Carillion Sees Good Revenue Visibility in 2012 and Beyond, Secures 'Buy' Rating

Carillion Plc reported 2011 profits at the top of expectations and won a 10-year property management deal worth £700 million with Oxfordshire Council. Given the wider economic outlook, the group expects trading conditions to remain challenging in 2012.

The contract win comes as a welcome boost to Carillion ahead of its interim trading statement release on May 2, 2012. Earlier this month, the group lost out £2 billion worth of highway maintenance project with Sheffield City Council to infrastructure services firm Amey UK Plc.

However, with a strong and resilient business, good revenue visibility and a record pipeline of contract opportunities, it continues to target growth in support services together with the doubling of its revenues in the Middle East and in Canada, in each case to around £1 billion by 2015. Consequently, Carillion remains well-positioned to deliver further growth in 2012 and beyond.

"For Carillion, the contract is significant proving the bears that it can indeed win these large integrated supported services contract, which form the cornerstone of its support services strategy," Seymour Pierce Analyst Caroline de La Soujeole wrote in a research note.

The British support services and construction firm's underlying profit before tax rose 13 percent to £212.0 million for the period ended 31 December 2011, which were at the top end of analysts' estimates. Profit earnings per share rose 9 percent at 43.0 pence, while total revenues remained flat at £5.1 billion after the group reduced its UK construction and civil engineering divisions in favour of overseas markets.

"Previously it has been guiding to substantial growth in UK support services from 2012 onwards but now suggests that it expects trading conditions to remain challenging in 2012 but continues to target growth in support services," Seymour Pierce added.

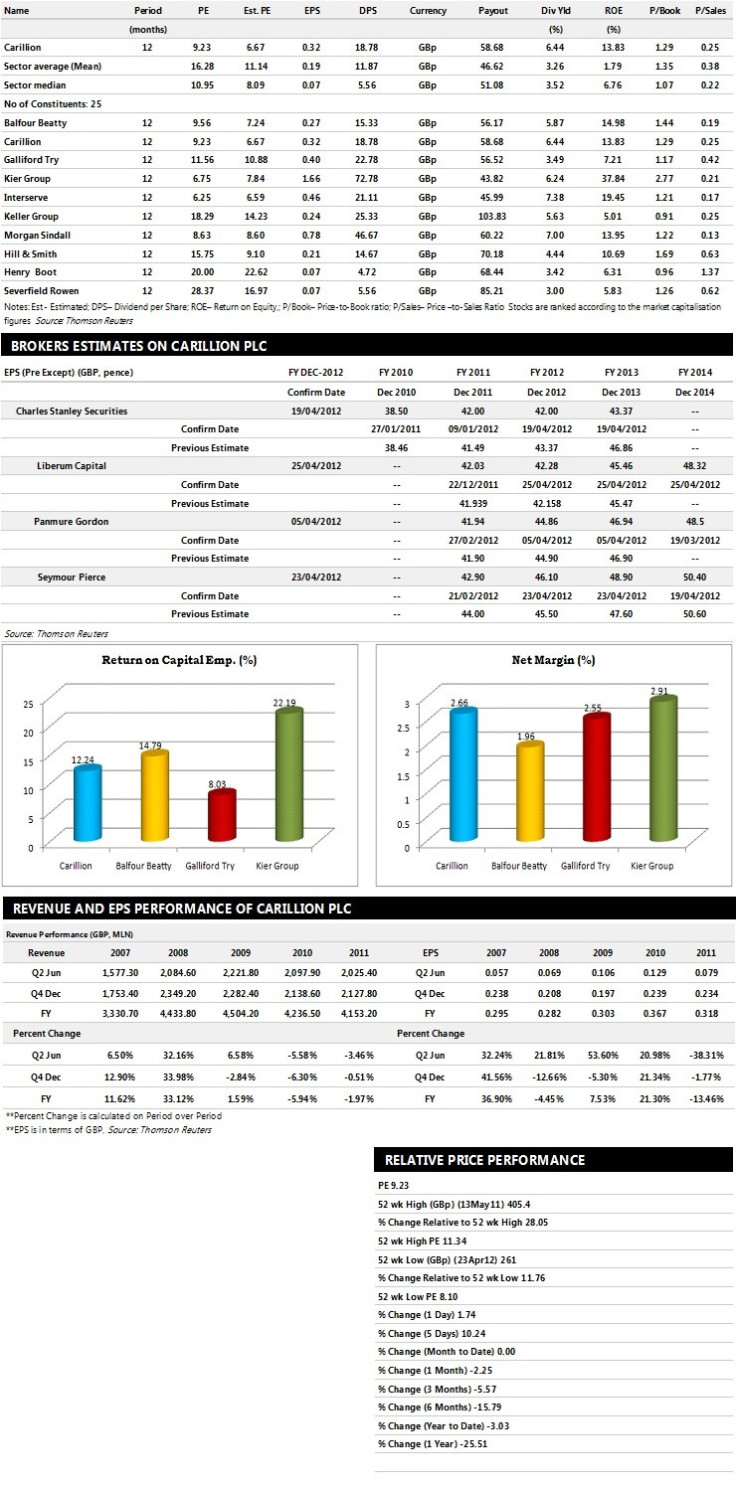

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Seymour Pierce recommends 'Buy' rating on the stock with a target price of 440 pence per share

- Panmure Gordon recommends 'Buy' rating with a target price of 400 pence per share

- Canaccord Genuity gives 'Buy' rating with a target price of 360 pence per share

- Liberum Capital assigns 'Hold' rating

Earnings Outlook:

- Liberum Capital estimates the company to report revenues of £4,313.45 million and £4,728.91 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £226.41 million and £244.64 million. Earnings per share are projected at 42.27 pence for FY 2012 and 45.45 pence for FY 2013.

- Seymour Pierce projects the company to record revenues of £4,980.50 million for the FY 2012 and £5,237.30 million for the FY 2013 with pre-tax profits (pre-except) of £235.20 million and £248.80 million respectively. Profit per share is estimated at 46.10 pence and 48.90 pence for the same periods.

- Charles Stanley expects Carillion to earn revenues of £4,225.80 million for the FY 2012 and £4,266.50 million for the FY 2013 with pre-tax profits of £224.80 million and £246.10 million respectively. EPS is projected at 42.00 pence per share for FY 2012 and 43.37 pence per share for FY 2013.

© Copyright IBTimes 2024. All rights reserved.