Can you predict profit warnings?

IBTimes UK expert financial columnist Edmund Shing gives his tips for spotting potential profit warnings

Investors in BT Group and Pearson have been heavily stung by the recent profit warnings announced by both companies in recent days.

BT's share price slumped by 21% on the day of the warning, while Pearson shareholders lost 29% on January 17 when it warned.

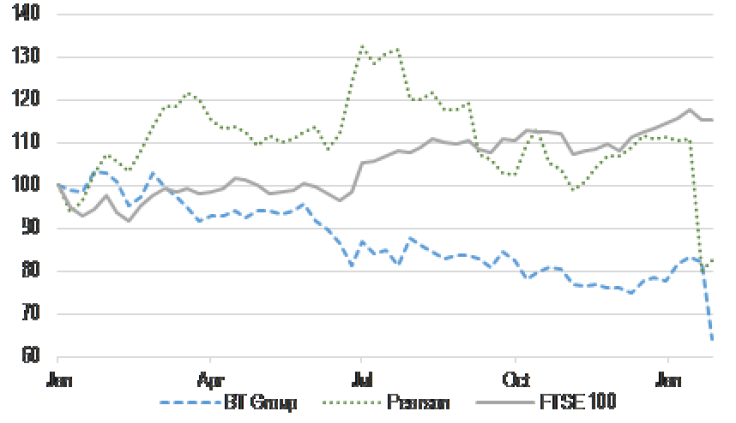

Clearly, these two members of the FTSE 100 index have done far worse than the index overall; the FTSE 100 has gained 15% since the beginning of last year, while Pearson has now fallen by 18% over the same period, and BT Group by an even worse 36% (see chart 1).

In the case of Pearson, this was not the first profit warning that the company had made, but in fact was the fourth such warning in the last five years.

Clearly, a number of problems facing Pearson have still not been resolved, notably the demand from the key US education market for textbooks which continues to decline quickly.

In the case of BT, this is perhaps more unexpected, as the origin of their profits warning can be found in an accounting scandal in its Italian telecoms operation, where senior executives used false accounting to overstate profits.

Watching for signs of potential problems ahead

While it is not always possible to predict potential profits warnings, there are some warning signs that investors can look for.

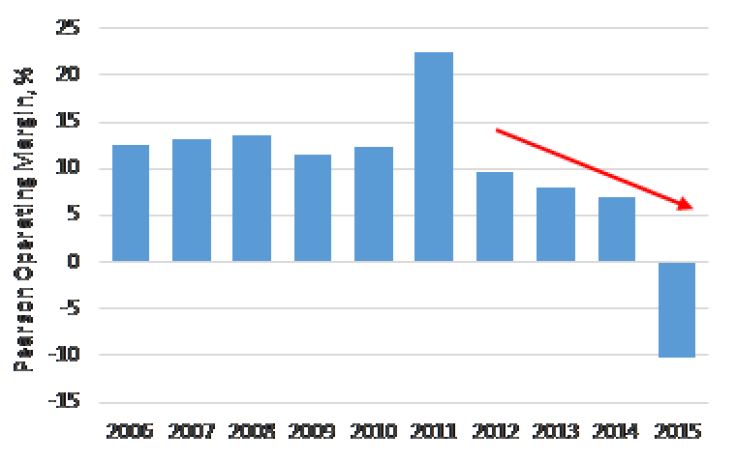

In the case of Pearson, this is somewhat easier to pinpoint. Given the litany of problems that Pearson has already had to contend with in the past few years, profitability has been suffering. Pearson's operating profit margin, a measure of how much profit Pearson makes per unit of sales, has been falling consistently since 2012 (see chart 2).

Between 2006 and 2011, Pearson consistently generated an operating profit margin of 12-13%. But from 2012 onwards, this was falling to 9%, then to 8%, and again to 7%, before tumbling to a loss in 2015.

