Compass Group to Dish Up Good Performance in FY 2012

Compass Group, the contract foodservice and support services group, has recently secured 'A-' long-term corporate credit rating from Standard and Poor's and remains very optimistic about the opportunities to grow the business.

The group is scheduled to report its pre-close trading update on March 27, 2012, when the current economic uncertainty is likely to put ongoing pressure on like-for-like volumes in parts of the business, the opportunities to grow the business is positive and its flexible cost base will enable it to respond quickly and effectively.

Compass is well placed to capitalise on the significant structural growth opportunities in both food and support services around the world and it is encouraged by the pipeline of new business.

Compass discovers growth potential across all its geographies, it is increasing its focus on expanding the presence in fast growing and emerging economies. It will also continue to drive cost efficiency, underpinning its expectation of further progress in operating margins over the medium-term. Strong cash flows should continue to enable both to reward shareholders and invest in value creating infill acquisitions.

S&P's rating reflects the group's strong business risk profile and leading global position in the food services industry, a position it maintains with a geographically diverse portfolio of well-established brands.

S&P anticipates that Compass' credit metrics will remain strong in 2012, economic uncertainty in established markets such as Europe could result in some cyclicality of revenues, particularly in the business and industry sector. Pricing flexibility for new and renewed contracts is also constrained by low barriers to entry and strong competition in the highly fragmented food services. Sovereign austerity measures and rising food input costs may also weigh on credit metrics.

The rating agency awaits a slight rise in gross debt at the end of 2012 to £2.1 billion from £1.9 billion in 2011, due to the higher European Medium Term Note (EMTN) issuance refinancing a smaller maturity.

Looking forward, S&P says the group has a positive outlook and reflects its view that Compass will maintain firm operating performance, credit metrics at levels comfortably higher than what S&P sees as commensurate with an 'A-' rating, and a conservative financial risk policy. Credit measures that it considers equal with the current rating are Funds from Operation (FFO) to adjusted debt of about 40 percent and adjusted debt to EBITDA of about 2.0x.

Positive rating action could occur if Compass were to sustainably maintain FFO to adjusted debt in excess of 45% and adjusted debt to EBITDA below 2.0x, despite ongoing acquisitive strategy and shareholder returns. The rating agency could revise the outlook to stable if Compass adopts a more aggressive financial policy, such as one that was significantly more shareholder-friendly. For example, an additional share buyback in 2013, and/or establishes an appetite for material debt-financed acquisitions. Although it is not its forecast scenario, rating downside could also arise if the group's operating performance were to deteriorate through significant loss of contracts or pressure on margins significantly below the levels demonstrated in 2009.

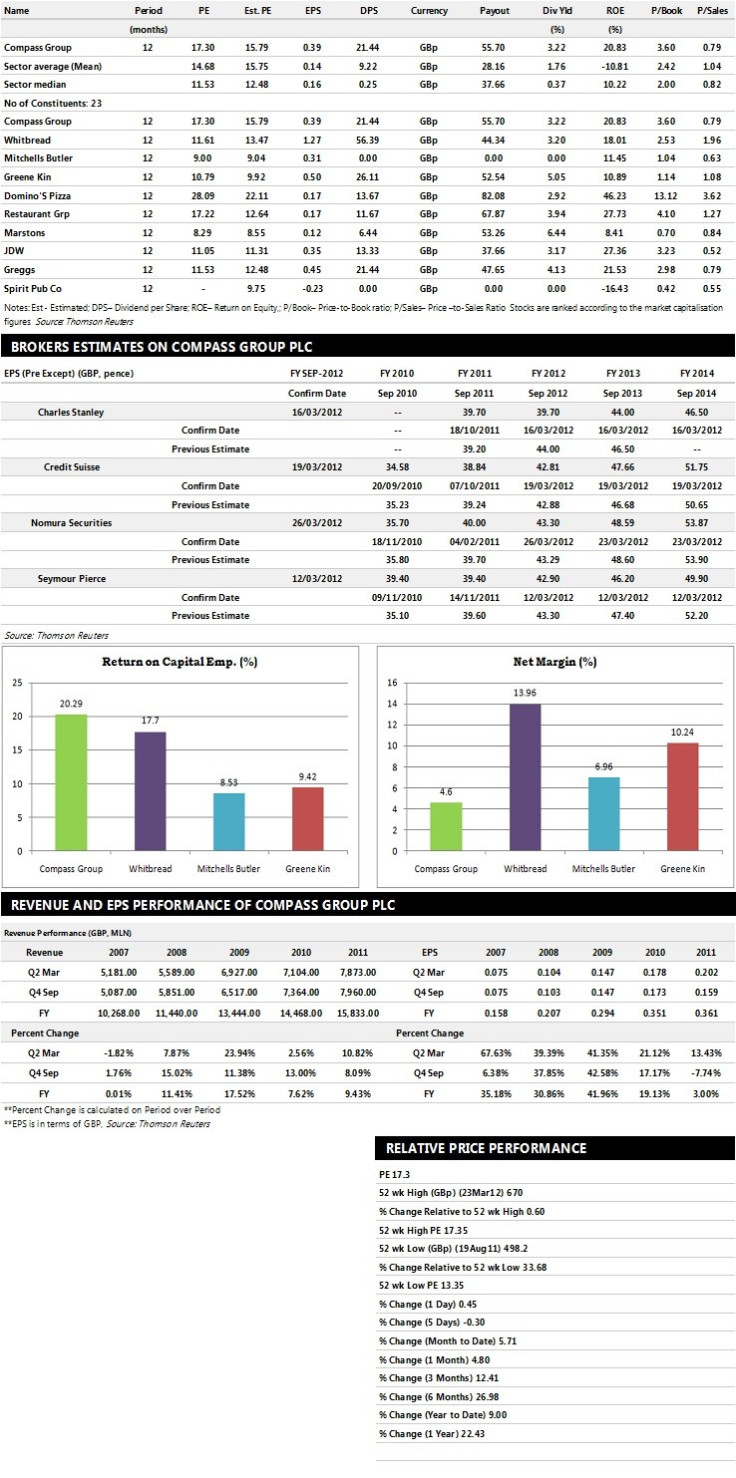

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Nomura Securities recommends 'Outperform' rating on the stock with a target price of 800 pence per share

- Credit Suisse recommends 'Outperform' rating with a target price of 744 pence per share

- Natixis assigns 'Outperform' rating with a target price of 680 pence per share

- Alphavalue gives 'Underperform' rating - Seymour Pierce assigns 'Buy' rating

Earnings Outlook:

- Nomura Securities estimates the company to report revenues of £16,946 million and £17,993 million for the FY 2012 and FY 2013 respectively with net profits (pre-except) of £807 million and £887 million. Earnings per share are projected at 43.30 pence for FY 2012 and 48.59 pence for FY 2013.

- Credit Suisse projects the company to record revenues of £16,807 million for the FY 2012 and £17,486 million for the FY 2013 respectively with pre-tax profits (pre-except) of £1,086 million and £1,191 million. Profit per share is estimated at 42.81 pence and 47.66 pence for the same periods.

- Charles Stanley expects Compass Group to earn revenues of £15,200 million for the FY 2012 and £16,300 million for the FY 2013 respectively with pre-tax profits of £1,033 million and £1,145 million. EPS is projected at 39.70 pence for FY 2012 and 44.00 pence for FY 2013.

© Copyright IBTimes 2024. All rights reserved.