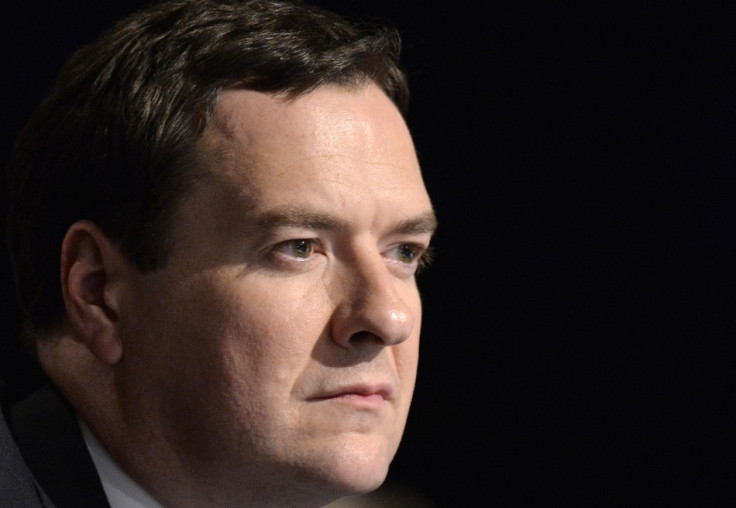

RBS Future Will Be Decided in 'Next Two or Three Weeks': George Osborne

British Chancellor George Osborne will decide the future of the state-controlled Royal Bank of Scotland in the "next two or three weeks".

Osborne told the Daily Telegraph that separating the bank's good and bad assets is his "priority for the next two or three weeks", and said that the bank cannot be left in its current form.

"That's the top of my in-tray," Osborne told the newspaper.

He also disclosed that the government will not sell its 81% holding in the bank until after the next general election. He added that the government is preparing to sell Lloyds Banking Group shares to the public.

"We are now looking actively at a retail offer for the next tranche of Lloyds shares," he said. "With RBS we are not, at the moment, close to the stage of being able to sell RBS shares."

"RBS was a much more complex bank. To be fair to management past and present it was a bank that was in a lot more trouble. The clean-up job has been more difficult but we have got to make these decisions now about the future for RBS."

Bank Restructuring

Having suffered from the global financial crisis, RBS was bailed out with £45bn ($73bn, €53bn) of government funds in 2008.

Bank officials and the government are dealing with its 'toxic assets', which are estimated at £50-£60bn by US asset manager Blackrock.

The UK Treasury has commissioned Rothschilds to examine whether the bank should be split in two, with a 'good' and 'bad' side. Advisers from Rothschild will prepare a report.

"We are looking at the case for a bad bank and if not a bad bank what is the alternative strategy that really gets on top of the problems in that bank and goes on being what I want it to be which is a bank supporting the British economy," Osborne added.

Meanwhile, the bank's newly appointed chief Ross McEwan sent a note to staff reassuring them about the future of the bank, and warning them not to be distracted by any speculation.

"The future of this company will not be about whether we operate in particular areas or where our problem assets sit. The future of this company is about how good a job we do for our customers, including those who are having difficulty repaying their loans. And it will be about how well we live up to all our responsibilities, particularly those we have to the UK," McEwan wrote.

© Copyright IBTimes 2024. All rights reserved.