GE to sell private-equity-lending unit to Canadian pension fund for $12bn

General Electric is selling its private-equity-lending business to Canada Pension Plan Investment Board for about $12bn (£7.8bn, €10.6bn), as the company looks to exit its banking business and focus on industrial assets.

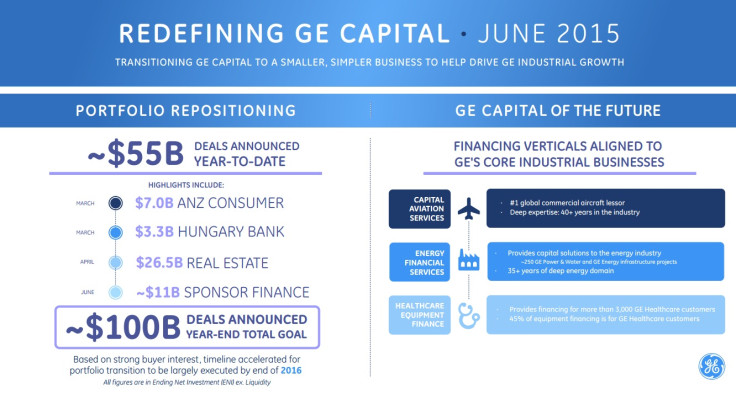

GE said it agreed to sell its so-called sponsor finance business, which includes Antares Capital, and a $3bn bank loan portfolio to Canada's largest pension fund. Following the sale, Antares Capital will keep its name and operate as a stand-alone business.

"This announcement is the next step in GE's transformation to a more focused industrial company," said Keith Sherin, chairman and CEO of GE Capital.

"The sale of Sponsor Finance aligns with our strategy to pair a smaller GE Capital with GE's long-term industrial growth."

The transaction, which is subject to regulatory and other approvals, is expected to be settled in the third quarter of 2015.

GE had already agreed to sell GE Capital Real Estate assets for $26.5bn.

GE is looking to sell most of its GE Capital assets over the next 18 months, as part of CEO Jeff Immelt's plan to reshape the company and further the role of its industrial businesses as the principal source of GE's earnings.

GE estimates that its industrial businesses will generate more than 90% of GE's operating earnings by 2018, up from 58% in 2014.

As of now, GE Capital has announced sales of more than $55bn and is moving towards the disposition of $100bn by the end of 2015.

The company is looking to reduce the size of its financial services business due to significant regulatory hurdles. The regulators view GE Capital's size as significant, and want the company to be subject to regulation as one of the largest lenders in the US. By reducing its financial business' size, GE intends to escape regulator's oversight.

© Copyright IBTimes 2024. All rights reserved.