JP Morgan Earnings: Bank Reveals $5.8bn London Whale Loss For 2012

- JPM reveals a loss, more than double original estimates originally said the "London Whale" losses from its CIO will be around $2bn

- JPM: "Our previously filed financial statements for the 2012 first quarter should no longer be relied upon"

- JPM: "There was a material weakness in our internal control over financial reporting at March 31, 2012 related to CIO's internal controls over valuation of the synthetic credit portfolio"

1433 BST: The investor conference call has ended. Thank you very much for joining IBTimes UK for this special live blogging section.

1431 BST: JPM shares up in pre-trading on estimates for 2012 being too low

1428 BST: Cavanagh: "I can't speak for the regulators but we have spent a lot of time with them."

Dimon: "The board as an independent group is still working with regulators on thie CIO case."

1424 BST: JP Morgan's Loss: The Explainer

Heidi Moore, New York bureau chief and Wall Street correspondent for Marketplace has published a great quick and snappy guide around the JP Morgan London Whale case. Check it out if you want a quick guide to what happened and what went wrong. In plain English.

1421 BST: What's the outlook with the drag from Europe?

Dimon: "Business in Asia and Europe in down. US remains to be seen."

1417 BST: Nancy Bush, NAB Securities refers to Slide 8 here and asks about CIO risk team in April.

1414 BST: Dimon has the seal of approval from legendary investor Warren Buffett who is currently on Bloomberg TV at the moment.

1412 BST: Dimon: "We should have just conducted more stress tests in the CIO portfolio."

1410 BST: Cavanagh: "VaR does not capture change in correlation. It is backwards looking. VaR is only one model."

1407 BST: Analyst points out the failures of risk management for CIO ....

Cavanagh: "Overall mistake was including the [trades] that were very different to the rest of the portfolio that had its own set of risk wrapped around it. It needed a different model to tackle it."

1403 BST: Dimon refuses to comment on any communications between derivatives traders and Libor submitters

1359 BST: Basel III effects

Braunstein: "The NPR on Basel I is the main issue"

Dimon: "We will be fine whatever the Basel III numbers are."

1355 BST: Analysts asks Dimon if the company have reached a level of size and complexity making it too difficult to manage, following the CIO event.

Dimon: "No. I can't prove a negative. We believe we have very good controls. We made a mistake and we tackled it the best way we could. This was an exception. We made a mistake and have completely disclosed that mistake. CIO was not where we were expecting a mistake... We should never, ever have gone that big... It is not possible in the real world not to make mistakes. That is only possible in the fictional world. "

Laughter resounds.

1351 BST: Nancy Bush from NAB Securities asks Dimon to explain how the bank's underlying trends were very positive this quarter but there is a "disconnect over what is happening across the world."

Dimon says the bank has been growing marketshare through various loan growth.

Bush asks litigation reserves?:

Dimon, "$300m in litigation reserves"

1347 BST: Dimon comments on an analyst question about the current Libor scandal: "All of these things, we are totally open with regulators and investigators. I would be a little patient if I were you and not all companies are in the same position. I wouldn't make assumptions. "

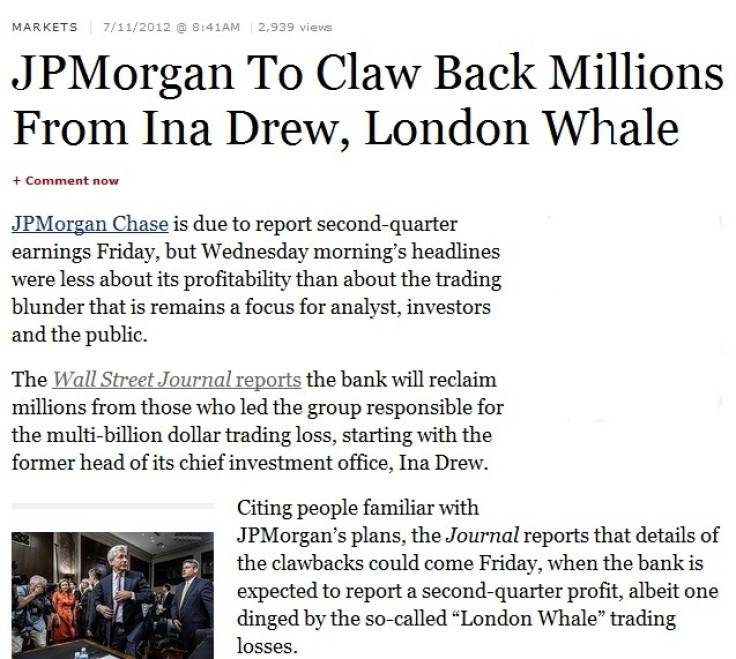

1343 BST: Dimon jumps in on the call and talks about Ina Drew: "She has acted with integrity at all times, even though she was involved in this mistake."

