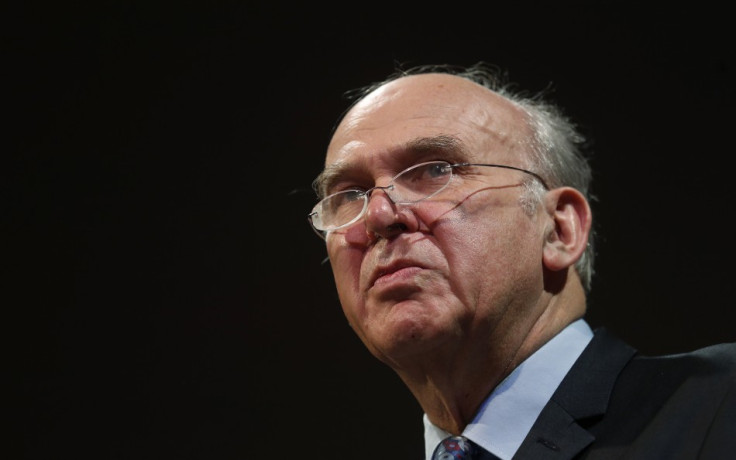

UK Business Secretary Vince Cable: Banks Taking Too Long to Pay Out Mis-selling Derivatives Claims

Britain's biggest banks are taking too long to pay compensation to victims who were mis-sold complex derivatives, says the UK business secretary.

Speaking with the Financial Conduct Authority (FCA)'s chief executive Martin Wheatley in a meeting, Vince Cable said the banks should stop dragging their heels and start paying struggling businesses.

"I am frustrated at the lack of progress on the mis-selling of interest rates swap agreements (IRSA)," Cable said.

"I meet many small businesses, as I travel round the country, who have been afflicted by this scandal and those who deserve compensation should not be left waiting any longer."

Cable added that the updates from the FCA, on the progress of the review scheme, should be used o hold banks accountable for slow progress on payments.

What's Slowing It Down?

IRSAs are contracts between a bank and its customer where typically one side pays a floating, or variable, rate of interest and receives a fixed rate of interest payments in exchange.

They are used to hedge against extreme movements in market interest rates over a given period. Companies that have seen the value of these products move against them as rates fell during the recession now owe banks crippling sums of money in interest payments each year.

Some 40,000 IRSAs sold to UK businesses are said to be eligible for the FCA review, which was launched in June last year.

However, at the end of January 2013, the FSA unveiled its findings from a pilot scheme that examined the sale of 173 IRSAs to British firms and found that at least 90% of those did not comply with at least one or more regulatory requirements.

Although, the one year anniversary for the review has passed, the banks are working at different speeds when it comes to delivering redress.

Since every case and claim is unique the process is lengthy and complicated.

Each side of the claim is blaming each other for the compensation payment hold-up.

Sources close to the banks told IBTimes UK that some businesses are "delaying the process themselves" because some are filing for "erroneous" consequential losses.

"Some lawyers and consultants are pushing for as much money as possible, as they get a bigger cut of the compensation, but some of the consequential loss claims are ridiculous," said one source.

"Some are for theoretical business losses from owning a swap but companies should know that you can't claim for that."

Under the FCA review, no payments can be made until the entire process of determining redress is completed, which includes consequential losses.

This is aimed at preventing a party being able to make claims over and over again and costing firms multiple sets of bills from fresh reviews.

This means that while a bank can make an initial offer - a product tear-up or switch and/or compensation - if a company is claiming for CL on top of this, then it would have to wait until after the banks have assessed the application for damages.

On the flip side, businesses say they don't understand why the amount of redress offered can't be paid out first and then, if, consequential losses are granted then pay it out in a second instalment.

"I understand why consequential losses are wrapped in the process but when it comes to pay outs- it's just a joke," said one business owner that didn't want to be named for fear of reprisal from their bank.

"The only reason why they aren't splitting the payments is because they don't want us to go out and hire a forensic accountant or a lawyer for the latter half of the claim," added another.

© Copyright IBTimes 2024. All rights reserved.