George Osborne election budget as it happened: Britain is 'walking tall again'

- George Osborne claims that the British economy is "walking tall again"

- Income tax cut for 27 million, but £12bn more in welfare cuts on their way

- New raid on banks to bring in over £5bn

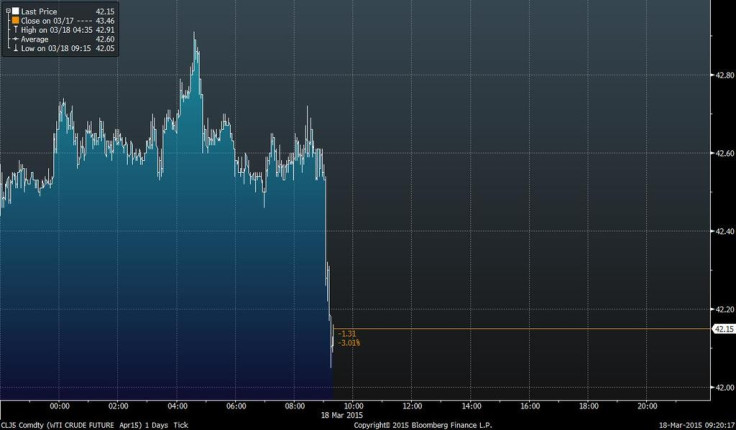

- Tax break for struggling North Sea oil firms

- Ed Miliband calls it "a budget people won't believe"

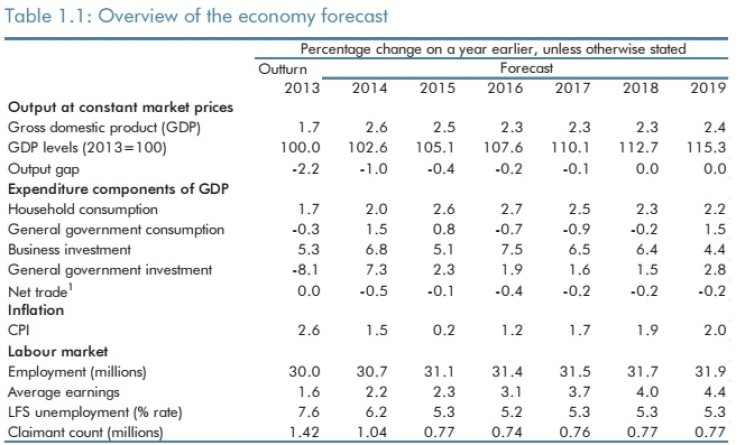

- OBR growth forecasts: 2015 - 2.5%; 2016 - 2.3%; 2017 - 2.3%; 2018 - 2.3%; 2019 - 2.4%

- Inflation predicted to sink to just 0.2% in 2015

It was a budget that gave a bit of something to everyone. There was the income tax cut for 27 million people. There was the tax break for the North Sea oil industry, which is struggling with falling oil prices. There was the infrastructure spending committed to the "Northern Powerhouse". Savers will get the first £1,000 they put away tax free, pulling 95% of them out of savings tax altogether. First time buyers will get their mortgage deposits subsidised by the government, which will add 25% to whatever they put away. Small firms have been promised a long-overdue review of the punitive business rates system. He targeted the bankers - always a popular measure outside of the City of London - by hiking the bank levy.

It was very much an election budget - which is convenient, because there is a general election coming up - and packed with giveaways. But without necessarily giving anything away. None of the spending, claims Osborne, is unfunded. And he did not divert from his main path: that of austerity. There would be billions of pounds more in cuts to public spending, notably a further £12bn off the welfare budget, which will squeeze further the incomes of the poorest.

The headline economic figures look good. The employment rate has hit a record high. The economy will grow at the fastest rate in the developed Western world. The claimant count is tumbling. The deficit will be erased by 2018/19, when there will be a £7bn surplus (though this is lower than the £23bn forecast beforehand). And debt will start falling in the same year as attention can be turned to paying it off.

Labour was unconvinced. Ed Miliband, the Labour leader, called it "a budget people won't believe". He said incomes are still falling and people have been made worse off by the coalition government and that it has exacerbated the "cost of living crisis".

But the stage has been set for the election with this budget. Osborne painted a picture of an economy on the mend, one that creates opportunity and rewards those who work hard. The plan may be tough, but it is working, he says, and they are creating a sustainable economy for the future.