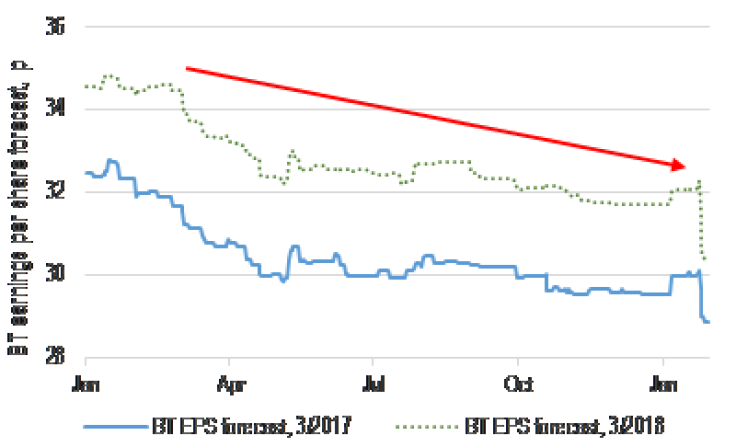

In the case of BT Group, financial analysts who study the company for a living have been growing more cautious in their profits forecasts, since the beginning of 2016. From this date up to the day before BT's profits warnings, they have cut their earnings forecasts for BT by 9% (see chart 3).

Should you be rushing in to buy either of these companies today, after the precipitous falls in share prices for each?

I would counsel against such aggressive action; after all, profits warnings are often like London buses – they never come alone, but typically in a group, one after another (as we have seen with Pearson).

Buying a stock market index gives safety through diversification

Instead, for those looking to invest in the stock market, I would advise exactly that – invest in the whole stock market, through a so-called index fund. An index fund such as one based on the FTSE 100 index, effectively gives the investor a one-stop shop to buying a little bit of each of the 100 companies in that index.

So while a FTSE 100 index fund would hold little bits of Pearson and BT, it also holds bits of 98 other UK-based companies too. Even if these two are doing badly, chances are that the other 98 are doing rather better.

But you don't have to confine yourself to indices of UK companies; the world of exchange-traded funds (ETFs) allows the investor easy access to stock markets across the globe in a few clicks.

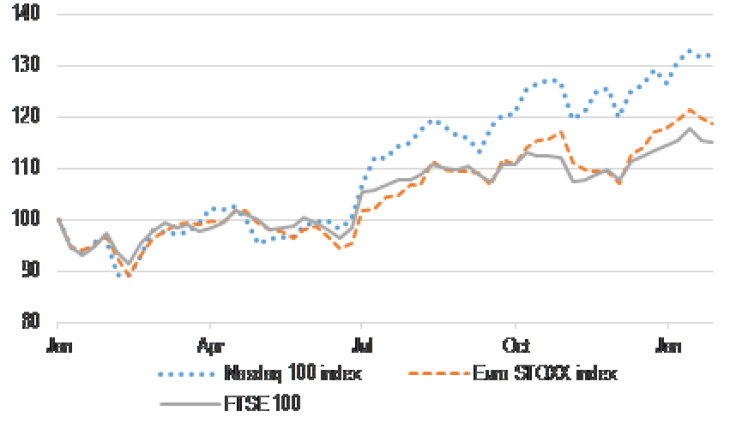

Two such stock market indices that are clearly beating the FTSE 100, from the viewpoint of a UK investor using pounds sterling, are the European stock market and the Nasdaq index in the US.

While the FTSE 100 has risen 15% since the beginning of 2016, the Euro STOXX index of Continental European stocks has gained 19% in pounds, while the Nasdaq has gained an even more impressive 32% thanks in part to the strength of the US dollar (see chart 4).

Cheap Index ETFs

A very cheap way to buy exposure to the 100 companies in the FTSE 100 index is via the Vanguard FTSE 100 UCITS ETF (code: VUKE). Vanguard effectively charge investors in this ETF an extremely low 0.09% annual management fee, or 90 pence per £1,000 invested.

If you want instead to invest in shares in Continental Europe (dominated by France, Germany and Switzerland), then the Vanguard FTSE Developed Europe ex UK UCITS ETF (code: VERX) is worth a look. This carries an annual management fee of only 0.12%, equivalent to £1.20 per £1,000 invested.

Finally, for investing in the technology-heavy US Nasdaq index, UK-based investors could look at the Powershares Nasdaq-100 UCITS ETF (code: EQQQ), which carries an annual 0.3% management fee for giving investors access to the likes of Apple, Microsoft and Amazon.

© Copyright IBTimes 2024. All rights reserved.