Brent hits over five-and-a-half-year low amid supply glut

Brent February contract falls to $56.74 in intra-day trade

Brent crude traded lower for a fourth session on 30 December, with prices dropping to an over five-and a-half-year low, amid a global supply glut and the possibility of a mini-rally following output disruptions in Libya.

Brent February contract was trading 1.80% lower to $56.84 a barrel at 0900 GMT after dropping to $56.74 in intra-day trade, the lowest level since May 2009.

US February contract was trading 1.44% lower to $52.84 a barrel after tumbling to an intra-day low of $52.70, also its lowest since May 2009.

Forecasts for a 900,000-barrel draw in US oil stocks last week checked further losses. The American Petroleum Institute (API) is scheduled to release its report later in the day, while the US Department of Energy's Energy Information Administration (EIA) will release its inventory data on 31 December.

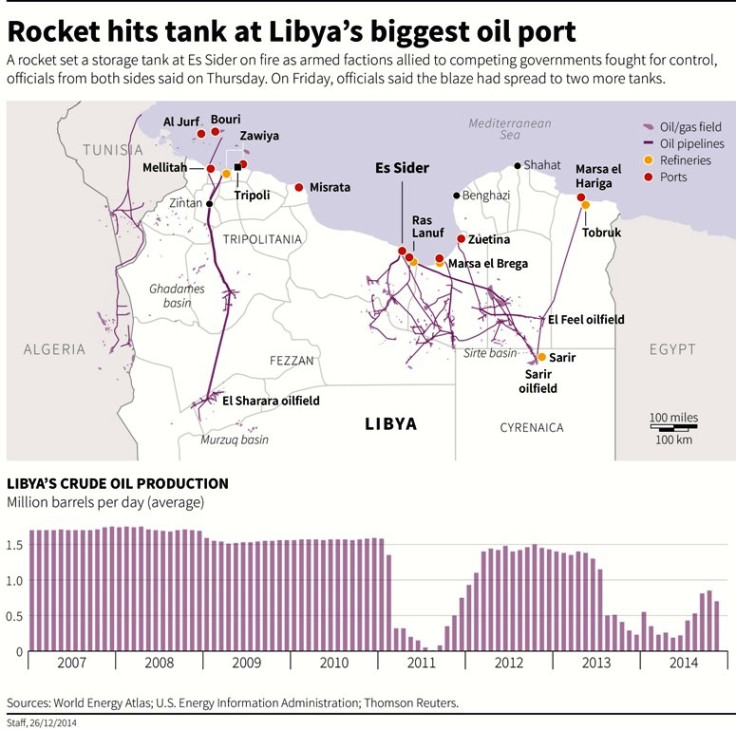

Prices also drew support from supply disruptions in Libya. The Opec member is producing 128,000 barrels per day from oil fields linked to the eastern port of Hariga after fighting halted operations at the key export terminals of Es Sider and Ras Lanuf.

Ken Hasegawa, commodity sales manager at Newedge Japan forecast that Brent could drop to $55 a barrel and US crude to $50 a barrel early next year.

Hasegawa told Reuters: "There's no sign of any reduction of output by OPEC."

Michael McCarthy, chief market strategist at Sydney's CMC Markets, said: "A potential surprise draw in US oil stocks would give a short-term fillip to the upside.

"Libya is not a major producer but the disruption could be a trigger for a mini-rally."

Oil prices have almost halved since June this year. Prices have fallen over 20% since Opec refused to cut output on 27 November despite a global supply glut.

© Copyright IBTimes 2024. All rights reserved.