Nonsense, says Miliband and Labour. There may be a recovery, but it is being felt by the few at the top, not the many at the bottom. Household incomes are still weak. There aren't enough quality jobs around. The austerity has gone too far and too fast, actually harming the recovery rather than helping it. And the government is ignoring the real picture in the economy, one of food banks, zero hours contracts and inequality - all the while they cut tax for millionaires.

The public can decide who they believe on May 7...

Things have quietened down again now after the budget announcement. Behind the scenes, the wonks will be hunched over reams of statistics and data from the Treasury and OBR, scrutinising every last decimal point. They'll undoubtedly have more to say tomorrow. Until then, thanks for reading IBTimes UK's live coverage of the 2015 budget.

If you want more, take a look around our site where you'll find up-to-the minute news and analysis.

Ukip leader Nigel Farage has put down his pint (now a penny cheaper, cheers George) and given his take on the budget.

This government has evidently failed in its promise to the British people to eradicate the deficit and whilst it took Labour 13 years to double the debt this government has done it in five. Mr Osborne talks about a long-term economic plan, today he pushed all his targets back and created a long grass economic plan.

Ukip economic spokesman Patrick O'Flynn added:

Yet again we have witnessed the spectacle of a Chancellor entirely ignoring the impact of unlimited immigration on the wages and employment prospects for working people.

Mr Osborne likes to boast about his long-term economic plan. But it is obvious that he has no plan whatsoever to bring rises in real wages within reach for working families after many years of decline.

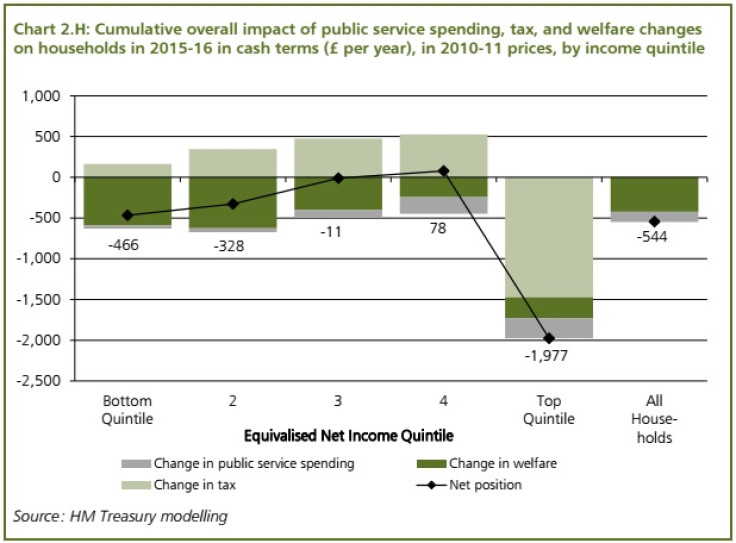

The Treasury looks at how its budget policies will affect the different income groups. In cash terms, the poorest fifth of British people will be £466 a year worse off in 2015/16, primarily because of the cuts to welfare.

But the richest fifth will see a bigger drop in their income. According to the Treasury, they will be £1,977 worse off because of changes to tax, welfare and public services. When you look at all households together, we're £544 worse off.

At least he clipped a penny off the tax on pints and 2% off duty on spirits. Cheers George.

Cryptocurrency news from our technology reporter Anthony Cuthbertson:

The UK government has announced as part of its 2015 budget that it will be investing £10m into a research initiative looking at bitcoin and other digital currencies.

The announcement follows a call for information about digital currencies in November 2014 and forms part of a major new report - revealed by IBTimes UK - that also provides regulatory clarity and legitimacy to digital currencies, specifically around anti-money laundering requirements.

Read the full story.

This is a worry. The Institute for Public Policy Research (IPPR) points out that household debt will soon be bigger than it was before the financial crisis, when measured as a proportion of household income.

Tony Dolphin, the IPPR's chief economist, said:

The OBR forecasts that household debt will soar to a record 171% of income by 2019, surpassing the 168% peak in 2008. This is more plausible than its export and investment forecasts, though it would require a change in trend from the last few years, when the debt ratio has been moving slightly downward. But this would be a highly undesirable outcome: that households could have more debt, relative to income, by the end of the decade than they had when the financial crisis hit.

But Dolphin thinks there is some creative accounting going on:

The OBR makes these assumptions because this is the only way it can make its forecasts add up, given the path chosen by the government for its own spending. Because the government plans to make substantial cuts to its spending over the next few years, other elements of demand have to grow strongly to compensate if the economy is to grow by almost 2.5% a year.

