Major UK lenders' financials hint at a turnaround, but can investors bank on the sector again?

Banks have been rebuilding their balance sheets and returning to form – once again piquing equity investors' interest.

The banking crisis of 2008 left the industry in tatters. In addition to the integrity and reputation of financial corporations being damaged almost beyond repair, the lack of accountability for such apparently irresponsible and morally reproachable behaviour met with great public disdain.

Banks have been struggling to recover ever since and the public's perception of the sector remains a predominantly negative one.

With many companies cleaning up their books since 2008, balance sheets are looking healthier, yet valuations still offer attractive investment opportunities.

The first quarter financials of Lloyds, RBS, Barclays and HSBC seem to be pointing to a bit of turnaround from the dark days of the global financial crisis of 2008-09.

So investors might be wondering if the time is right to put their faith in the banking sector and explore opportunities in the sphere.

Morningstar is certainly bullish about the sector with a recent report suggesting that US corporate tax reform could drive financials in the coming months, although this benefit will not be uniformly distributed across the sector.

We are at the beginning of a new cycle where many of the investment trends of the last few years, such as defensive growth, have gone into reverse.

This is giving way to more cyclical, value-type investments, and since Brexit and Donald Trump's election as US president, fund managers who overweight sectors such as banks are outperforming. So where might there be opportunities for investors?

Banks: a reliable source of income?

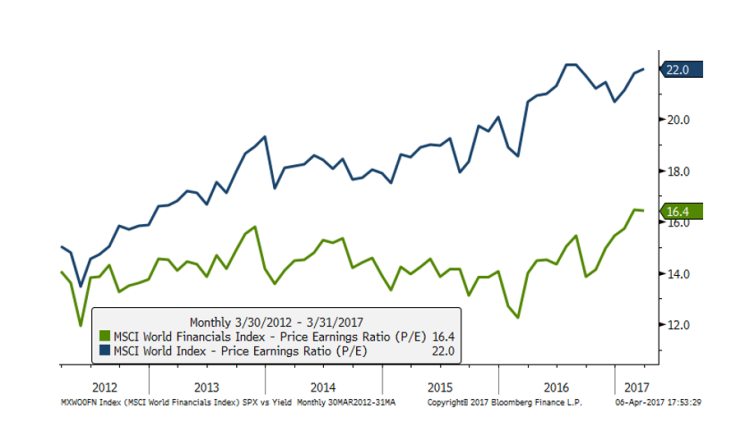

The chart below shows the price-to-earnings (P/E) ratio of the MSCI World Financials index is lower than that of MSCI World, which indicates the sector is undervalued.

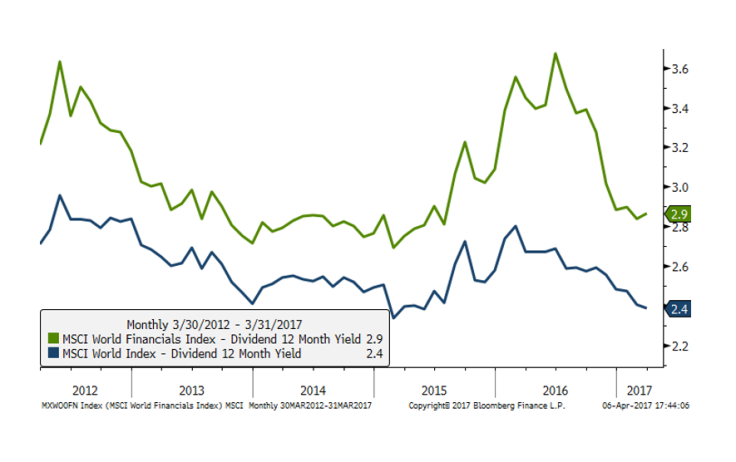

You can also see the dividend yield from financials is higher than that of the MSCI World index, which indicates the sector is valuable for investors from an income perspective.

Besides traditional banks, what other opportunities could investors take advantage of in the financial sector?

- Even though the financial sector is dominated by banks, there are some other opportunities to be found in sub-sectors, such as financial technology (e.g. online payment and digital platforms), financial services (e.g. asset managers, rating agencies & stock exchanges), and insurance and in emerging markets.

- The rise of ''fintech'' (financial technology) highlights just one of a number of opportunities emerging from the financial services sector. In this space, transaction processing firms are benefiting from the ongoing global secular shift towards card-based and electronic payments.

- Rating agencies and exchanges also play a crucial role in providing diversified investment opportunities within the sector and are more defensive and relatively insulated from volatile macro headwinds.

- While banks and insurers generally benefit when interest rates rise, demographics are a powerful long-term driver for emerging market banks and insurance companies. With the penetration of loans and mortgages amongst an expanding middle class set to explode over the next decade, companies catering to these markets will continue to grow. Banks orientating their businesses to service the growing wealthy across the globe are also likely to benefit.

Why the future looks bright for the financial sector

Financials looks an interesting sector right now for a number of reasons:

- Favourable macroeconomic and regulatory environment

- Valuations are attractive

- It offers diversification

- Strong dividend growth

- Reduced regulation, but still combined with rigorous stress testing

- High barriers to entry

However, challenger banks are disrupting the bigger, more established players through the use of technology.

Financials are positioned to benefit from the more benign economic backdrop in the US, a rising interest rate environment, lower corporate taxes, greater infrastructure spending and potentially less regulation in the sector.

Banks, in particular, have been rebuilding their balance sheets and are now returning to form, and the health of these businesses is reflected in the level of dividends they are now paying. It remains to be seen what the full impact of Brexit will be, and whether UK banks decide to move some of their operations to mainland Europe, but the financial industry remains broadly positive.

Michelle McGrade is the Chief Investment Officer of TD Direct Investing, the UK brokerage arm of Canada's TD Waterhouse bank. Since the mid-1990s, Michelle has specialised in manager selection and portfolio management, researching managers with different disciplines across the globe. Prior to her role at TD Direct Investing, Michelle worked at both Executive Director and Chief Investment Officer levels at Bank of Bermuda, Coutts, Northern Trust, Investment Solutions and Mediolanum.

© Copyright IBTimes 2024. All rights reserved.