Edmund Shing: Crisis spells opportunities in Legal & General dividends

August was clearly a torrid month for investors! By the 24th, the FTSE 100 had lost 13% and, in the process, had dipped below the 6000 level. Thanks to worries over a serious slowdown in China and the likely knock-on effects to global growth, the Footsie now stands 7% below its start-2015 level.

It is at times like these, when the whiff of market panic is in the air, that long-term investors would do well to recall the words of reputedly "the world's greatest investor", Warren Buffett:

"Be Fearful When Others Are Greedy,

And Greedy When Others Are Fearful"

In other words, now could well be a good time to buy into shares as they are now cheaper than at any time this year.

Why You Should Not Panic Now

There are still plenty of reasons to buy UK shares today – here are just three:

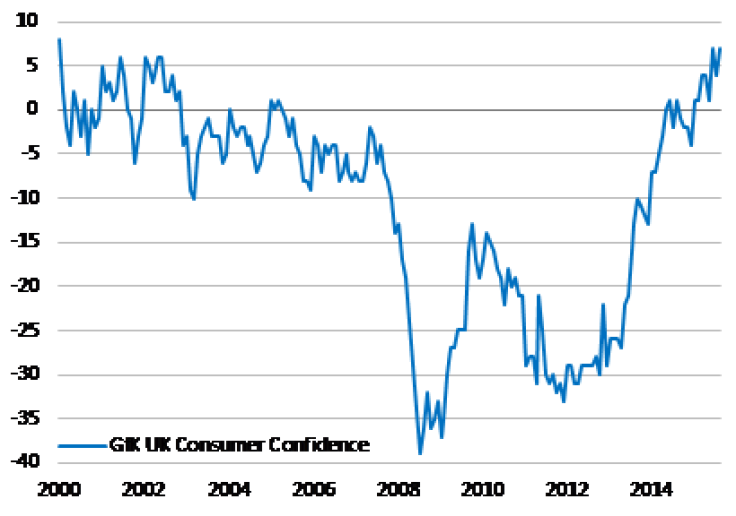

- UK economic growth is still solid: retail sales are growing at an annual 3.5% rate, while mortgage approvals have hit their highest level since 2008. Underlining the strength of the UK consumer, August's GfK consumer confidence reading was the highest seen in the UK since the year 2000 (Figure 1).

- The largest global economy, the United States, grew by an impressive 3.7% in the second quarter of this year, driven by a very strong services sector.

- While China is undoubtedly not growing as quickly as in prior years, it is far from being as disastrous as financial markets would have you think. The Chinese government still has impressive resources that they can use to stimulate growth, if necessary.

Figure 1: UK consumer confidence is at its highest since 2000 Source: GfK, Bloomberg

But probably the most encouraging single indicator for me is UK investment growth from April to June of this year. UK corporate investment grew by 5.7% compared with the same period a year earlier.

If companies are borrowing and investing, then economic growth should remain solid and companies should see profits grow at a healthy pace. All of which should be good for share prices in the long run.

Benefiting from lower prices via higher dividend yields

At a time when the official inflation rate is exactly zero and interest rates in the High Street remain below 2%, one of the best ways to take advantage of lower share prices is by buying into companies that offer substantial dividend yields.

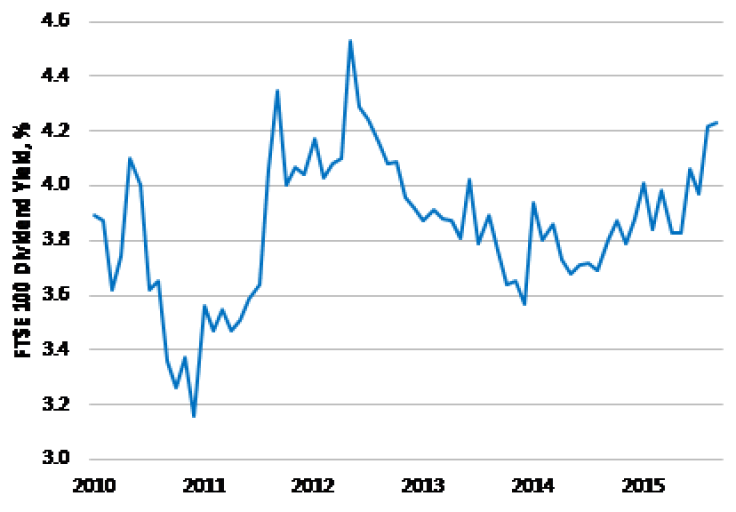

The FTSE 100 index today offers a dividend yield well over 4% (Figure 2). So for each £100 invested in the FTSE 100 index today, you should receive an annual dividend cheque of £4.20.

But you can do even better than this by focusing on high dividend yield companies.

The insurance company Legal & General (LSE code: LGEN) is a good case in point. Profits have grown steadily since 2011, and are forecast to continue to grow solidly to the end of 2016. It is forecast to pay a dividend yield of 5.7% this year – i.e. an annual income of £5.70 for every £100 invested now in Legal & General. Moreover, this dividend stream should grow steadily in the years to come.

Compare that yield to cash deposit rates of 2% or less on the High Street and yields of just over 2% on long-term UK government bonds, and you can see the attraction to an income investor (such as a retiree).

Buying a group of high yield companies via an ETF

However there is a second option. Instead of buying individual companies which offer generous dividend payments, you could buy shares in an exchange traded fund, or ETF, which buys a broad range of high dividend shares (such as L&G).

The iShares UK Dividend UCITS ETF (LSE code: IUKD) is one such fund; you pay £9.01 per share in this fund (as of Friday September 18), effectively buying exposure to 50 high dividend-yielding companies in the UK.

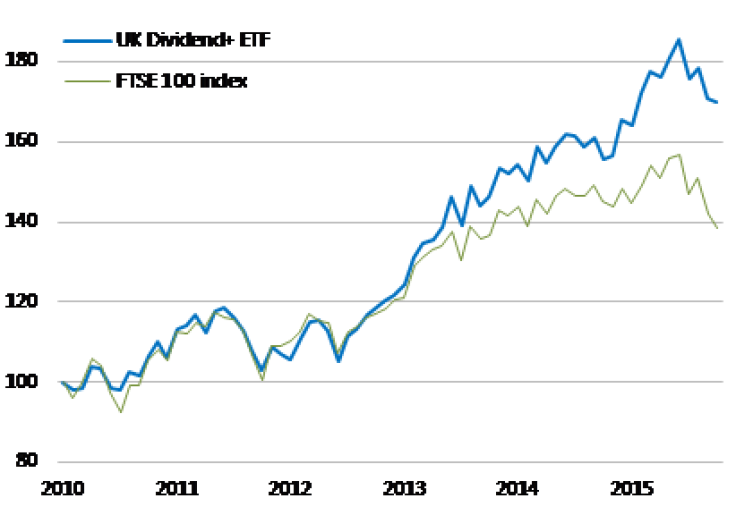

Since the beginning of 2010, this UK Dividend ETF has turned an initial investment of £100 then into £170 today (including reinvested dividends), far in excess of the £140 you would have received from an investment in a FTSE 100 fund (Figure 3).

This recent crisis then should spell opportunity for the canny investor – and investing in generous stock dividends are a good way to go.

Edmund Shing is Global Head of Equity Derivative Strategy at BNP Paribas in London. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2024. All rights reserved.