Gold Rallies Above $1,300 as Investors Boost Holdings

Gold was headed for the biggest weekly advance since August 2013 as downbeat US economic data boosted the precious metal's safe-haven demand, with holdings in the biggest exchange-traded product (ETP) expanding to a near two-month high.

Gold futures for delivery in April shot up 1.3% to $1,316.90 an ounce at 7:14a.m. on the Comex in New York. Prices were on track to log a 4.3% gain for the week as a whole, the biggest such increase since the week ended 16 August.

In London, gold for immediate delivery jumped 1.1% to $1,317.15 an ounce after touching $1,319.75, the highest price since 7 November.

Bullion was on track to finish above the 200-day moving average for the first time since February 2013. It has traded above the 100-day moving average since 10 February.

SPDR Expands

Assets in the SPDR Gold Trust expanded 1.2% to 806.35 metric tons, the highest since 20 December, 2013.

Assets in the biggest ETP backed by gold, down 41% last year, are up 1.2% this week and were on track for their third weekly advance.

Gold's rally has been driven in part by "very, very strong" physical demand, Greg Robinson, chief executive of Newcrest Mining, Australia's largest producer, said during a 14 February media call.

"Gold got seriously hammered last year, and with the stock markets not performing as well as expected, some investors are reconsidering their allocation to gold," said Wallace Ng, a Shanghai-based trader at Gemsha Metals.

"Physical demand this week has been good," Wallace told Bloomberg.

Commerzbank Corporates & Markets said in a note to clients: "In the past few weeks, the gold price has recovered from its historic slump last year: at almost $1,300 per troy ounce, the yellow precious metal is currently trading a good 7% higher than at the start of the year.

"The World Gold Council's review of the fourth quarter of 2013 will be unlikely to [lessen] the tailwind as demand data should confirm that China has overtaken India as the world's largest gold consumer and investment demand from the West decreased again significantly in the fourth quarter."

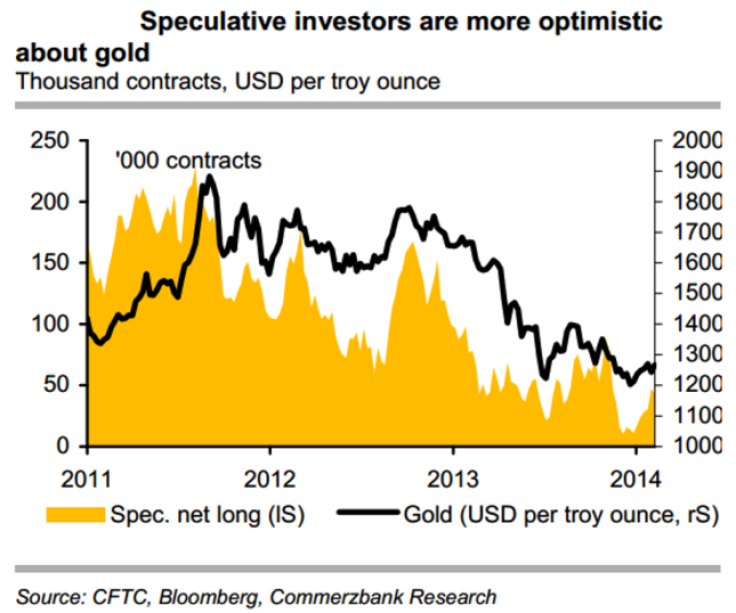

"That said, a turnaround looks likely here. Not only are short-term oriented investors betting more on rising prices, and net long positions are more [than] four times as high as in early December, at almost 44,000 contracts, but an end of ETF outflows that weighed so heavily on prices in 2013 is now also in sight," the German firm said.

"The uptrend for gold should therefore continue in the short term and could even gain more momentum if the psychologically important threshold of $1,300 is surpassed. We see the gold price at $1,400 per troy ounce at the end of the year," it added.

Earlier, Barrick Gold chief executive, Jamie Sokalsky, said he was more optimistic that prices had bottomed amid reports of Chinese demand and slowing ETP sales.

Fed Boost

US Federal Reserve chief Janet Yellen said on 11 February that the central bank would reduce its bond buying stimulus in measured steps. She restated that the taper process was not following a pre-determined course.

The Fed's stimulus taper has weighed down on emerging-market assets, which in turn has raised gold's safe-haven allure.

China Stockpile

Data showed earlier in the week that China imported and produced more gold in 2013 than its consumers bought.

China imported 1,158 tonnes of gold through Hong Kong in 2013, more than double its 2012 total; and also imported gold through Shanghai but those numbers are not available.

Meanwhile, domestic production rose over 6% to 428.16 tonnes in 2013, the China Gold Association (CGA) said on 10 February.

However, gold consumption hovered at 1,176.4 tonnes.

US Economy

Meanwhile, recent US data showed that more Americans had filed for government-sponsored jobless benefits and that US retail sales fell unexpectedly in January, indicating that the world's leading economy began the year on a weak footing amid a cold wave.

© Copyright IBTimes 2024. All rights reserved.