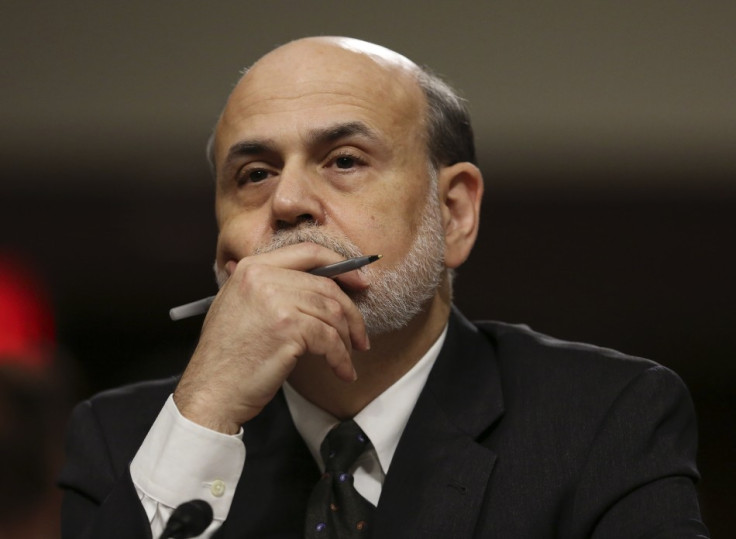

Markets, Economics, Politics: Don’t Blame Fed Reserve Chairman Ben Bernanke

Profit taking will dominate the markets this week but don't blame Federal Reserve Chairman Ben Bernanke.

Markets

Last week, equity investors got the excuse for profit-taking that they had been looking for and, with the end of the month (and May of all months!) not until Friday, there is surely more to come.

The Federal Open Market Committee (FOMC) was always the most likely to furnish a pretext but, with Bernanke's being as impeccable as usual in his testimony on Wednesday to Congress's Joint Economic Committee, attention switched later in the day to the minutes of the meeting three weeks ago.

Disagreement among the Committee over how to reach future decisions was apparently enough for some trigger-happy punters.

Other investors, struggling to understand what had changed in the US, were then assailed by the latest HSBC/Markit China Manufacturing PMI's falling further (this time into contractionary territory below 50), followed by a 7% dive in the hitherto unstoppable Nikkei.

It was a holiday on Monday in both the US and UK, but more selling is very likely in the build-up to the release of important US data on Thursday and Friday.

It is, therefore, important to keep in mind that the FOMC has not changed its policy of not reducing asset purchases from the current unless and until the economy picks up.

Profit-taking in equity markets, albeit on somewhat tenuous grounds, has further unsettled bond investors, who were already contemplating the dreadful day when yields must at last break sharply upwards. Last week it was the turn of Japanese and European bonds to be hit by jitters and there should be more this week.

Tumbling equity prices is fuelling yet another rally in Gold, and its protracted retreat is increasingly becoming a story fit for a financial latter-day Xenophon to chronicle.

A combination of falling equity and bond prices would normally be expected to boost the dollar and, indeed, is doing so against most currencies, especially the minor ones. However, profit-taking from shorting the yen and Swiss franc is proving hard to resist in these last few days of May.

Politics

Given its illustrious attendees, much could be achieved at the upcoming G8 Summit in Northern Ireland but there is so much disagreement on political issues such as Syria and over austerity vs. growth that very little can be expected.

UK Prime Minister David Cameron plans to major on 'tax tourism' but the main culprit nations are far too small to be invited.

The almost eerie tranquillity in the European Monetary Union (EMU), as compared to the UK, is continuing but the local elections in Italy will highlight the disagreement over austerity within the new coalition government. In the UK, the Whitsun recess should take some heat off Mr Cameron but last week's cover of 'Private Eye' depicts the gravity of his plight under the caption 'Coalition in Crisis!' with the Prime Minister saying to Nick Clegg 'I can't work with the Tories any more'.

With Ed Miliband, head of the Labour Party, failing to shine, the Tories should surely be trying to tune into the real concerns of voters. Those whom the gods wish to destroy, they first make mad!

Economics

A raft of US data may not be quite good enough to sustain the dubious argument that the FOMC is only a month or two away from tapering its quantitative easing programme. On the other hand the second cut of Q1 GDP should show that the economy as a whole is moving forward with consumers leading the way.

UK consumers are still far from confident but sight should not be lost of last week's rather good GDP, Public Borrowing and Inflation data.

Another set of terrible Unemployment data is due from the EMU but investors seem to have become immune to any bad news from there. More attention is likely to be paid to official Manufacturing PMI Survey from China's National Bureau of Statistics.

Alastair Winter is the Chief Economist at Daniel Stewart & Co.

© Copyright IBTimes 2024. All rights reserved.