Manchester United shares - for devout fans and signature stock hoarders only?

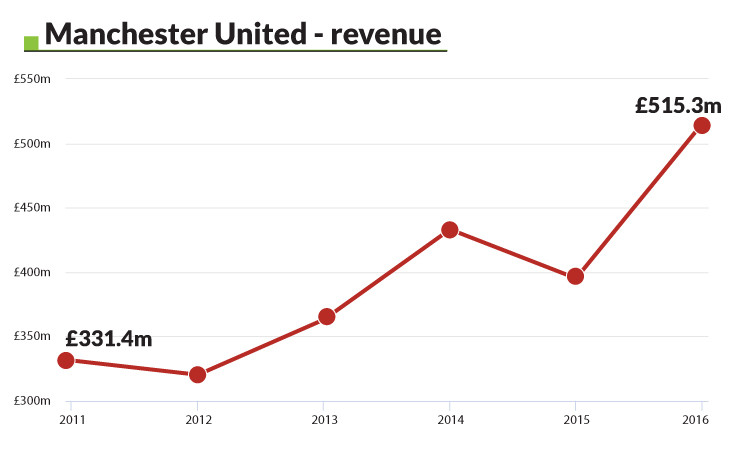

United have been listed for over five years but their shares have gone nowhere despite the club's extraordinary commercial success.

On Thursday (9 February), Manchester United's executive vice chairman Ed Woodward told investors the club remains on track to deliver record revenue this year, after posting a sharp increase in second quarter earnings.

If achieved, the feat would be even more impressive when one considers that just last month the 20-time champions of England were crowned the richest club in the world in Deloitte's Football Money League, after posting revenue of £515.3m for the 2015-16 season – the highest ever recorded by any football club.

And yet, for all their financial success, the club's shares remain something of a puzzle. Much like United have done on the pitch over the last three seasons, they have flickered but have never fully ignited.

They might make for a great collector's item for fervent fans and for those who want to own a stake in one of the most recognisable sport brands in the world, but a lot of investors have steered clear.

The club made its debut on the New York Stock Exchange in August 2012, following an offering of 16.7 million shares, each priced between $16 and $20.

However, the Glazer family, which took control of United in a controversial takeover in 2005, put up for sale only 10% of the club, with the shares issued by Red Football LLC, the entity representing the late Malcolm Glazer and his family.

Two years later, the Glazers sold a further 5% of the club, pocketing approximately £88.7m in the process.

Despite being one of the most famous and successful football clubs in the world and enjoying the sort of commercial profile some of their peers can only dream of, United's IPO never set the pulse of investors racing.

The (red) devil is in the detail

As is often the case in this kind of situation, the devil was in the detail. At the time of the club's IPO, the shares put up for sale were divided into "A" and "B" classes and, following the listing, new shareholders, which included George Soros' investment company, controlled around 42% of Manchester United Class A shares.

However, under the dual-class share structure outlined in the IPO, that gave them only 1.3% of total voting power. Crucially, the Glazers, which retained 58% of Class A shares, also held all of Class B shares, which carried 10 times the voting weight and, therefore, left the American family with 98.7% of the voting power.

"The fact that Manchester United are quoted in New York is irrelevant as 75% of the stock is owned by the Glazers and 15% by Citadel, Och-Ziff Capital Management and Perry Capital," Panmure analyst David Buik told IBTimes UK.

"Sport is a precarious business and the demographics of sport as a business have changed in the last decade. Investors are much more savvy than they were. I fail to see how a prospectus could possibly sell guaranteed growth to prospective investors."

Facebook, Groupon and Zynga adopted a similar lopsided structure in their IPOs, but many felt the nature of United's listing was so skewed in favour of the Glazers that it was not worth it.

"The principal advantage to the Glazers from listing in New York rather than London is that the A/B dual share structure is acceptable in the US and not in the UK," Andy Green, investment director of a City equity firm and adviser to the Manchester United Supporters Trust, said at the time of the IPO.

"It would be very hard to float a company with such diminished voting rights for outside shareholders in London."

Having been tax registered in the UK since its inception, United's tax domicile was moved to the US, where, at 35%, the income tax is higher than the UK's 28%.

"The fact that the Glazers are happy for the club to pay a higher tax rate tells us a lot about the importance of the A/B share structure to them," Green added.

To make matters worse, under the Jumpstart Our Business Startups Act of 2012, United indicated it would take advantage of the opportunity of enjoying reduced financial reporting requirements for up to five years and would not pay a dividend.

Shares stuck in mid-table

If the shares did not capture the imagination before the IPO, they have hardly set the world alight since. To borrow a football analogy, they have been stuck mid-table for six years.

With the exception of the second stake sale, which sent the stock price as high as $19.31 a share, when the shares have moved, they have gone in the wrong direction. In February last year, shares hit a three-year low of $13.86, as Louis Van Gaal's side stumbled its way through a rather dismal campaign - one which, admittedly, ended with them lifting the FA Cup at Wembley.

"The shares have gone nowhere in six years and the club is just a cash cow so the Glazer family can fund their other, rather unsuccessful, sporting enterprises," explains Buik.

A large majority of United fans strongly opposed the takeover and some still harbour resentment towards the American owners. In 2005, disillusioned with the takeover which saddled the club with over £700m of debt, a group of fans abandoned the three-time European Cup winners and decided to set up FC United of Manchester, a rebel club.

Five years later, match-going fans wore green and gold scarves – the colours of Newton Heath, the club which would become Manchester United in 1902 – as a massive anti-Glazers protest swept Old Trafford throughout the season.

Talks of a takeover, however, soon faded away, as did the protest. United won the league in 2011 and in 2013 and, under Jose Mourinho, they are looking to return to the dominance of old after three dismal seasons.

However, while change in the dugout has been the plate du jour since Sir Alex Ferguson's departure, change in the boardroom appears unlikely.

"Unless someone comes in with a monster bid like say $25 a share, there is no way the Glazers are selling," Buik adds.

"They need the club to milk it for its much needed cash."

© Copyright IBTimes 2024. All rights reserved.