Government to Provide Tax Break-Up

Chancellor George Osborne is set to announce a government service for all tax payers, through statements listing out the amount of tax that an individual pays to the state. It will also mention details of how the tax money was spent. The service will commence in 2014-15.

The move by the government is meant to increase transparency in all work related to the state.

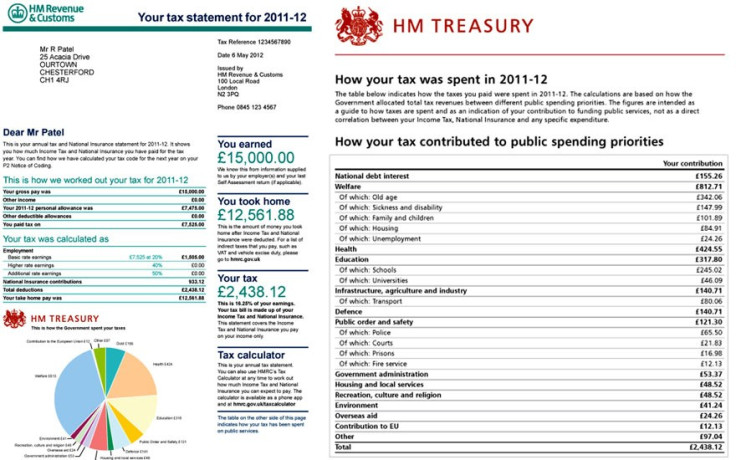

In an example cited by the treasury to explain how the tax invoice for the state would look like, the base-amount for the tax paid for a year was set at £25,000.

In the breakdown of taxes paid, the larger share from the pool of £25,000 was spent on social welfare, accounting for £1900.71. Welfare is backed by expenditure on health at £992.91 and £743.26 goes into basic education.

The remaining tax money goes towards shouldering national debt at £363.12. Defence gets £329.08 to while the police gets £153.19. Those paying £25,000 a year do their bit towards social causes around the world with a contribution of £56.74 towards foreign aid. Our neighbours and member nations of the European Union pocket £28.37 as contributions from an English citizen, reported the Guardian.

© Copyright IBTimes 2024. All rights reserved.