FX Fixing Scandal: UK Government set to Announce New Market Crackdown

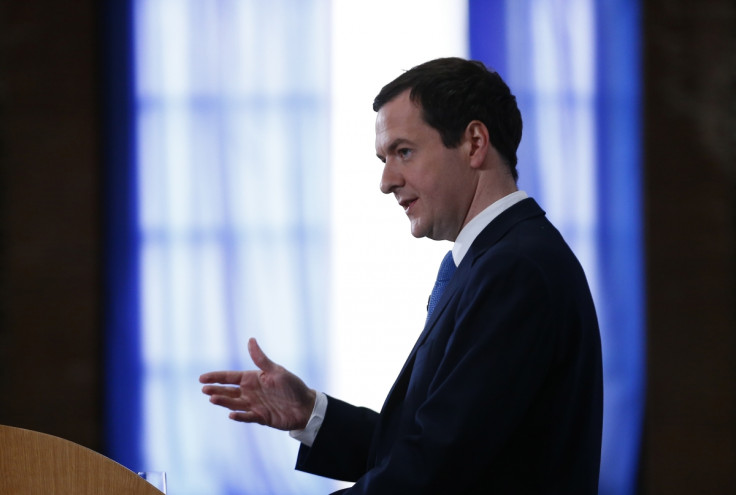

UK chancellor George Osborne will announce major changes to the way bankers trade foreign exchange in a bid to put an end to the currency fixing scandal and clean up market practice.

Following in Bank of England governor Mark Carney's footsteps, Osborne is tipped to unveil his plans to crack down on the scandal hit market where dozens of chief traders have left their banking roles amid internal and external investigations.

According to an unnamed government official, cited by the BBC, the announcement will be made some time this month.

The UK Treasury declined to comment on the report but released the following statement to the media: "Ensuring confidence in the fairness and effectiveness of financial markets is central which is why we've taken action to reform Libor, and why we're now using the lessons we have learned here to inform and shape the important ongoing global debate on benchmark reform."

In May, Carney expressed his desire to crack down on benchmark interest rate and currency market manipulation after leading a number of reviews into how Libor and FX is set.

"Merely prosecuting the guilty to the full extent of the law will not be sufficient to address the issues raised," he said at the time.

"Authorities and market participants must also act to re-create fair and effective markets."

Previously, IBTimes UK exclusively revealed that a whistleblower alerted regulators in the US, UK and Switzerland in 2011 to some of the world's largest trading companies and banks manipulating benchmark sterling, US dollar and Swiss franc currency rates.

However, it was not until 2013 that these authorities started investigating allegations of market rigging.

Meanwhile, US, Asian, and UK authorities are investigating a number of banks into FX rigging allegations.

Around 20 high-ranking FX traders have left their jobs since the probes began but the banks all declined to say whether these departures were related to the investigations or have stated that the bankers were exiting for unrelated reasons.

The FX Market

The daily $5tn (£3.1tn, €3.7tn) currency market is the largest in the financial system and is pegged to the value of funds, derivatives and products.

Morningstar estimates that $3.6tn in funds, including pension and savings accounts, track global indexes.

FX rates are calculated and compiled by using data from a variety of submitted provisions on a number of platforms, such as ThomsonReuters.

It is then calculated by WM, a unit of State Street, to form WM/ThomsonReuters at 1600 GMT daily.

© Copyright IBTimes 2024. All rights reserved.