You'll remember her from this:

1340 BST: The investor call opens to questions

1341 BST: Cavanagh quashes questions over whether Bruno Iksil and other CIO employees leaving the bank: "We have taken people actions on a timely basis. ButWe are not providing more details on people actions and individuals."

1338 BST: Cavanagh says that the London Whale incident was "isolated". "Makes us step up our game."

1335 BST: Cavanagh: "We have a new Chief Risk Officer who will oversee all functions. We have a more robust risk committee and significant senior officers on the committee and external subject experts. Better market risk limit structures also implemented. We have also strengthened the model review group and questions over escalation. Group will also assess the analytical testing and model review. All market VaR models have been reviewed."

1333 BST: Cavanagh: "Synthetic credit VaR model in CIO was meant to be updated to be more accurate. So fundamental problem with the process was the implementation communication. Sloppy implementation. Calculation mistakes led to lower VaR compared to what it should be. We have strengthened the process, since, on approval and implementation processes."

1330 BST: Cavanagh: "We had a less than robust risk committee supporting the CIO. Event will prompt major changes. CIO risk team did not challenge the front office enough or escalate concerns."

1328 BST: Cavanagh: "We are doing a complete revamp over CIO management"

1327 BST: Cavanagh: "There were numerous risks that grew that people did not understand or understand how to manage these risks."

1325 BST:Cavanagh: " VaR model was not in focus in the first quarter."

1322 BST: Cavanagh: "CIO breached risk limits twice in the first quarter"

1318 BST: If you haven't seen this ....

This is a great profile over who Mike Cavanagh is:

1316 BST: Mike Cavanagh, head of the bank's Treasury & Securities Services group, takes over and kicks off with digest over what went wrong at the CIO office, resulting in the London Whale losses.

"Cause: CIO judgement, monitoring and escalation was poor. Risk management was ineffective. Risk limits were not granular enough, approvement of VaR model was poorly done."

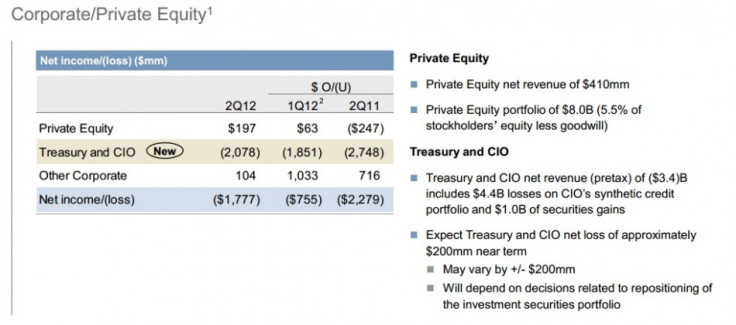

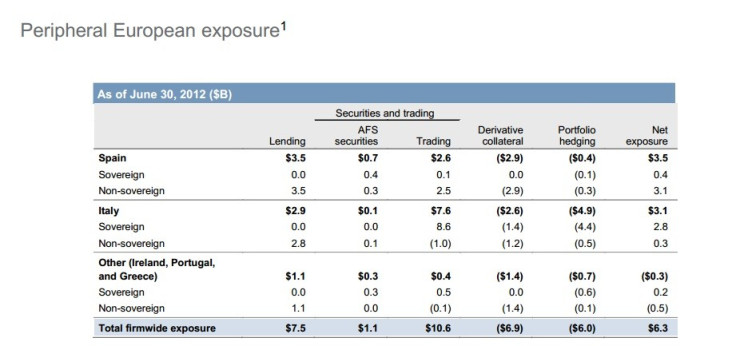

1313 BST: With all the focus on the London Whale losses, it's worth noting JPM's sovereign debt exposure

1311 BST: OUTLOOK FOR Q3

~$900m one-time gain due to swap termination associated with TruPS redemption in 3Q12

1306 BST: Braunstein: "We are going to give three separated unit reports. All incrementally updated and reinvestment strategies."

