House prices slowing across UK cities and 'agents will look to re-price stock'

Hometrack says average house price in UK's 20 major cities rose 9.5% over the year - but it is a reduction.

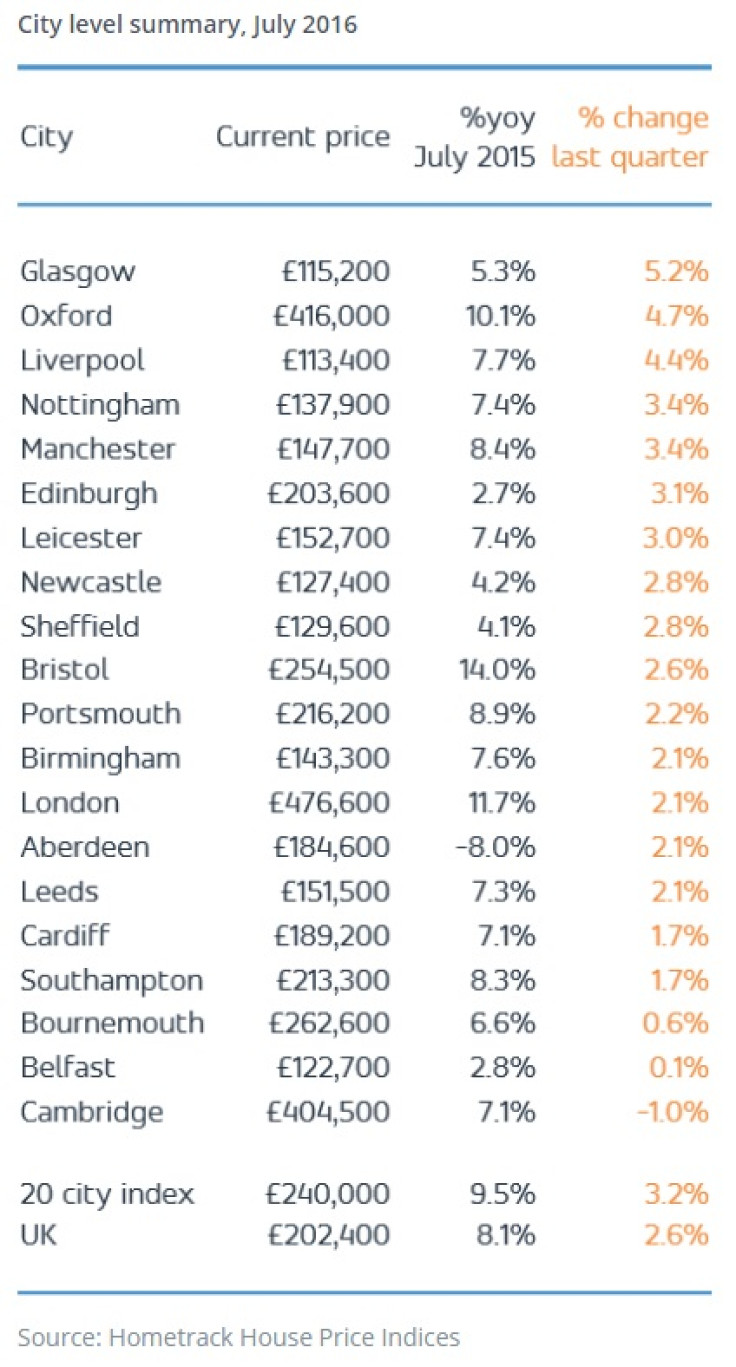

House price growth across the UK's 20 largest cities is slowing, led by a weakening of the London market. The average headline house price for those cities rose 9.5% over the year to £240,000, slower than June's 9.9% annual growth rate, according to the UK Cities House Price Index for July 2016, compiled by Hometrack, a property data firm.

On a quarter-on-quarter basis, the UK cities average grew 3.2%, down from 3.4% in June.

Much of this slowdown is attributed to London, where the quarterly growth rate fell to 2.1%, its lowest in 17 months. On an annual basis, the average price in London rose 11.7% to £476,600.

The city's market is feeling the weight of affordability issues, property tax hikes on investors and expensive homes, and the uncertainty surrounding Brexit.

"We continue to believe that turnover will register the brunt of the slowdown in London," said Richard Donnell, insight director at Hometrack.

"In the face of lower sales volumes, agents will look to re-price stock in line with what buyers are prepared, and can afford, to pay. Past experience shows that this process can run for as long as six months and relies, in part, on how quickly sellers are willing to adjust to what buyers are prepared to pay."

House prices will fall by 1% in 2017 on average in the UK as the vote for Brexit pulls the market down, said a forecast from Countrywide, the UK's largest estate agent group. But they will recover to 2% growth in 2018.

© Copyright IBTimes 2024. All rights reserved.