Sainsbury To Ramp Up Investments, Expects Good Progress In Difficult Consumer Environment

J Sainsbury, the retailing and financial services and property investment group, expects customers to spend cautiously in 2012, particularly in first half of the year. Although the short term remains challenging, key events later in the year, such as the Queen's Diamond Jubilee and London 2012 Olympic and Paralympic Games provide opportunities for growth.

With its continued investments to support customers through difficult times, the group is scheduled to release its Q4 trading statement on Wednesday.

Sainsbury has strong relationships with its customers and is regarded as a trusted and respected brand with 934 stores across the UK, it believes that significant further value for shareholders can be created in the years ahead by investing further in the businesses. The group expects to make good progress even in the difficult economic environment for UK consumers.

The group in its third quarter trading statement for 14 weeks to 7 January, 2012 reported total sales rose 7.0 per cent (4.5 per cent excluding fuel) with like-for-like sales up 4.8 per cent (2.1 per cent excluding fuel). Christmas customer transactions were up 1.5 million to 26 million, increasing the group's market share.

While commenting on the trading, Chief Executive Justin King said: "This was a strong quarter, rounded off by our best Christmas ever, despite the economic backdrop. This was a record-breaking Christmas, with our biggest ever week, day and hour for sales as customers celebrated with Sainsbury's quality food. General merchandise and clothing continued to grow faster than food."

Analysts expect J Sainsbury, the country's No.2 online food retailer, to report a 2.1 per cent rise in fourth-quarter (10 weeks to March 17) sales at stores open at least a year, excluding fuel, but including VAT sales tax. That would match the growth achieved in the third quarter (14 weeks to Jan. 7) and put it ahead of major rivals.

The group already exceeded 165,000 orders a week to become the UK's second largest online food retailer. The 20 per cent year on year rise in orders a week makes it the fastest growing online grocery business.

British retailers have struggled over the last year as consumers battled inflation, government austerity measures, worries about job security, a stagnant housing market and the impact of the euro zone debt crisis. But the UK government and the Bank of England expect a rise in consumption later this year when inflation is set to fall. UK retail sales remained sluggish in February but rose in January. The data and a string of promising business surveys have raised hopes of recovery in 2012.

In February Sainsbury announced the investment of £2m in Tamar Energy Limited, a new company focused on producing energy from organic waste matter. Tamar Ltd was launched and is backed by a number of investors who are contributing over £65m to establish the business, to develop a UK network of over forty anaerobic digestion (AD) plants. Collectively they will generate 100MW of green electricity over the next five years. The project brings together the UK and international blue chip partners and investors whose input and expertise will develop the business.

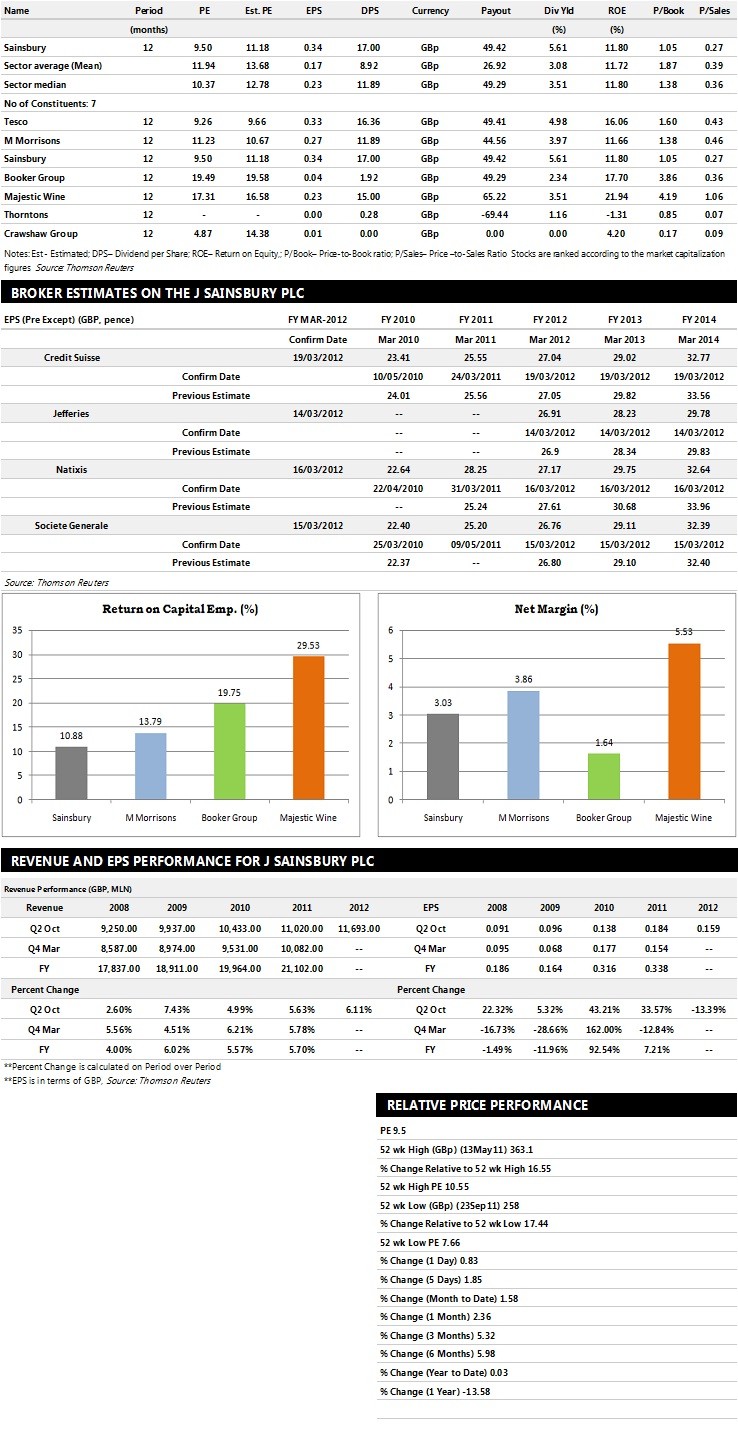

Brokers' Views:

- Oriel cuts to 'Hold' rating from 'Add'

- Credit Suisse recommends 'Under Perform' rating on the stock

- Societe Generale assigns 'Hold' rating with a target price of 310 pence per share

- Nomura Securities gives 'Hold' rating

- Jefferies assigns 'Hold' rating with a target price of 310 pence per share

Earnings Outlook:

- Credit Suisse estimates the company to report revenues of £22,801 million and £23,858 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £710 million and £755 million. Earnings per share are projected at 27.04 pence for FY 2012 and 29.02 pence for FY 2013.

- Natixis projects the company to record revenues of £22,350.75 million for the FY 2012 and £23,426.86 million for the FY 2013 with net profits (pre-except) of £569.94 million and £621.86 million. Profit per share is estimated at 27.17 pence and 29.75 pence for the same periods.

- Societe Generale expects J Sainsbury to earn revenues of £22,157 million for the FY 2012 and £23,376 million for the FY 2013 respectively with pre-tax profits of £704 million and £772 million. EPS is projected at 26.76 pence for FY 2012 and 29.11 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents seven companies based on market capitalisation.

© Copyright IBTimes 2024. All rights reserved.