And the OBR has to forecast growth at this level, because if it is any weaker, a shortfall in revenues will make it impossible for the government to achieve its deficit target. The OBR's forecast, therefore, should be seen not as the most likely outcome for the economy, but rather as an outcome that would allow the government to achieve its deficit reduction target.

This is a table from the OBR's latest forecast, which shows the rate of growth expected across different parts of the economy. One big positive: after so many years of a real terms fall in wages, with inflation outstripping pay, that lost ground is being made back up again. And 2015 will be a bumper year for real pay, with average earnings rising by 2.3% and consume price index inflation growing by just 0.2%.

Ian Stewart, chief economist at Deloitte, says there is room for manoeuvre on public spending, but a squeeze is still ahead:

Mr Osborne is offering a vision for the next Parliament of rising incomes, falling debt and a little less austerity.

Today's tax changes are too small to have anyone scrambling to change their forecasts for GDP growth. The really big change is in a significant easing of fiscal policy in the last year of the next Parliament.

Mr Osborne plans to trim £16 billion off his planned budget surplus, which will enable him to eliminate the deficit and ease up on austerity in five years' time. Mr Osborne says the share of GDP accounted for by public spending, rather than dropping to the lowest levels since 1938/39, will return to 1999/2000 levels.

The austerity ahead looks a bit less intimidating. But that doesn't detract from the fact that, whatever happens on 7th May, a major squeeze on public spending lies ahead.

One of Osborne's big plays was a new raid on banks. He is raising the bank levy to 0.21% and says it'll bring in an extra £4.4bn. But will it? There is uncertainty and risk abound. Read our report for more.

Comments in from Natalie Bennett, leader of the Green party. She's no fan of Osborne's austerity:

This final coalition budget offers little hope to the many millions of people across Britain who are struggling to get by. Austerity economics has failed.

Incomes are still lower than they were in 2010, household debt is up and inequality continues to plague this country. In the world's sixth-biggest economy, people should not have to queue at food banks or work in insecure jobs that don't pay enough to get by on.

We need to see a radical departure away from the kind of business-as-usual economics on display in today's budget. That means building an economy that works for the common good, an economy that pays people a Living Wage, protects our public services and invests in renewable technologies that cut fuel bills and help combat climate change.

Buried deep in the OBR's report, published alongside the budget, is a grumble about the time it was given to scrutinise the costings in George Osborne's budget - i.e. not much. Is there a row brewing between the Treasury and its independent watchdog?

Business seems to be backing the Osborne budget, with CBI Director-General John Cridland saying it put the country on a path towards growth.

"Stability and consistency are what businesses need to grow and prosper. This Budget sets the tone, providing a clear plan for fiscal health and growth," Cridland said.

"This Budget has some encouraging measures to help businesses create jobs for the benefit of all.

"The brighter fiscal picture has allowed the Chancellor to recalibrate his deficit reduction plans. In the next Parliament this fiscal breathing space should be used to achieve intelligent reductions in public spending, together with much-needed infrastructure and innovation.

"With business investment a crucial driver of growth, the Chancellor has signalled his intention to continue the Annual Investment Allowance. We want it to be made permanent in the Autumn Statement at £250,000 - this will fire the UK's economic kiln by spurring smaller firms to invest in plant and machinery.

"The reduction of the headline rate of Corporation Tax to 20% next month, is a meaningful step in making the UK the most competitive tax regime in the G20 and will help to attract investment.

Cridland highlighted the decision to reduce the supplementary charge faced by North Sea oil and gas companies as a way of restoring the beleaguered industry after oil prices plummeted and said pension reforms would allow "breathing space" for the industry as consumers "get to grips with all the changes".

One surprise omission in the budget was the reported increase in the inheritance tax threshold.

Osborne said he would "conduct a review on the avoidance of inheritance tax through the use of deeds of variation" and report back in the Autumn.

"The budget was remarkably quiet on the much talked about - but seemingly inaccurate - suggestion of an increase in the Inheritance Tax threshold," said Robert Brodrick, partner at Payne Hicks Beach, the private and commercial legal advice specialist.

"This remains frozen at £325,000, where it has been for the last 6 years. Instead, the government announced a review into the use of deeds of variation for tax purposes. I think the message has to be watch this space until after the election."

Following today's projections, Paul Johnson, of the Institute for Fiscal Studies, has hinted there could be an end to austerity in sight.