This includes:

Corporate / Private equity

Treasury and CIO performance

Fortress Balance sheet

1256 BST: JPMORGAN CFO BRAUNSTEIN SAYS TOTAL LONDON WHALE LOSSES $5.8BN THIS YEAR

1254 BST: JPM's CFO Braunstein talks slowly and clearly about questionable CIO trader data:

"We were concerned about the CIO traders intent when marking the portfolio losses and we questioned the integrity of the trader marks. We thought it would be prudent to report this and restate our Q1.!

1251 BST: Dimon closes with speech:

"You can see throughout the whole crisis that we still managed to grow. We are not proud of this moment but we are proud of the company. We have learned a lot and this has shaken the company to the core."

"You can never say you won't make mistakes. We work in a risk business."

1249 BST: As with all losses, legal or illegal, Dimon calls the London Whale incident as an "accident"

1246 BST: Dimon: "We will not buy back stock until board review and we submit new capital plan to Fed and hopefully if all goes well, we will star buying back stocks in the fourth quarter"

1244 BST: JPM shares in positive after hours territory.

1242 BST: JPM: All CIO Synthetic Credit Managers Have Left Firm

1241 BST: Dimon: "CIO will always be subordinate to the needs of the rest of the company."

1240 BST: DIMON: "REMAINING CIO PORTFOLIO: $11BN SHORT, IDENTIFIED TO OFFSET POTENTIAL LOSSES

1236 BST: Dimon on investor call - massively reduced risk

"The synthetic credit portfolio - from the loss of synthetic credit, the worse thing was to manage down these illiquid things. We did get it down faster than hoped."

"These are generally crude but accurate, $30bn RWA down from peak down from where it was in December."

"IG9 down 70%, reduced high grade yield and complex risk down by 70%"

1230 BST: JPM kicks off investor conference call

Jamie Dimon, CEO, JP Morgan:

"We've had 100s of people fixing this."

"Hopefully after this, we will be a stronger company after this."

1222 BST: So do we have another case of fraud on our hands?

The last few months, details over civil or criminal convictions, investigations into fraud - even a major terrorist financing probe a la HSBC - has dogged headlines.

JPM's London Whale loss has been catastrophically bad in exposing terrible risk management practices, lax controls and greedy banking culture - but it was certainly a legal loss.

However, with JPM revealing that its traders had been lying all along about its losses (see below posts) then surely the SEC will have to get involved with seeking out those who have committed fraud?

1220 BST: JPM Restatement in its entirety

If you want to read the full thing, click here

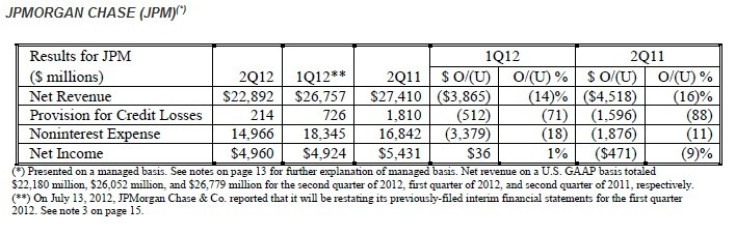

1216 BST: JPM overall results

Here's an overview:

Figures look much better than they should, since some of the London Whale losses have been pushed into Q1 results .....

1210 BST: CIO will no longer trade a synthetic credit portfolio

Jamie Dimon, CEO at JP Morgan:

"CIO will no longer trade a synthetic credit portfolio and will focus on its core mandate of conservatively investing excess deposits to earn a fair return. CIO's $323 billion available-for-sale portfolio had $7.9 billion of net unrealized gains at the end of the quarter. This portfolio has an average rating of AA+, has a current yield of approximately 2.6%, and is positioned to help to protect the Firm against rapidly rising interest rates. In addition to CIO, we have $175 billion in cash and deposits, primarily invested at central banks."

"The Firm has been conducting an extensive review of what happened in CIO and we will be sharing our observations today. We have already completely overhauled CIO management and enhanced the governance standards within CIO. We believe these events to be isolated to CIO, but have taken the opportunity to apply lessons learned across the Firm. The Board of Directors is independently overseeing and guiding the Company's review, including any additional corrective actions. While our review continues, it is important to note that no client was impacted."

