Panama Papers as it happened: Mossack Fonseca leak reveals world leaders' offshore wealth

- A massive leak of confidential documents has revealed how the world's elite use offshore tax havens to hide billions.

- 11.5 million records of offshore holdings from secretive Panamanian law firm Mossack Fonseca were obtained by German newspaper Süddeutsche Zeitung and shared with more than 100 other media.

- The data gave an insight on the private wealth of 72 current or former heads of state which have used shell companies and offshore accounts, often through close associates or family members.

- Among leaders tied to offshore wealth are Russian President Vladimir Putin, Pakistan's PM Nawaz Sharif, Ukrainian president Petro Poroshenko, the King of Saudi Arabia and Bashar al-Assad.

- Mossack Fonseca denies any wrongdoing saying it has acted beyond reproach for 40 years.

Bearer shares have been banned in many offshore finance centres but not in Panama, which is one of the reasons that the country is ranked extremely low on the OECD rank of tax havens.

A bearer share is basically a piece of paper that shows that you own a piece of the company, but is the only record of ownership and, as a result, allow owners to hide their assets. The BBC published a handy guide to bearer shares here.

Mossack Fonseca has denied that they were involved in any "illegitimate activities" in a statement to Reuters. The full story is here.

More pictures emerging of the protests in Iceland. Thousands have taken to the streets over claims that the country's leader, Sigmundur Gunnlaugsson, owned an offshore company, Wintris, with his wife.

Thousands are here for the #protest in #Reykjavik.#PanamaLeaks #Iceland #SigmundurDavid #austurvollur pic.twitter.com/E9LuJjPnXE

— Seth Sharp (@sharpseth) April 4, 2016

For more information on Panama, check out IBTimesUK's profile from earlier today.

A passport page that appears to show Bashar al-Assad's cousin, Rami Maklouf, stamped by HSBC is doing the rounds on social media.

Rami Makhlouf passport page (stamped by HSBC). Part of Panama Papers: https://t.co/Re5oJqGFEg pic.twitter.com/dcEyQ0SA95

— Michael Weiss (@michaeldweiss) April 4, 2016

IBTimesUK published a profile on the Makhlouf family recently after the death of Assad's mother, Anisa Makhlouf.

BBC's Panorama is due to air at 7.30 pm and it has been hinted that new revelations are due to come out relating to the Panama Papers.

But what are they likely to entail?

The speculation has been that new public figures may be linked to Mossack Fonseca, or more details given on those already revealed.

The BBC, for its part, is not giving anything away...

Watch more on the #panamapapers story: Panorama Tax Havens of the Rich and Powerful Exposed. Tonight 7.30PM BBC One pic.twitter.com/inXsQe1byo

— BBCPanorama (@BBCPanorama) April 4, 2016

Meanwhile, IBTimesUK has analysed the impact of the scandal on offshore finance centres closer to home, including Jersey and Guernsey.

A trust company director in the island said that the Panama Papers scandal did not bode well for the Channel Islands. That said, he also argued that Jersey was a very different animal to Panama or the British Virgin Islands.

"Jersey isn't the sort of place where you're going to find someone like Gaddafi," he said, referring to the late Libyan dictator.

Tax expert John Christensen has written an in-depth piece for IBTimesUK in which he says that the Tax Justice Network is not surprised by the Panama Papers revelations.

"I welcome this leak and hope it will put pressure on the legal profession generally to clean up its act across the world, " he says.

The suspended UEFA president Michel Platini has responded to tax avoidance allegations made in the Panama Papers. He was named as managing an offshore company called Balney Enterprises Corp, Le Monde reported.

However a statement by Platini's spokesman said that former French footballer "wants to inform that, as he stated it many times to the journalists in charge of the investigation, all of his accounts and assets are known to the tax authorities in Switzerland, where he has been a fiscal resident since 2007", the Associated Press reported.

The US Justice Department has said that it will look at the documents to see they are evidence of corruption that could be prosecuted in the US, the Wall Street Journal reported.

Meanwhile prosecutors in Spain have opened a money laundering probe, AFP news agency reports.

France has also opened a preliminary investigation with the financial prosecutors office saying, regarding several hundred French citizens mentioned in the leaked documents, that possible tax evasion "was likely to concern French taxpayers".

