for the Canadian company. By the middle of 2011 RIM had grown its user base to 70 million globally and looked set to remain a powerful force in the smartphone market.

Future is bright

The future should have been bright for RIM. At the time only 13 percent of the phones bought were smartphones; today that figure is almost 50 percent. There has been huge growth in the sector over the past four years, but sadly for RIM, it has not taken advantage.

While RIM's market share has remained steady, and even grown slightly, it has been overshadowed by the growth of Android and iOS in the last two years. RIM's market share in the US has all but dried up, and after a series of technical problems, as well as well-publicised leadership issues at the company, it came into 2013 struggling to survive.

The launch of BlackBerry 10 this Wednesday, along with the BlackBerry Z10 and BlackBerry X10 smartphones, is seen by many as a final chance for RIM to remain as a significant player in the smartphone business.

The company's CEO Thorsten Heins has already indicated it will consider licencing the BB10 operating system and many believe that if the new software and accompanying phones fail to grab the attention (and more importantly the money) of the public then it could be forced to sell off its remaining IPs, which are the most valuable asset RIM has.

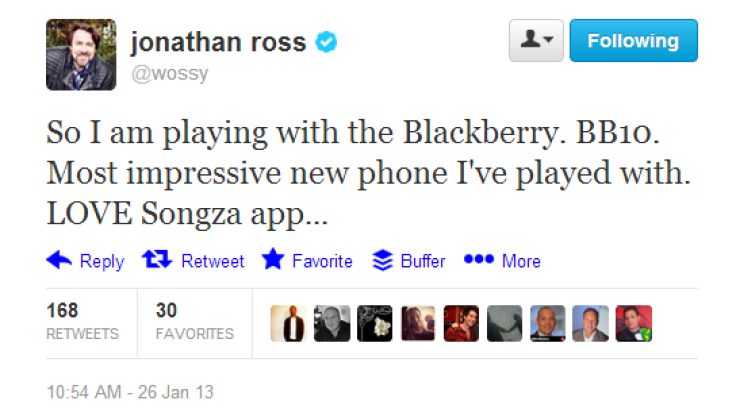

Along with the launch of BB10 on Wednesday in six cities around the globe, RIM will run an ad for BB10 during the high-profile and hugely-expensive Super Bowl half-time slot next month. The company has also seeded some early BlackBerry Z10 handsets to celebrities, with Jonathan Ross tweeting how much he loved the new phone over the weekend.

However all this may not be enough to save the troubled company. Jan Dawson, chief telecoms analyst at Ovum believes the new platform will only provide a "temporary boost" in performance but "no salvation for RIM."

"RIM continues to face the twin demons of consumer-driven buying power and a chronic inability to appeal to mature market consumers. There is nothing in what we've seen so far of BB10 that suggests it will conquer the second of these demons, and the first is utterly out of RIM's control."

However Dawson doesn't mean this is the end for RIM in the short term: "We don't expect a speedy exit from the market; with no debt, 80 million subscribers and profitability in the black in at least some recent quarters, the company can continue in this vein for years. But its glory days are past, and it is only a matter of time before it reaches a natural end."

And that is the most likely outcome. RIM's market share has dropped to a level which is sustainable, but growth looks highly unlikely. If rumours about the price of the new smartphones from RIM are to be believed, then it won't be able to compete on price with the vast swathe of budget Android devices out there, while RIM no longer commands the brand loyalty which Apple still manages to secure.

IBTimes UK will be attending the London launch of BlackBerry 10 bringing you all the latest news, reviews and interviews from the event.

© Copyright IBTimes 2024. All rights reserved.