"There was a noticeable change of tone on austerity," he told the BBC.

"Not much will change over the next couple of years. But the chancellor has reserved substantially what might happen in the long run.

He says that austerity could be stopped in the years 2018/19. It's theoretical, as it four or five years down the line. But it's an indication of the future direction."

Miliband's response was laced with attacks on the government's record over the past five years.

He said: "Never has the gap between the Chancellor's rhetoric and the reality of people's lives been greater than it was today.

"This is a budget people won't believe from a government that's not on their side because of their record, because of their instincts, because of their plans for the future and because of a budget that, most extraordinarily, had no mention of investment in our NHS and our vital public services.

"It's a budget people won't believe, from a government they don't trust.

"This Chancellor has failed the working families of Britain. For the first time since the 1920s, people are earning less at the end of a government than they were at the beginning."

"It's a recovery for the few from the government of the few."

TUC General Secretary has weighed in on pension reform that will see then be able to trade their annuities.

"The government is again attempting to remedy a market failure by creating another market in the blind hope that this one might be different.

"It's hard to see how such a trade in so-called 'death bonds' could work without a strong risk that many retired people will get a poor deal."

Under new proposals and as part of the government's plan for a recovery felt across all regions of the UK, Manchester and Cambridge will pocket every penny of business rate increases.

Miles Gibson, head of UK research, at commercial property firm CBRE said it would "accelerate growth" outside of London and the South East.

"It's also welcome news for businesses across the UK that the Chancellor is pledging to increase investment available to UK regions through new enterprise zones and improved transport links.

"The announcement that Greater Manchester and Cambridge will receive 100% of the increase in business rates, will further help the businesses in our key cities prosper.

"The benefits to regional economies should stimulate a new wave of economic growth that will capitalise on rising business confidence.

"This announcement could bring local and regional economic acceleration."

In a play for the so-called "grey vote", Osborne confirmed changes to the pension system, allowing them to cash out their annuities.

Andy Cumming, head of wealth management at Close Brothers Asset Management, suggested the chancellor should have waited to see what the impact of last year's reforms were before imposing more.

"Increased financial freedom at retirement has been a crucial step forward in the last year, but the Chancellor has fired the starting gun on the resale of annuities before we have seen the impact of last year's reforms," Cumming told IBTimes UK.

"It is a natural progression from the last Budget's changes, and for thousands of annuitants, the move will be beneficial.

"However, it will be vitally important that there will be sufficient guidance for those looking to sell – especially if their current annuity is still the best option, providing value for money and supporting retirement goals."

The Campaign for Real Ale raised a glass to a cut in beer, cider and scotch duty and a freeze to duty of wine.

Chief executive Tim Page said: "CAMRA is delighted with today's hat-trick of an unprecedented third consecutive cut in beer tax, with another penny of a pint, which will be welcomed by millions of beer-drinkers across the country.

"The last two cuts have already had a huge impact, saving over 1,000 pubs from closure and keeping the price of a pub pint down. Independent research by CEBR forecasts that the price of a pub pint will now be more than 20p cheaper than it would have been had the beer duty escalator remained in place.

"A third cut in beer tax is a huge vote of confidence in the importance of pubs and brewing. It will help ensure the sector returns to long term growth after many years of pub closures and falling beer sales, caused in part by a 42% beer tax increase between 2008 and 2012, and throw a lifeline to struggling community pubs across the country.

"Britain is known around the world for great pubs and real ale, and we should all be incredibly proud that this industry has just reported growth for the first time in a decade. We hope Britain's millions of pub goers will head to their local this evening to give three cheers to a historic third cut in beer tax!"

Reactions are coming in after Osborne announced what he described as one for Britain, "the comeback country".

Terry Scuoler, chief executive of EEF, the manufacturers' organisation, said:

"The Chancellor gets three cheers from manufacturers for the measures he's included to boost exporters. His decision to bring forward compensation for industries facing vast and uncompetitive energy costs, such as steel makers, is a huge vote of confidence for them and for manufacturing more widely. In addition he has committed to a stable and competitive tax regime, which we wholeheartedly support."

North Sea oil and gas taxes have been cut to kick start the ailing industry. Osborne said he would slash the supplementary levy from 30% to 20%. The cut will be backdated to start of January

The government's older workers czar Ros Altmann has criticised Osborne's move to cut the lifetime allowance of tax free pension savings from £1.25m to £1m.

