Gold investment grows as fears rise over global interest rates and falling investments

So far this year, most investments have done somewhat poorly. The FTSE 100 indexhas lost over 2% since the beginning of 2016, Chinese shares have fallen 13% and the US S&P 500 stock market has lost 5% since January 1.

But one investment that has performed very well over 2016 to date is gold: the gold price has gained some $160 (£114, €145) per ounce or 14% since the turn of the year (Chart 1). This is in fact the best start to a year that gold has enjoyed since 1980.

Still Time to Climb Aboard the Gold Train?

Well, the first thing to note is that this rally is only pushing gold out of a three year downtrend, with the gold price still a very long way from the $1,800 per ounce peak it reached back in 2012 (Chart 2).

What is driving the gold price higher?

The key driver for this latest surge higher in gold prices has been the fears that investors now have over global interest rates. Central banks worldwide such as the European Central Bank and the Bank of Japan are now putting in place negative interest rates, with the risk that these interest rates will become even more negative as time goes on.

Negative interest rates mean that we will have to pay banks to keep our money, rather than the other way around which has historically been the case.

Basically, this then makes gold much more attractive as an asset to hold, as there is no lost interest from holding money instead on deposit in a bank. Also, investors clearly are becoming more distrustful of banks and the global banking system generally. Under these circumstances, gold is attractive as a long-term store of value that is recognised and accepted across the world.

The American investment bank JP Morgan has analysed historical periods when interest rates were low and falling historically (going back to 1975), and found that over these periods, gold as an investment performed better than stocks and shares, bonds and even other commodities.

Physical demand for gold is rising

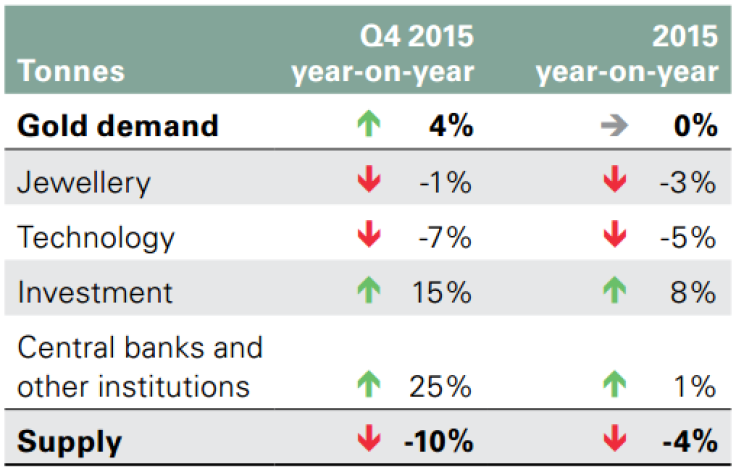

According to the World Gold Council, physical demand for gold rose 4% year-on-year in the fourth quarter of 2015, driven by both investment demand and buying by global central banks such as the People's Bank of China to boost their reserves (Chart 3).

New supply of gold from gold mining companies has also been relatively restrained: annual global gold mine production only rose by 1% in 2015 over the previous year, and recycling of scrap gold fell to multi-year lows.

So overall, the classic supply-demand balance looks relatively encouraging for gold prices going forwards, particularly if investment demand for gold continues to increase.

Ways to Buy Gold Exposure

There are a number of ways to invest in gold.

The first is to directly buy physical gold, in the form of gold coins. These are sold by the Royal Mint, Some of the most popular coins they sell include the £360 gold sovereign, which is 7.98 grams of 22 carat gold. You can also buy a one-ounce gold proof coin for £1,495 from the Royal Mint. They even sell online at www.royalmint.com.

Secondly, you can buy into a fund that invests in physical gold bars (held in a bank vault), offered in the UK by ETF Securities. They offer the ETFS Physical Gold exchange-traded commodity fund (UK code: PHGP), priced at £82.98 per share.

Thirdly, if you like risk, you can also buy shares in a gold miner. My favourite UK-listed gold miner is Caledonia Mining (UK code: CMCL), a small-cap mining company that mines gold in South Africa.

It is a very cheap stock on valuation metrics like P/E or price/book, it has a lot of cash available on its balance sheet and even pays an attractive income, in the form of a 6.6% dividend yield.

© Copyright IBTimes 2024. All rights reserved.