California Issues Bitcoin Foundation With Cease and Desist Notice

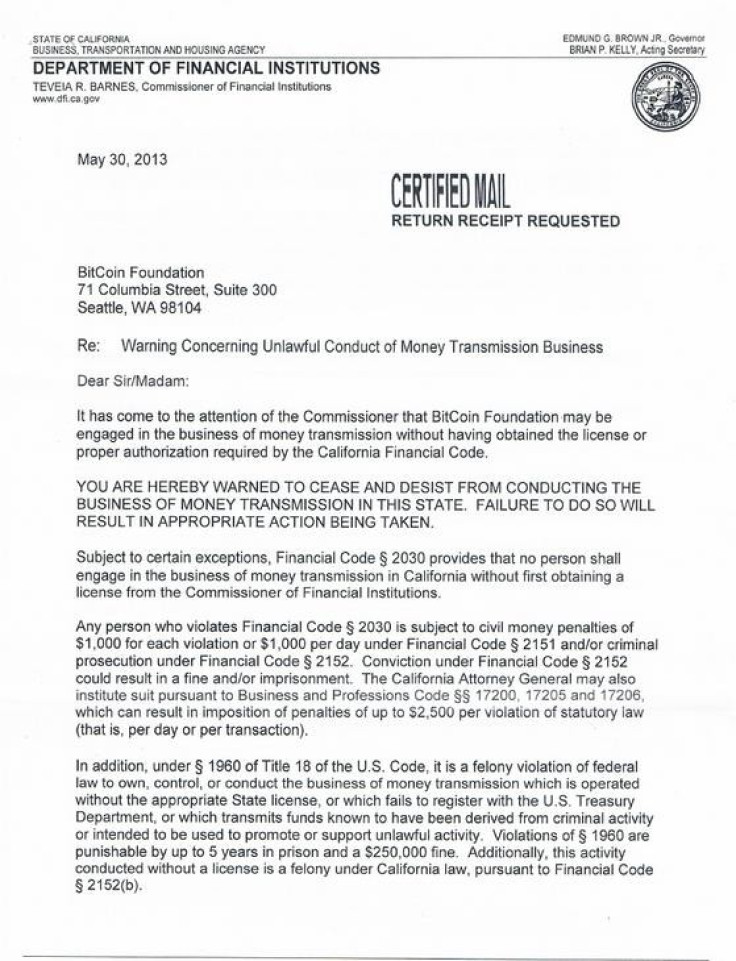

California's Department of Financial Institutions has issued a cease and desist warning to Bitcoin Foundation for allegedly engaging in the business of money transmission without a license.

If found guilty, the conference organiser for Bitcoin, the decentralised digital currency, could face fines of $1,000 - $2,500 (£650 - £1,600) per violation, or per day if violations are less frequent; the notice adds that further criminal prosecution could result in five years in prison and a fine of up to $250,000 for individuals behind the transmissions.

Must Read: What is Bitcoin and how does it work?

The notice, sent to the foundation but not addressed to anyone directly, states: "It has come to the attention of the Commissioner that Bitcoin Foundation may be engaged in the business of money transmission without having obtained the license or proper authorisation required by the California Financial Code.

"You are hereby warned to cease and desist from conduction the business of money transmission in this state. Failure to do so will result in appropriate action being taken."

A nonprofit corporation registered in Washington, DC, Bitcoin Foundation's role is to standardise and promote the open source Bitcoin protocol, receiving financial support from individuals and corporations who use the digital currency.

The only problem is that Bitcoin Foundation doesn't appear to be involved in making financial transactions at all, and is instead concentrated on promoting best practices for using the currency among its subscribing members.

Speaking to IBTimes UK, Jon Matonis, board director of Bitcoin Foundation, said the letter was not received by him until two weeks after the 30 May date stated within it, adding: "I can say that the Bitcoin Foundation is not engaged in money transmission and we should view this is an opportunity to educate state regulators on issues related to the Bitcoin industry."

It isn't yet clear if California's bank regulators have got the wrong target, or have issued similar notices to other Bitcoin-related companies, signifying a wider crackdown on the currency.

Traded through a peer-to-peer network, Bitcoin has no centralised bank through which transactions pass. Instead, the digital currency is transferred directly from the computer of one user to another in order to pay for online good and services.

Boom and bust

The currency gained widespread media attention earlier this year when its valued soared and immediately crashed, followed by days of hacking and attacks on exchanges like Japan-based Mt. Gox, which are used to transfer Bitcoins into real-world currencies like dollars and pounds, and visa versa.

The news comes just days after Mt. Gox, the world's largest Bitcoin exchange and responsible for 70% of global transactions, suspended users from withdrawing their Bitcoins as US dollars for two weeks.

The exchange said in a statement last week: "We are currently making improvements to process withdrawals of United States Dollar denominations, and as a result are temporarily suspending cash withdrawals of USD for the next two weeks.

"Please be reassured that USD deposits and transfers to Mt. Gox will remain unaffected, as will deposits and withdrawals in other currencies, and we will be resuming USD withdrawals once the process is completed."

The move will doubtless go down badly with customers, especially as Mt. Gox is currently being sued by CoinLab, another Bitcoin exchange, for $75m (£48m) on allegations that it had failed to deliver on a deal that would see Mt. Gox offload much of its US customer base to the Seattle-based CoinLab.

© Copyright IBTimes 2024. All rights reserved.