Osborne will find £30bn of savings by 2016/17 by trimming Whitehall (£13bn) amd welfare (12) and by tackling tax avoidance (5).

Closing tax loopholes with the so-called "Google Tax" will raise £3.1bn

Osborne says the Treasury will sell £9bn of Lloyds Bank shares and £13bn of mortgage assets from failed Northern Rock and Bradford & Bingley.

He goes on to say that the reported £23bn surplus in 2019/20 he wanted to build will instead be £7bn

Starting his address to MPs, Osborne has said "Britain is walking tall again."

The Chancellor said "growing faster than any major economy in the world."

"Today I can report more people have jobs in Britain than ever before".

"Living standards were set back by the recession but projections show living standards will be higher than when we came into office."

"We have a plan that is working and this budget is for you"

"Britain's ecomomy grew 50% faster than German, three times faster than the Eurozone zone and seven times faster than France."

PMQs is winding down and the Chancellor is getting his papers in order. Here are the main topics to look out for:

- Inheritance tax

- Higher threshold of income tax and National Insurance

- Growth forecasts from the Office for Budget Responsibility

- Digitised tax returns

- Measures for cryptocurrency

- Swansea Bay Tidal Lagoon

- Improving employment figures

- North Sea oil tax

Fascinating demographic breakdown by YouGov on the public's perception of how the government has handled the economy.

A majority of people aged 60 or older think Osborne has performed well, while only 38% of people aged 18-24 think he has.

Half of middle class (ABC1) people think he has done well, while just 37% of traditionally working class people (C2DE) agree.

On the new digitised tax return, Lucy Brennan, of accountants Saffery Champness, doubted if it would have an immediate effect.

"It is human nature to leave things to the last minute, and if people can, they will. In this respect, the system may mean little change for some people," Brennan told IBTimes UK.

"Millions of people who run informal businesses, or receive rent and dividends for example, will still need to submit their income and other details manually. Those thinking that the government will be able to collect all data effortlessly will be disappointed."

"From an accounting point of view, there is a huge amount of detail that will need to be worked out. Particularly where people's affairs are complicated, we can expect snags."

NHS, beer, and a "plan that is working" are the favourite words or phrases to be uttered by Osborne in his speech, according to Betfair

Former health secretary Andrew Lansley has told the BBC he hopes the Conservatives start looking ahead to the future and possibly slashing tax in years to come.

"I hope there a two budgets, a coalition budget...and a Conservative budget that looks beyond the next year and even the year after when there is a real opportunity for a reduction in people's tax burden."

The South Cambridgeshire MP also called for the National Insurance threshold to be increased.

"Form my point of view, if you really want to achieve a position to reduce the tax burden...you have to work on income tax and National Insurance."

EXCLUSIVE - Osborne's plans to make an announcement surrounding digital currencies like Bitcoin.

The Treasury has met with members of the cryptocurrency community to discuss the potential it holds and an announcement may have made its way into the Chancellor's speech.

Osborne had previously said the UK needed to look at the benefits of fintech [financial technology].

Alex Russell, professor of petroleum accounting at the Robert Gordon University in Aberdeen, tells the BBC that failure to support North Sea oil would have a "catastrophic" impact on the industry.

"The industry employs 450,000 people currently across the whole of the UK, half in England.

"The benefit to the economy has been incredible."

North Sea oil producers are set to benefit from tax breaks in today's Budget when a new investment allowance is outlined.

The measure would equate to tax relief on all new spending, including on exploration.

Also on the table is a cut to the supplementary levy companies pay on top of corporation tax.

Oil companies are considering reining in exploration in the face of reduced profits.

Report - the Financial Times claims a senior Tory said Osborne could spring a surprise and increase the National Insurance threshold, which currently starts at £7,956.

The move would disproportionately affect people on low income and put more money in their pocket.

FT deputy political editor Beth Rigby quotes the source as saying: "It snookers Labour and puts money into people's pockets"

More Clegg: "We [Lib Dems] will not repeat the mistake of making commitments we can't deliver"

On failure to deliver tuition fee promise, Clegg said Miliband promised to "end boom and bust" and Cameron said "no ifs, no buts" about immigration.

"We have delivered far, far more policies that that one we failed to deliver."

"There are more women in employment that ever before...a bigger increase im full time work over the last year than ever before."

Nick Clegg will be on Woman's Hour at 10am to discuss what the Lib Dems have to offer females.