1208 BST: Uh-oh. JPM shares turn negative in after hours

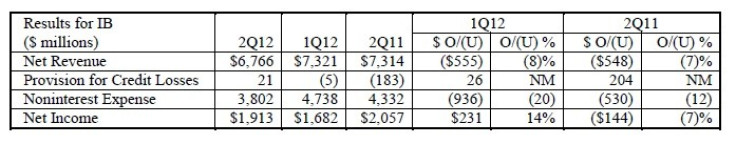

1205 BST: JPM's investment banking results

Here's a quick visual on JPM's IB results:

1200 BST: JPM ... oh and yeah, by the way we lost $4.4bn from the London Whale bad hedging bet

JPM has released its earnings data and funnily enough at the top of the press release, the bank kicks off with:

- Investment Bank maintained #1 ranking for Global Investment Banking Fees

- Consumer & Business Banking average deposits up 8%; Business Banking loan originations up 14%

- Mortgage Banking originations up 29%

- Credit Card sales volume<sup><small>3 up 12%

... and various other bits about how wonderful they are.

However,, here's the meaty stuff:

First-half 2012 net income of $9.9 billion, EPS of $2.41 and revenue of $49.6 billion not impacted by first-quarter 2012 restatement; second-quarter 2012 balance sheet and capital ratios also not impacted

- $4.4 billion pretax loss ($0.69 per share after-tax reduction in earnings) from CIO trading losses and $1.0 billion pretax benefit ($0.16 per share after-tax increase in earnings) from securities gains in CIO's investment securities portfolio in Corporate

- $2.1 billion pretax benefit ($0.33 per share after-tax increase in earnings) from reduced loan loss reserves, mostly mortgage and credit card

- $0.8 billion pretax gain ($0.12 per share after-tax increase in earnings) from debit valuation adjustments ("DVA") in the Investment Bank

- $0.5 billion pretax gain ($0.09 per share after-tax increase in earnings) reflecting expected full recovery on a Bear Stearns-related first-loss note in Corporate5

- Substantial progress achieved in CIO

- Significantly reduced total synthetic credit risk in CIO

- Substantially all remaining synthetic credit positions transferred to the Investment Bank

- Investment Bank has the expertise, capacity, trading platforms and market franchise to manage these positions

- CIO synthetic credit group closed down

1158 BST: JPM REPORTS LONDON WHALE $4.4BN LOSS

$4.4 billion pretax loss ($0.69 per share after-tax reduction in earnings) from CIO trading losses and $1.0 billion pretax benefit ($0.16 per share after-tax increase in earnings) from securities gains in CIO's investment securities portfolio in Corporate

1154 BST: JPM's vote of no confidence in their own estimates

Just when you thought it couldn't get worse in at least the PR department for JPM and Jamie Dimon's reputation - the bank has had to file its restatement for Q1.

In addition, it said most poignantly (emphasis ours): "Our previously filed financial statements for the 2012 first quarter should no longer be relied upon. We expect to file restated financial statements for the first quarter as soon as practical but no later than when we file our financial statements for the second quarter.

In addition, we have determined that there was a material weakness in our internal control over financial reporting at March 31, 2012 related to CIO's internal controls over valuation of the synthetic credit portfolio. The control deficiencies were substantially remediated by June 30, 2012.

Our internal review of these matters is ongoing. If we obtain additional information material to our periodic financial reports, we will make appropriate disclosure.

More detail related to the restatement is available in a Form 8-K that the firm is filing this morning with the U.S. Securities and Exchange Commission."

1152 BST: JPM shares, positive in after-hours

1148 BST: JP Morgan to Amend Interim Financial Statements for 2012 First Quarter

Fresh off the wires, JP Morgan will restate its previously-filed interim financial statements for the first quarter of 2012. The restatement will have no effect on total earnings or revenues for the company year-to-date.

JPM SAYS:

"More specifically, traders in CIO were expected to mark their positions where they would expect to be able to execute in the market. In this instance, while the positions were within thresholds established by an independent valuation control group within CIO, the firm has recently discovered information that raises questions about the integrity of the trader marks and suggests that certain individuals may have been seeking to avoid showing the full amount of the losses in the portfolio during the first quarter.

As a result, we are no longer confident that the trader marks reflected good faith estimates of fair value at quarter end and we decided to remark the positions utilizing external "mid-market" benchmarks, adjusted for liquidity considerations. While there are a range of acceptable values for such positions, we believe our approach represents an objective valuation and is a reasonable approach under the circumstances."