John Christensen, executive director of the Tax Justice Network has told Radio Free Europe/Radio Liberty that the Panama Papers show how law firms are no longer able to protect the identities of those who use offshore tax havens.

"I suspect that criminals and the business elites and the wealthy elites around the world will be losing their sleep in the coming weeks because the level of secrecy which they have been assured for decades can no longer be assured," he told the radio station.

A representative for the former prime minister of Georgia and multi-billionaire Bidzina Ivanishvili said he had nothing to hide after his name was said to have appeared in the Panama Papers.

The Associated Press reported how Gia Volski from the ruling Georgian Dream party, told state TV that Ivanishvili "has nothing to hide and has never hidden anything".

The family of footballing great Lionel Messi has denied in a statement that he was involved in tax evasion.

The Barcelona star and his father were named as owners of a Panama company that had not been disclosed when there was a Spanish probe into their tax affairs.

The family said that the Panama company that the files referred to was an "inactive" company that never had any funds or active current accounts.

In a statement it said: "The Messi family wants to make clear that Lionel Messi has not carried out any of the acts attributed to him, and accusations he created a ... tax evasion plot, including a network of money-laundering, are false and insulting," AFP reported.

The Panama Papers reveal how a UK banker set up an offshore finance company allegedly used by the regime in North Korea to help sell arms and expand its nuclear weapons programme.

They show how Nigel Cowie, who lived in the hermit kingdom for two decades, was behind a Pyongyang front company called DCB Finance Limited. It was registered in the tax-free haven of the British Virgin Islands.

He said that the company was used for legitimate business and he was not aware of any unlawful transactions, The Guardian reported.

The German newspaper Suddeutsche Zeitung, which first obtained the Panama Papers has reported the extent of German involvement with Mossack Fonseca.

The majority of the country's banks, 28 in total, used its services. In Germany, in addition to Deutsche Bank, Dresdner Bank, Commerzbank and BayernLB used the Panamania law firm.

France 24 has reported French authorities have opened an preliminary investigation into aggravated laundering and tax evasion in the wake of the Panama Papers leak.

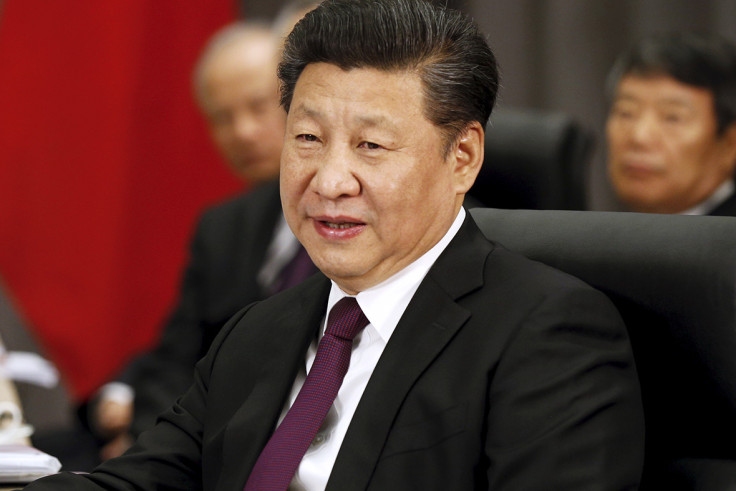

While heavily censored Chinese news outlets have covered the Panama Papers scandal, focusing on Vladimir Putin and the US$2bn (£1.4bn) money trail that allegedly leads to the Russian President, one high profile group of Chinese figures were notable for their absence – the family of Chinese President Xi Jinping.

At least eight top Chinese officials and associates, including President Xi Jinping's brother-in-law Deng Jiagui, are linked to offshore deals, IBTimes UK reports. They hid millions of dollars, according to an investigation of 11.5 million documents leaked from one of the world's largest offshore law firms.

As IBTimes UK has already reported, Jürgen Mossack, one of Mossack Fonseca's founding partners, was the son of a former SS soldier turned CIA spy.

According to German media, Mossack's father, Erhard Mossack was the equivalent of a senior corporal in the SS' combat division.

Ramon Fonseca, a founder and director of Panama-based law firm Mossack Fonseca has told Reuters that the leak is part of "an international campaign against privacy".

