How to Scam Expense Claims and How to Stop Them

As any person on the road will tell you, there are definitely perks to their job – from staying in nice hotels and taking customers out for lavish meals to travelling across the country in style.

But how do you keep track of what claims are legitimately within the company's expense policy rules versus what staff are actually claiming for?

As a manager, you're often left with trying to balance the books at the end of the month using paper receipts, which is all well and good for smaller organisations, where keeping track of who is spending what is relatively easy – but when you're managing hundreds of expenses claimants, this can be nigh on impossible.

Spotting claims errors and intentional over claiming is difficult.

My sales team and I recently travelled across the country and we decided to try out some of the more common expenses scams and fiddles to see how easy it is to over claim and how difficult life can be for payroll professionals spotting it – as a gesture of goodwill, we donated £500 of 'scammed' money to MacMillan Cancer Support.

Scam 1: Hidden Drinks

Software Europe's company policy, like many other companies, is that you can't claim alcohol on expenses.

Our roadshow started in London, so myself and the team decided to have a meal out. We were able to persuade the waiter to change the drinks on the receipt to food items – getting around the no alcoholic drinks policy.

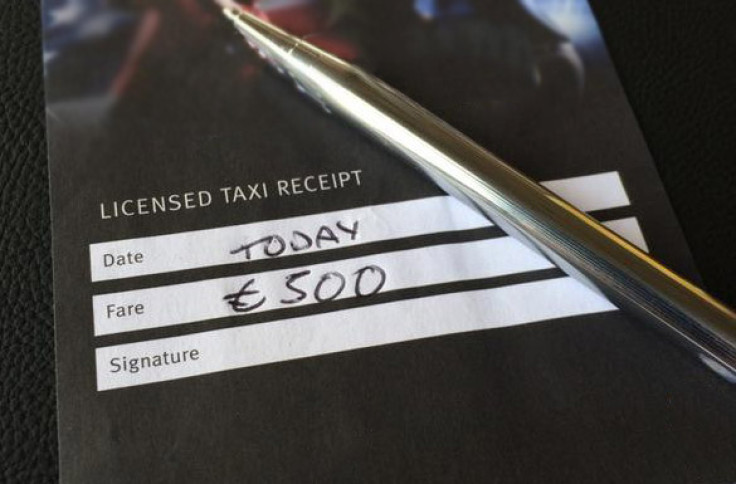

Scam 2: Blank Taxi Receipt

Perhaps this is the most well known, and certainly one of the most common expenses fiddles. Quite simply it's asking for a blank taxi receipt and filling it in yourself.

Our taxi from London King's Cross to our Hotel (also in London) therefore, cost £500 according to the receipt.

A little excessive perhaps, but with a blank receipt it really is that easy to lie about the cost of a journey.

Scam 3: Meal Sign-off

The employee claims for a lavish meal and the manager then signs it off. I took my team out for dinner and told one of my team to pay the bill.

They did and I immediately signed off and approved the expense – once again we were able to get around the 'no alcohol' expense policy.

Scam 4: 1<sup>st class train travel

Helpfully, receipts for rail tickets don't show what class of travel the ticket is for; so travelling first class can be quite easy to get away with.

Most expenses policies usually ask for standard class travel only.

Scam 5: Boosting Mileage Claims

This is quite a simple scam, adding more miles on to a journey. Simple. Effective. Wrong.

Scam 6: The "Double Dip"

As I mentioned earlier, one of the perks of working on the road can be eating out; why should only one person claim for the meal, when two people can?! This scam involves both employees claiming back the cost of the meal, even though only one of them paid for it.

Scam 7: Refunds and Complaints

This certainly isn't one of the more common scams, but one that you should be aware of nonetheless, and this one I actually did more by accident than anything else.

When checking out from my hotel I was given a receipt for payment, and when they asked if I had enjoyed my stay, I mentioned there was an issue with my room. Subsequently the hotel refunded me £14. That went straight in my pocket and I, of course, didn't inform the payroll team!

Scam 8: Non-Existent Passengers

Again, this is another fairly simple con to boost an employee's expenses reimbursement.

Travel expenses often allow for additional money for passengers in the same vehicle. It's very easy to make up fictitious passengers, and very hard to disprove.

What Now?

I'm sure you're thinking that it's all well and good knowing what different expenses scams and fiddles there are, but how can you stop it from happening? As more and more services move online, the ability to drill down into specific expense line items becomes much easier, but in addition to that, expenses software can and should have reporting capabilities.

Therefore, it's a simple case of looking at the top spenders and what they're spending company money on each month.

More often than not you'll see that even of those top-spending employees, they're not scamming expenses they are simply claiming legitimate expenses. However, by examining the top spenders each month, and checking their expenses against their peers will give a good indication that something isn't right.

Whilst trying to fiddle one of our expenses in a restaurant we actually had a chance to speak with the owner, who told us that at least a few times a week she is asked to modify the bill in some way, such as changing 'drinks' to 'special' line items. Expenses scamming is, I'd argue, far more prevalent than you'd think.

One of the most common scams, as mentioned above, is over claiming mileage allowance. Most people wouldn't think twice about rounding up their mileage claims.

One extra mile may not seem like a lot, but if you consider organisations pay, on average, 45p per mile and may have hundreds or even thousands of staff on the road, each extra mile per staff member can equate to a significant amount of lost money through, essentially, fraud.

By using expenses management tools such as Software Europe's, you can mitigate many of these scams – policy checking, mileage checking etc. can all be automated, saving payroll managers time in examining expenses, and giving them more time to focus on other business needs.

Neil Everatt is the CEO of Software Europe

© Copyright IBTimes 2024. All rights reserved.