Michael Page Continues Diversification, Maintains Strong Financial Position

Michael Page International, the specialist recruitment consultancy, is prepared to continue its geographic expansion, as there remain many long-term development prospects in its newer territories, particularly Latin America and Asia.

The group is scheduled to report its full year results on March 6, 2011 and expects new country openings in Columbia, Morocco and Taiwan, as well as several new office openings in existing countries.

Even though the Eurozone outlook is difficult, the group's activity levels remained strong but the growth of the activity through offers, acceptances and fees slowed as customers and candidates became more careful.

According to trading update, Michael Page's FY 2011 gross profits increased by 25 per cent to £553.7m. The group expects to report profit before tax at £85m, which is 18 per cent up on 2010 and continues to gain from its geographic and discipline diversification, achieving growth during the year in all reported disciplines and geographic regions. It reported a strong financial position, with approximately £60m of cash at the end of the last year.

The year-on-year progress rates slowed from those in the third quarter, particularly in Southern Europe. The significant exception was Germany (7 per cent of the Group), which continued to record year-on-year growth in surplus of 40 per cent. The headcount in the EMEA region rose by 20 in the fourth quarter, with investment continuing in the stronger growth areas and new start-ups, moderated by reductions through natural attrition in countries where year-on-year growth rates have slowed.

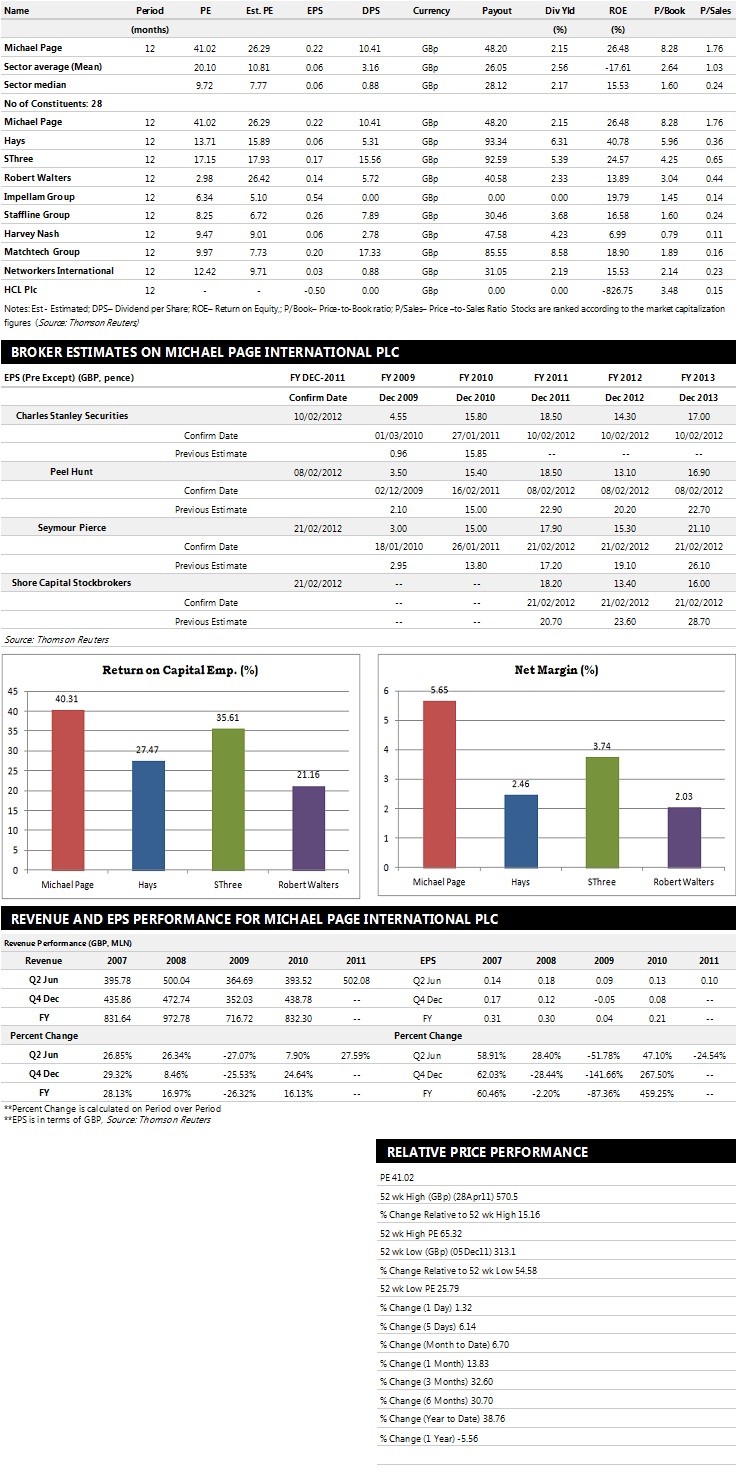

Brokers' View:

- Goldman Sachs recommends 'Neutral' rating on the stock with a target price of 386 pence per share

- Seymour Pierce assigns 'Sell on Strength ' rating

- Shore Capital Stockbrokers gives 'Buy' rating

- Peel Hunt assigns 'Sell' rating

- Charles Stanley recommends 'Buy' rating.

Earnings Outlook:

- Seymour Pierce estimates the company to report revenues of £1,005.20 million and £1,079.40 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £85.30 million and £72.50 million. Earnings per share are projected at 17.90 pence for FY 2011 and 15.30 pence for FY 2012.

- Shore Capital Stock Brokers projects the company to record revenues of £560.80 million and £611.80 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £84.10 million and £61.40 million. Profit per share is estimated at 18.20 pence and 13.40 pence for the same periods.

- Peel Hunt expects Michael Page to earn revenues of £550.50 million for the FY 2011 and £587.10 million for the FY 2012 respectively with pre-tax profits of £87.90 million and £62.20 million. EPS is projected at 18.50 pence for FY 2011 and 13.10 pence for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2024. All rights reserved.