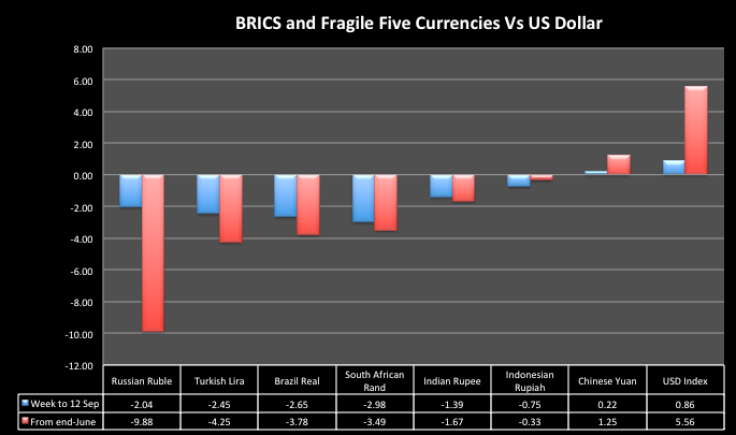

BRICS and 'Fragile Five': Ruble Worst Performer Followed by Lira, Yuan and Rupiah Best

Of the three "fragile five" currencies which are also members of the Brics community - the Indian rupee, Brazilian real and South African Rand - the Indian unit has been the least fragile in the recent past, an IBTimes UK study shows.

Out of the remaining two, the Turkish lira has been more volatile, while the Indonesian rupiah has been the best, even compared to the Brics group currencies.

The Russian ruble is not in the fragile list but that was the one seen the steepest fall as geopolitical tensions escalated on the Russia-Ukraine border. The unrest had also weighed on Turkey too, another close by nation in the region.

Of all these emerging market currencies, the Chinese yuan was the only one that has been appreciating, despite sharp gains in the US dollar index, thanks to the stringent exchange rate policy and upbeat economic performance of the world's second largest economy.

As the market braces for the 17 September FOMC meeting, people are assessing the likely impact of the ending of the Fed's asset purchase tapering, which is on track to complete within about a month.

That is an event more or less priced in - but the Fed guidance on the first rate hike will be a very important portion in the statement. It will be even more important for the emerging market currencies.

'Fragile Five' is the term coined by a Morgan Stanley analysts in 2013 to together call Turkey, Brazil, India, South Africa and Indonesia, which are considered the most dependent on unreliable foreign investment to finance their growth ambitions. It compares to Jim O'Neill's BRICS - the group of the five largest emerging economies.

Chinese Yuan

The Chinese currency has rallied 0.22% in the week to 12 September and 1.25% since July. The yuan has been on the rise since reversing the direction from a 17-month low in April and is now trading at a six-month high.

That yuan has competed is fourth straight monthly rally in August. It is up 2.3% from the April low so far and another 1.4% rally will take it back to the February high of 6.0407, where the Peoples Bank of China steeped in to arrest the yuan's gains.

Now that even a sharply rallying dollar could not prevent the yuan rally, any negative surprise in the Fed policy will make the yuan rise faster.

Russian Ruble

The ruble fell to a new multi-year low of 37.77, down 0.66% on the day, and more than 2% in the week.

It had ended July and August lower and has fallen nearly 10% since the end of June when the Russia-Ukraine issues started escalating.

Indian Rupee

The rupee has touched a one-month low of 61.06 this week before recouping a portion of that on Friday and it ended the week 1.39% weaker.

Broadly, the rupee has been on a weakening trend ever since hitting an 11-month high of 58.23 in May. It is now down 4.6% from the May high.

However, charts show that a decisive closing break above 62.0 by the USD/INR is necessary to weaken the rupee's uptrend since last year August.

Indonesian Rupiah

Broadly, the rupiah is on a downtrend since reversing the direction from the five-month high of 11,271 touched in April.

This week it touched a two-month low of 11,889 before reversing some of the losses and ended the week just 0.75% down.

When compared to the end-June level, the rupiah is even more stable - it is just 0.33% down since then.

Brazil's Real

The real has fallen to a one-month low of 2.3014 on Wednesday and it is down 2.65% so far in the week.

The near 6% rally in the dollar since end-June has helped the 3.5% drop in the real during the same period.

By falling another 60 pips, the Latin American unit will hit its lowest in five months.

Turkish Lira

The lira has fallen to a five-month low of 2.2140 this week and was down 2.4% in the week too.

Turkey's trade prospects too were weakened by the Russia-Ukraine unrest, and the same is reflected by its currency.

The lira is down more than 4.2% since end-June, second only to Russian ruble in the combined group of 'fragile five' and BRICS.

South African Rand

The rand has dropped to a more than six-month low of 11.0217 against the dollar this week. From last Friday, the rand is down nearly 3%, the worst performer from both the currency groups.

The South African currency has been on a weakening trend since the last week of May. It has fallen 3.5% since end-June when geopolitics started helping the dollar.

USD Index

The dollar index, the gauge that measure's the greenback's strength against a basket of six major currencies on a trade-weighted basis, has skyrocketed to a 14-month high of 84.5 on 9 September.

The index that has been up for third straight month, saw some profit taking after hitting the peak but has been closing higher again, since Wednesday.

At the high of 9 September, the USD index was up 0.86% from last Friday and 5.9% from end-June.

© Copyright IBTimes 2024. All rights reserved.