Autumn Statement 2014: Osborne abolishes stamp duty 'slab system' to parry Labour's 'unworkable' mansion tax

Britain's Chancellor George Osborne has unveiled a raft of new reforms to stamp duty in a bid to curb rocketing house prices and hit back at what he called the "unworkable" mansion tax pledged by Labour.

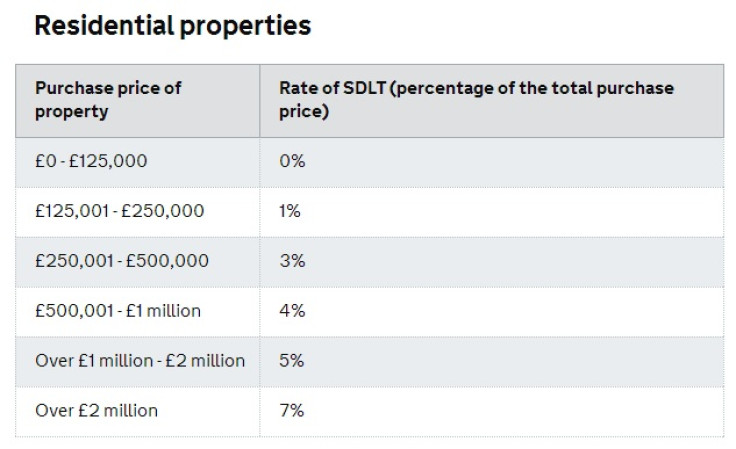

During his Autumn Statement 2014 announcement in the House of Commons, Osborne confirmed that as of midnight tonight, Whitehall will help "98% of homebuyers" by abolishing the stamp duty "slab system" [Figure 1].

Stamp duty works on a "slab" basis, by which the percentage paid applies to purchase price band. This can have a distorting effect on the housing market, because a house is very difficult to sell at prices just above each threshold, for example, £250,001.

"The stamp duty payments have become a burden for ordinary families especially when rising house prices have pushed properties into a higher tax bracket," said Osborne.

"However only homes that cost just over £937,000 will see their stamp duty bill go up under this system."

There will 12% rate for most expensive houses and tax will only be paid on the portion of the housing cost falling into one of the tax brackets.

Office for National Statistics data, house price annual inflation was at 12.5% in England, 5.8% in Wales, 7.6% in Scotland and 10.9% in Northern Ireland.

The average UK house price in September 2014 stands at £273,000 (€342,025, $427,614) compared with £274,000 in August.

The regional breakdown showed that the average property price in England stood at £285,000, £172,000 in Wales, £143,000 in Northern Ireland and £197,000 in Scotland.

In October, the HMRC reported that the UK government raked in an additional £1.5bn in residential property stamp duty over the last 12 months.

Whitehall took £6.45bn in yield from house sales – a 31% increase from the previous year when it took £4.9bn.

Breaking it down, the majority of transactions took pace in England, accounting for 95%; 3.3% of sales happened in Scotland; 1.4% in Wales; and just 0.3% in Northern Ireland.

Well over a third (£2.72bn) of the income came from London, and 21% from the South East, according to the data.

Britain's main opposition Labour has proposed raising the tax on properties valued above £2m but it has been met with fierce criticism from some members of the public and celebrities which claim that soaring UK house prices have involuntarily pushed their homes into a higher tax bracket than when they bought it.

The proposed mansion tax would result in those property owners being annually charged £3,000 while that bill could rise to £19,000 for more pricey homes.

However, the Conservative-led coalition has already tried to appease the electorate with taxing more wealthy property owners with a different form of tax, while also trying to alleviate a housing shortage across the country.

Stamp duty will be cut for 98% of people who pay it - only the highest value residential properties will pay more

Under the old rules, you would have paid Stamp Duty Land Tax at a single rate on the entire property price. Now, you will only pay the rate of tax on the part of the property price within each tax band – like income tax.

Under the old rules, if you bought a house for £185,000, you would have had to pay 1% tax on the full amount – a total of £1,850. Under the new rules you don't start paying tax until the property price goes over £125,000, and then you only pay tax on the price of the property within the tax bands over that price.

Under the new rules, you'll pay nothing on £125,000 and 2% on the remaining £60,000. This works out as £1,200, a saving of £650.

This will make the system fairer, and means stamp duty will be cut for 98% of people who pay it.

Source: UK Treasury

Last year, Osborne confirmed in the Autumn Statement, that foreign property investors would have to pay capital gains tax (CGT) in a bid to prevent a housing bubble from forming and to rake in lucrative reserves for the Treasury.

People living in Britain pay 18% CGT and 28% if they make a profit when reselling a property that is not classified as their main home.

People who own properties in the UK and are deemed non-residents are currently exempt from CGT.

© Copyright IBTimes 2024. All rights reserved.