1140 BST: Hitting the wires (Reuters) right now: JPMORGAN -RESTATEMENT RELATES TO VALUATIONS OF CERTAIN POSITIONS IN SYNTHETIC CREDIT PORTFOLIO OF FIRM'S CHIEF INVESTMENT OFFICE

- 13-Jul-2012 11:39 - JPMORGAN -REACHED A DETERMINATION TO RESTATE FIRM'S PREVIOUSLY-FILED INTERIM FINANCIAL STATEMENTS FOR THE FIRST QUARTER OF 2012

- 13-Jul-2012 11:39 - JPMORGAN CHASE & CO JPM.N - THE RESTATEMENT WILL HAVE NO EFFECT ON TOTAL EARNINGS OR REVENUES FOR THE COMPANY YEAR-TO-DATE

- 13-Jul-2012 11:39 - JPMORGAN CHASE & CO- RESTATEMENT ANNOUNCED TODAY WILL REDUCE FIRM'S PREVIOUSLY-REPORTED NET INCOME FOR 2012 Q1 BY $459 MILLION

- 13-Jul-2012 11:39 - JPMORGAN- FIRM REACHED DETERMINATION TO RESTATE ON JULY 12, 2012, FOLLOWING MANAGEMENT REVIEW OF MATTER WITH AUDIT COMMITTEE

- 13-Jul-2012 11:39 - JPMORGAN -RESTATEMENT RELATES TO VALUATIONS OF CERTAIN POSITIONS IN SYNTHETIC CREDIT PORTFOLIO OF FIRM'S CHIEF INVESTMENT OFFICE

1133 BST: Addressing risk management

It will be interesting to hear what steps JP Morgan will be putting in place to amend failures in its risk management and compliance functions.

Interestingly, at industry magazine Risk, writers found out that "75 risk committee members at 15 institutions, only four have previously held a senior risk position at a big financial firm."

With a cluster of CIO employees reportedly leaving / left the bank, this could be an opportunity for Dimon to announce new risk manager appointments.

1120 BST: Whale and Co - go?

Word on the street, or the WSJ, said that three of the CIOs employees Achilles Macris, Javier Martin-Artajo and Bruno "The London Whale" Iksil have left the bank.

While no other media outlets have confirmed this, the WSJ added:

"J.P. Morgan is expected to reclaim, or claw back, compensation from all four people, according to people familiar with the bank."

1110 BST: Another nifty chart ...

The following chart from the Wall Street Journal is a good little reminder about how bad JPM's stock has been performing since the London Whale event.

Hopefully the results and earnings call will put to an end investor concerns and uncertainty over the extent and level of losses and damage from the bad hedging bet.

1108 BST: Earnings Preview

While many market participants will be concentrating on London Whale related losses, let's take a look at a sneak preview of what analysts are predicting about its wider earnings:

- JPM will hold an investor call Friday morning at 7:30am EDT

- Investors are expecting an update on JP Morgan's Chief Investment Office (CIO) losses

- JPM said on May 10th call that the CIO sustained a $2bn loss

- Data from Bloomberg has 26 analysts at Buy on JPMorgan, 11 with a Neutral rating, two at Sell. The Street's price target average is $44, ranging from $28 up to $60.

- Goldman Sachs is looking for EPS of 60 cents. GS recently added JPMorgan to its America's Conviction List, saying shares have vastly underperformed since the CIO disclosure. Goldman also noted that the CIO unit accounts for just 5 percent of EPS at the bank.

- Deutsche Bank sees EPS of 91 cents. The firm is modeling CIO losses of $4 billion in the quarter, or $2 billion net of securities gains. The firm also sees FICC trading down 25 percent from last year, but given macro weakness and de-risking, there might be chance for some downside to expectations.

1101 BST: Just a little reminder of why we are here .....

It's not every day that we dedicate live coverage to a bank earnings report, but this one is set to be one of the most widely anticipated releases.

In May this year, JPM confirmed that the bank has lost billions of dollars, after an employee at its Chief Investment Office (CIO) unit made a series of enormous bad hedging bets.

In one of the largest legal losses for a bank in recent history, Bruno Iksil, who reportedly deals in huge volumes, earned himself the nickname "the London whale" - which echoes gambling terminology that refers to a "whale" being a leviathan gambler who frequently bets monumental amounts of money.

While JPM said losses from the bet will be in the region over $2-3bn, multiple reports and estimates from unnamed sources have been littered throughout media coverage, ranging from $4bn - $9bn.

Here is just a visual towards the market reaction post London Whale losses were first officially announced:

1100 BST: Welcome to the Live Blog

Good morning and welcome to a special live JP Morgan Earnings Live blog.

Lianna Brinded, senior business reporter at IBTimes UK, will be blogging in the run-up to and during the JP Morgan earnings data release.

© Copyright IBTimes 2024. All rights reserved.