Ahead of the Deputy Prime Minister's appearance, read columnist Lydia Smith's view that women have been largely absent from the economic recovery.

On those employment figures, Business Secretary Vince Cable said:

"Today's employment figures are an historic moment. With almost three quarters of working age people now in work, we have achieved the highest rate of employment in the UK since records began.

"This is a sign that the long term decisions the Liberal Democrats have taken in government have created a more resilient economy.

"But we have also created a fairer economy with everyone sharing in the fruits of our recovery: more people, especially women, in full-time jobs and more young people in work. Everyone now has the opportunity to get on in life and achieve their full potential"

A timely boost for the governement as the Office for Nationalist Statistics reports UK unemployment fell by 102,000 to 1.86m in the three months to January.

It means unemployment has fallen to 5.7%. When the coalition was cobbled together in May 2010, there were 2.47m unemployed people in the UK.

Meanwhile, the number of people claiming jobseeker's allowance (JSA) last month fell by 31,000 to 791,200. The figure has plummeted from the 1.49m in May 2010.

Hot off the mint! The Chancellor shows off the new 12-sided £1 coin:

One of the measures expected to be announced today is the digitisation of the dreaded tax return.

Osborne wants to scrap the current paper self assessment in favour of a more efficient digital account in a bid to cut costs.

The new system will slash the time taken to complete the assessment from from 40 minutes to just 10 minutes a year.

Osborne is set to beef up his green credentials today with plans to construct the world's first tidal lagoon in Swansea Bay.

The £1bn project - which has a 120 year lifespan - could generate 10% of the UK's electricity needs when it is up and running.

The 20m high wall will funnel enough water to fill 100,000 Olympic- sized swimming pools through its turbines every day.

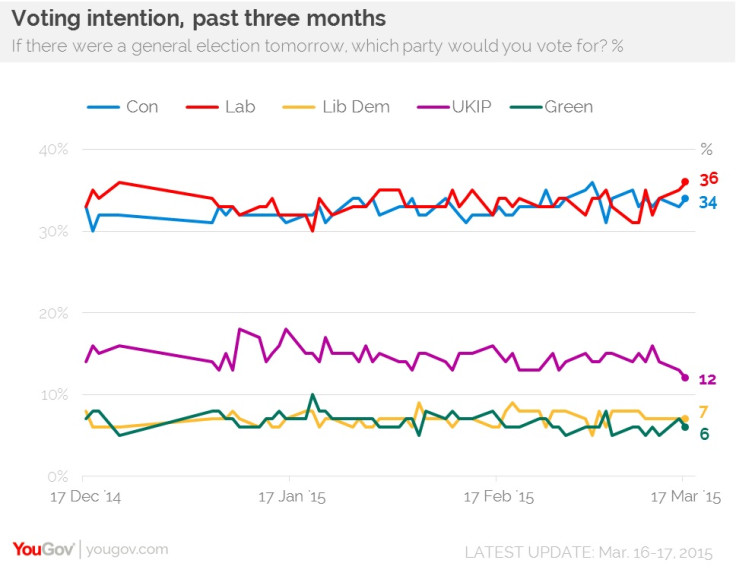

After ruling out a coalition with the SNP, Labour has edged ahead of the Conservatives in the latest YouGov poll.

A poll for the Sun newspaper puts Labour at 36%, their highest rating since December 2014, with the Conservatives at 34%.

The Liberal Democrats remain at 7%, Ukip support has waned to at 12% and the Greens have sunk back to 6%.

How many more of these will you see in your pocket?

The design of the new £1 coin was unveiled yesterday as the finishing touches were put to the Budget statement.

Designed by Walsall teenager David Pearce, the design - which features a rose, leek, thistle and shamrock emerging through a Royal Coronet - will be on coins that enter circulation in 2017.

The Tories struck a blow to Ed Miliband and Ed Balls yesterday when the party published a video of the pair working in the Gordon Brown Treasury.

Under the heading "Don't let them do it again", the clip claims Miliband and Balls had their hands on the levers of power when Labour "wrecked the economy" and "would do the same again".

Balls has criticised Osborne's proposed cuts, saying they would take the UK "back to the 1930s".

Good morning and welcome the IBTimes UK's live Budget blog.

In what could be his final statement as Chancellor, George Osborne will outline outline the fiscal policies the government believes will finally topple the deficit and create a £23bn surplus by 2020.

Follow @IBTUKPolitics for the lastest news and reaction

© Copyright IBTimes 2024. All rights reserved.