Mis-Selling Derivatives Scandal: FCA Reveals 95% of Swap Sales Were Non-Compliant

The Financial Conduct Authority has vented its frustration over the banking sector's slow progress in reviewing interest rate hedging products, as data shows 95% of sales were non-compliant.

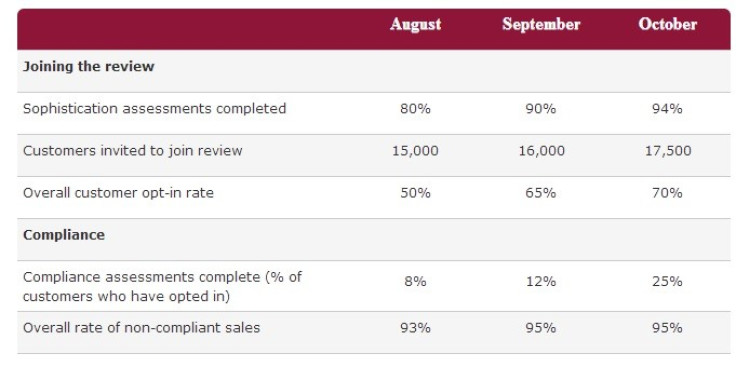

The overall rate of non-compliant sales stood at 95% but only £15.3m (€18.3m, $24.8m) has been paid in redress to customers, according to the FCA's review data for October. [Figure 1].

"Progress to this point has been slower than expected, but the latest figures show a significant pick up from earlier publications. We have written to the banks to make our expectations clear and agree practical ways to speed up the process," said the FCA in a statement.

"We have also agreed with HSBC, RBS and Lloyds Banking Group that they will split payments for redress relating to the swap and consequential losses to simplify and speed up the process. We expect the number of offers to increase over the next few months."

The Review and Pilot Scheme

At the end of January this year, the FCA unveiled its findings from a pilot scheme that examined the sale of 173 IRSAs to British firms found that at least 90% of those did not comply with at least one or more regulatory requirements.

Nearing the end of 2013, FCA data shows that non-compliant sales are still around the same level.

While some 40,000 IRSAs sold to UK businesses are said to be eligible for review, the pilot scheme was aimed at assessing a select number of cases in order to test the range of disputes and assess the scale of redress owed to customers who were mis-sold these complex derivatives.

"The FCA gave the banks six to twelve months to complete their reviews from the start of the process (May 2013) and are frustrated that they are all expecting to meet the lower end of the FCA expectations," said the regulator in a statement.

"The FCA expectation has been that the majority of customers who come under the scope of the review will have been informed of their compliance assessments and, if applicable, will have received an initial basic redress offer by the end of the year.

"Additionally, the FCA expectation has been that the whole process will have been completed within 12 months of starting."

The FCA reported that the banks were aiming to send out at least 1,000 redress determinations in October.

Actual figures were closer to 800 (450 'full tear up' determinations, 200 alternative product, and 150 in relation to compliant and non-compliant sales where no redress was due).

Bank Responses to FCA Report

HSBC: "As today's published figures indicate, our Past Business Review is progressing well, and we are doing everything we can to complete it as quickly as possible, providing a fair and reasonable outcome to these customers."

"Our recent decision to introduce 'split payments' is speeding up the process and means customers get redress that is due to them at the earliest opportunity, potentially months earlier than under the process for a single payment. We are continuing to build momentum, and we have plans in place to meet the FCA deadlines."

Barclays: "It is in Barclays' interests as well as our customers to complete the review as soon as possible. Our 600 dedicated staff continue to progress the review thoroughly with those customers who have responded to us.

"We would encourage those who haven't yet responded to do so shortly so that their reviews can commence. Where we have made mistakes, we will put them right."

Lloyds: "Today's Financial Conduct Authority's report into participating banks' review of Interest Rate Hedging Products shows increasing momentum in Lloyds Banking Group's assessment of cases and the subsequent customer contact programme. In the current reporting period the Group has seen a quadrupling of the number of redress outcomes communicated to customers, when compared to the previous period."

"This momentum is expected to continue, with the number of redress outcomes expected to double in the coming month. The Group remains on schedule to communicate redress outcomes to customers within the 12 month timeline set by the FCA, having commenced the review in May this year."

RBS had not returned calls for comment at the time of publication.

© Copyright IBTimes 2024. All rights reserved.