"We're dedicated to making legal structures which we sell to intermediaries such as banks, lawyers, accountants and trusts, and they have their end-customers that we don't know," said Fonseca.

"We believe there's an international campaign against privacy. Privacy is a sacred human right (but) there are people in the world who do not understand that and we definitely believe in privacy and will continue working so that legal privacy can work," he said.

Fonseca has said in a separate statement to the Guardian newspaper, which has been given access to the Panama Papers by the Consortium of Investigative Journalists:

"It appears that you have had unauthorized access to proprietary documents and information taken from our company and have presented and interpreted them out of context."

Steven Philippsohn, senior partner at PCB and Home Office Panel Member advising on strategies to counter fraud, has claimed the revelations seen in the Panama Papers could mean thousands could get money back off them which had been taken off them fraudulently.

He added:

The vast leak of information from Panama brings with it a huge opportunity to clawback money for those who were previously used and abused by financial fraudsters. Fraudsters have historically used the depths of secrecy allowed within offshore structures to hide all the details of such crimes, and indeed the profits made. Importantly, the key to opening the door to combating fraud is information. This leak gives us more than ever before. It is possible to investigate fraud and recover funds from something as small as one email from a nervous bank manager hidden within the papers. While it will take some time to analyse, obtaining this information will open up possibilities for thousands of fraud victims to get money back which was previously stolen from them to fund illegal affairs orchestrated by the world's rich and powerful.

Ukrainian President Petro Poroshenko has just responded to the allegations about him that appear in the Panama Papers, including that he set up an offshore account in British Virgin Islands in August 2014 during the conflict between his country and pro-Russian separatists.

Having become a President, I'm not participating in management of my assets, having delegated this responsibility to consulting&law firms

— Петро Порошенко (@poroshenko) April 4, 2016

I believe I might be the first top official in Ukraine who treats declaring of assets, paying taxes, conflict of interest issues seriously

— Петро Порошенко (@poroshenko) April 4, 2016

Earlier, IBTimes UK also complied all those from the world of football who have been named in the leaked documents, including Fifa executives, former Real Madrid and Manchester United starts and a certain Barcelona player.

More about the pressure on Iceland's PM from BBC business journalist Joe Lynam via Icelandic reporter Helga Arnardottir.

Icelandic parl meets at 3pm to discuss #panamapapers and prime minister. The President is on his way back from USA. HT @helga_arnar

— Joe Lynam BBC Biz (@BBC_Joe_Lynam) April 4, 2016

Motion of no confidence in PM likely to be tabled in Icelandic parliament at 3pm. #panamapapers

— Joe Lynam BBC Biz (@BBC_Joe_Lynam) April 4, 2016

Elsewhere on IBTimes UK, reporter Elsa Buchanan has looked at how the Mossack Fonseca leak has been covered across the world, including the perhaps unsurprising silence about Putin over in Russia.

There is already rising pressure on Iceland's prime minister in the wake of the leak of the documents which revealed Sigmundur Davíð Gunnlaugsson and his wife allegedly used an offshore firm for investments in Iceland's banks worth millions.

More than 16,000 people have signed an online petition demanding his resignation and nearly 9,000 people have said they will be attending a protest outside Iceland's parliament, according to a Facebook event page.

Gunnlaugsson has already given an interview in Iceland saying he will not step down over the Panama Papers. However, he did apologise for his "poor performance" after walking out on a television interview in a clip now seen around the world.

More details have emerged about the involvement of the late father of British Prime Minister David Cameron, Ian Cameron, in a fund incorporated in Panama and based in the Bahamas.

According to the ICIJ, Blairmore Holdings Inc, an investment fund which was once valued at $20m has never paid taxes on its profits in the UK.

ICIJ partner The Guardian revealed that Solomon Humes a lay bishop with the Pentecostal Church of God of Prophecy was on of up to 50 Caribbean officers that held roles and singed paperwork for the company.

A spokesperson for the David Cameron declined to say whether there was still family money was invested in the fund telling the newspaper it was "a private matter."

The spokesperson added that the Prime Minister had "taken a range of action to tackle evasion and aggressive tax avoidance".

