Is It Worth Paying $10,000 for a Scrypt Mining Rig?

With profitable bitcoin mining out of the reach of everyone except large-scale operations these days, many cryptocurrency enthusiasts are turning to scrypt-based altcoins as a potential new investment opportunity.

Initially designed to resist mining by the application specific integrated circuits (ASIC) rigs, scrypt-based coins like litecoin and dogecoin are soon set to see major changes as the first scrypt-based ASIC rigs come to market.

However dropping prices and delaying shipping could mean that people who have shelled out $10,000 (£5,800) for one of these rigs may never see a return on their investment.

Price drop

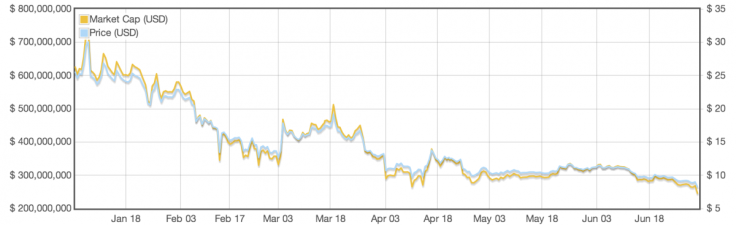

In the last six months the price of the two most most popular scrypt-based altcoins - litecoin and dogecoin - has been consistently dropping.

Litecoin - seen by many as the silver to bitcoin's gold - has seen its market capitalisation drop from a high of over $750 million to less than a third of that value today.

Dogecoin has seen a similar decline, with its market cap going from a high of over $90m in February to below $20m this weekend for the first time since January.

There are various reasons for the price drops including waning interest, huge coin dumps and some in-fighting among the people involved in promoting and using the coins.

Mining Rigs

However there is likely a bigger threat to the price of the coin's future in the shape of ASIC mining rigs.

The scrypt algorithm was designed to be resistant to the types of powerful mining rigs which have dominated the bitcoin network (which uses the SHA-256 algorithm) for a couple of years now.

The reason for this was to allow individuals to mine the likes of litecoin and dogecoin using their own PCs at home, something which is impossible with bitcoin these days.

However manufacturers have now managed to create ASIC mining rigs, with several going on sale earlier this year.

Titan and Viper

KnCMiner and Alpha Technologies are two of the biggest names in the mining rig business, and both announced scrypt-based products earlier this year.

KnCMiner sold $2 million worth of its $10,000 Titan rig in just four hours with the Swedish company saying it was planning on building 2,500 rigs in its initial production run.

Alpha has not revealed how many of its Viper rigs it sold after they went up for pre-order in March.

However both companies have struggled to give customers a concrete shipping date, with KnCMiner saying some time in Q3, and Alpha Technologies latest update on its Viper machines failed to mention a shipping date.

The issues are related to the problems with chip manufacturing and fabrication.

Is it worth the investment?

This leads us to the question, is it worth paying $10,000 for a mining rig which will be mining coins which are worth a lot less than when customers both the machines in March.

Yes, ASIC machines will offer huge benefits in terms of power efficiency over GPU-based mining rigs but will that be enough for those who have made the significant outlay to make a return on their investment?

The price of litecoin and dogecoin has been dropping for six months now but the advent of thousands of ASIC mining rigs onto the respective networks could see that price drop even further, making the investment in these rigs seem risky at best.

Speaking to IBTimes UK about the issues facing the scrypt mining business, chief marketing officer for KnCMiner, Nanok Bie, said his company is just meeting customer demand:

"As a company we focus on producing hardware the market demands. We obviously don't rule over exchange rates of certain single currencies, and we have no say on difficulty, just like everybody else. Producing high-end processors is a costly, risky and tricky endeavour.

"Our processors aren't tailored for a particular currency, they are directed towards specific algorithms – like SHA-256 and Scrypt. Our users can choose what coins they'd like to mine with our machines and it's ultimately the customer's themselves who'll have to make the calculations on ROI for their application. Nobody can predict the exchange rate, even a few minutes ahead and the exchange rate changes everything in mining.

One coin per algorithm

Bie added that even if there is only one coin per algorithm in the future, there will still be a market for ASICs for each algorithm, regardless of which currencies are utilising that particular algorithm.

Giving an update on when KnCMiner's Titan product will ship, Bie said the latest date is sometime in Q3, though it still doesn't have an exact shipping date due to "uncertainties in wafer yield and the rather complicated process of manufacturing these chips."

Bie added: "We're working hard towards a Titan-release in mid-Q3, but can't make a promise on a date, due to the cumbersome international process of producing them."

Alpha Technologies seem to be having similar problems with getting their products into customers' hands, with July the latest shipping date quoted by the company - though an update on its website at the end of June makes no mention of a delivery date for customers.

Both companies have increased the hashing power of their respective rigs for free to try and appease customers frustrated by a lack of clarity around shipping dates, but with the price of altcoins like litecoin and dogecoin continuing to drop, the algorithms getting harder and thousands of ASIC rigs set to join the network at the same time, it is going to be tough to see how these customers will see much of a return on their investment any time soon.

© Copyright IBTimes 2024. All rights reserved.