Coalition Mid-term Report: Is the Government Giving up on the Deficit?

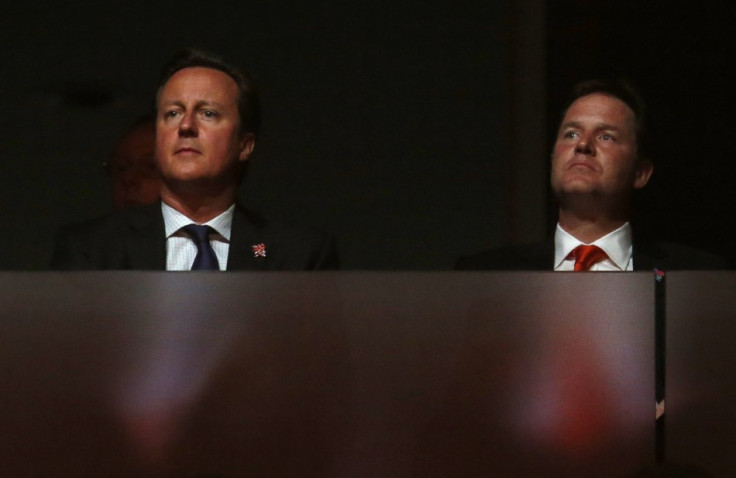

All things considered, Conservative Prime Minister David Cameron and his Liberal Democrat Deputy Nick Clegg, have established a close working relationship over the past two-and-a-half years of Coalition Government.

On 07 January 2013, the two leaders were yet again taking centre-stage for a Coalition Government: Midterm Review where the media were assured of their unwavering resolve and their working together for the national interest.

Never natural bedfellows - as we are reminded with the resignation of Lord Strathclyde, Conservative Leader of the House of Lords - they each have had perforce to make compromises which have taken the edge off the more severe cutbacks the Conservatives would otherwise have made whilst paying little more than lip service to the green issues so dear to the Lib Dem heart. This give-and-take and generally good working relationships between the two Party's workers has been a strength in keeping the Coalition together and also its weakness, laying it open to easy attack by the likes of Labour Leader Ed Miliband who said that Monday's Review was:

"...Empty promises, no real substance, no real detail."

Mr Miliband had a point that much was being made of little or nothing that we haven't already heard but really the big issue which dominated this particular conference was the announcement that legislation would shortly be forthcoming to help working families with childcare.

This will be most welcome news as presently about 27 per cent of parental income is spent on childcare at £5,000 per annum on average with higher expenditure in the likes of London. The cost of childcare to the Government is not insubstantial either with Lower Income Families Tax Credit costing £2 billion, Free Childcare for the first 15 hours per week for children between three and five years old costing £2.1 billion and a Working Parents Voucher Scheme adding a further £800 million annually.

Christopher Hope in The Telegraph on 07 January says that under this new scheme which is expected to be revealed in detail next week, families could be entitled to claim up to £2,000 per child, per year from their tax bills. The allowance will not be means-tested and so is open to all irrespective of income and will replace the current voucher scheme. It should pass in to law before the next General Election in 2015 and has the potential to produce a real boost to the economy. Mr Hope writes regarding the present set up:

"The result is that around one million women are believed to be missing from the workforce, deterred by often crippling fees for nurseries or childminders." Potential to unlock a lot of talent!

During the forthcoming weeks the Government promises to roll out a programme to include helping would-be homebuyers; a single-tier old age pension; capping care costs for the elderly; and building new roads through a system of toll charges.

Yet, whilst all this was emphasising the positive and we can all think of worthy causes, not just the Liberal Democrats, there was little by the way of explaining where any new income streams are likely to arise in an economy which is "bumping along a bottom."

Acknowledgement of the continuing need to bring the deficit down was all rather marginal but although not wishing to rain on anyone's parade, it still is one of the main reasons for the Coalition's existence. It is more than likely, the latest opinion polls aside, that when the electorate choose the next Government in 2015, the Coalition partners will be judged on the state of the economy and the Deficit/National Debt and how these will influence future spending patterns. Why we're in the mess everybody knows but if the situation is little improved the voters might be rather unforgiving.

The Chancellor, George Osborne's Autumn Statement in early December 2012 cut Corporation Tax to 21 per cent, scrapped a 3p Fuel Duty rise and raised the Tax-free Personal Allowance to £9,440 though he also catapulted 400,000 more people into the 40p rate of Income Tax. Over the next three years or so the tax changes will work to the Government's advantage by a couple of billions. Not enough! The deficit is showing every sign of stalling at near its current level of £120 billion.

The Liberal Democrats claim that their insistence on less severe welfare cuts and the substantial increase in the Tax-free Personal Allowance has helped struggling families. There may well be much merit in this argument but the fact remains that the Government's income figures are barely rising and much of the "efficiency" savings made by departments in Whitehall have been eaten up, in part by the increase in the cost of servicing the National Debt (£50 billion and rising).

Taking a look at figures from HMRC for 2011-2012, the UK Government's Income was £589.8 billion. The estimates for 2012/2013 (Oct 2012) show but a marginal improvement to £592 billion with Income Tax receipts down by an expected £3billion. Government spending on the other hand at £710.4 billion for 2011-2012 will barely change for this Tax Year and the Deficit could reduce by £1 billion to £120 billion - but then again it might not and be £6 billion either way.

Outlining a programme to help families makes for good politics but there was an underlining predicament that can't be ignored for long.

© Copyright IBTimes 2024. All rights reserved.