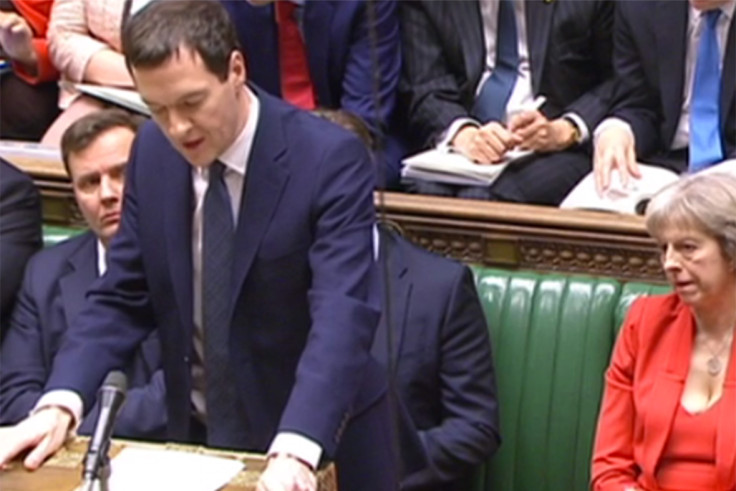

Budget 2016: George Osborne pledges to raise £9bn in crackdown on internet retailers avoiding VAT

Chancellor George Osborne has abolished rates for small businesses and slashed corporation tax for multi-national firms in an effort to appeal to Britain's "nation of shop-keepers" and lure more major firms to the UK.

He also announced a raft of new measures to raise £9bn (€11bn, $12.6bn) by cracking down on tax avoidance, preventing internet retailers from avoiding VAT and blamed the former Labour government for allowing firms to exploit loopholes in the British tax code.

The cuts to business rates for small businesses will see 600,000 small businesses save more than £6,000 per year, but will likely alarm local councils which will see a significant fall in revenue. Osborne also said that half of all properties in the UK will pay no or significantly less rates. He also pledged to cut commercial stamp duty so that 90% of companies will pay less, with 0% for properties up to £150,000 and up to 5% for properties about £250,000.

Osborne also set out new tax relief for those using websites such as Airbnb and eBay to rent out their homes or sell items online. They will qualify for two new tax free allowances worth £1,000 per year.

He rebuffed allegations that the Conservative Party caters for the rich rather than the poor by revealing that the richest 1% of Britons currently pay 28% of tax, the highest level ever, and blamed the former Labour government for allowing firms and individuals to avoid tax using loopholes in the law.

He also slashed tax for the North Sea oil industry, effectively slashing revenue tax on petroleum, and taunted members of the Scottish Nationalist Party (SNP) in parliament by arguing that if Scotland had chosen to leave the UK it would face an economic crisis.

© Copyright IBTimes 2024. All rights reserved.