According to the ICIJ investigation, Sergey Roldugin a long-time friend of Vladimir Putin has played a pivotal role in channelling some $2bn through numerous offshore companies.

Born in Riga, Latvia, in 1951 in the former USSR, Roldugin is a cellist whose brother studied with Putin at the KGB's training academy. In 1985 he became godfather to Putin's daughter Maria. Here is a profile of him.

The Kremlin said the ICIJ investigation has in Russian President Vladimir Putin its "main target" for it aims at undermining the country's stability.

Putin's spokesman Dmitry Peskov denied the President was implicated in any wrongdoing and speculated that the ICIJ, an international coalition of more than 100 media outlets, including Russia's Novaya Gazeta, is in fact tied to the US government.

"It's obvious that the main target of such attacks is our president," Peskov said.

Nordea the largest bank in the Nordic region said it "do not accept to be used as a platform for tax evasion" after it was linked to Panamanian law firm Mossack Fonseca. It tweeted:

Comment: Nordea do not accept to be used as a platform for tax evasion, we follow all related rules & regulations: pic.twitter.com/vLcTuINS0S

— Nordea (@Nordea) April 3, 2016

A number of footballer and football officials are also among individuals named in the leak. Lionel Messi, Michel Platini and Juan Pedro Damiani, a key member of Fifa's ethics committee, are featured in the Panama Papers.

You can read more about their cases here.

France's President Francis Hollande has welcomed the leak and thanked whistleblowers and reporters behind it.

Hollande said that authorities are to investigate all possible wrongdoings revealed. "These revelations are good news because they will increase tax revenues from those who commit fraud," he said.

Lord Ashcroft, who is named in the leaked documents, have denied ties to Mossack Fonseca.

His spokesman Alan Kilkenny, told ICIJ that the it was "entirely false" that "Lord Ashcroft either personally, or through a corporate entity in some way connected with him" had "'partnered' and 'done business'" with Mossack Fonseca.

"These allegations are completely untrue, and the events as described never happened. The records upon which you claim to rely for those allegations either do not exist or have been falsified," he said.

The ICIJ investigation revealed three children of Pakistan's Prime Minister Nawaz Sharif owned several London properties through British Virgin Islands-based firms.

The Sharifs, one of Pakistan's richest families, have faced similar allegations in the past. The siblings involved in the new leak, Maryam Nawaz, Hussain Nawaz and Hassan Nawaz, have not replied to requests for comments.

UK tax authorities said they are analysing the ICIJ data and are committed to fighting tax evasion.

Jennie Granger, director general of enforcement and compliance at Her Majesty's Revenue and Customs (HMRC) said:

HMRC is committed to exposing and acting on financial wrongdoing and we relentlessly pursue tax evaders to ensure that they pay every penny of taxes and fines they owe.

HMRC can confirm that we have already received a great deal of information on offshore companies, including in Panama, from a wide range of sources, which is currently the subject of intensive investigation. We have asked the ICIJ to share the leaked data that they have obtained with us. We will closely examine this data and will act on it swiftly and appropriately.

We have brought in more than £2 billion from offshore tax evaders since 2010 and the Government has repeatedly strengthened our powers and resources with new criminal offences and higher penalties, so we can take even tougher action against the minority who try to cheat the honest majority by hiding their money in offshore tax havens.

Our message is clear: there are no safe havens for tax evaders and no-one should be in any doubt that the days of hiding money offshore are gone. The dishonest minority, who can most afford it, must pay their legal share of tax, like the honest majority already does.

IBTimes UK's Dan Cancian has put up a short guide to the Panama Papers.

The late father of British Prime Minister David Cameron, Ian Cameron, is also named in the Mossack Fonseca documents.

A stockbroker and investor Cameron was involved in a Panama-based fund the Blairmore Holdings Inc. that was valued at almost $20 million in 1998, the ICIJ reported.

According to the leak the fund was not subject to corporation tax or income tax on its profits in the UK.

Several other Tories figures have also been touched by the leak. They are Michael Mates, who served as Northern Ireland minister in the early 1990s, Lord Ashcroft and Pamela Sharples.

Iceland's Prime Minister Sigmundur Davíð Gunnlaugsson walked out of an interview with Swedish television company SVT after he was asked about his ties to an offshore company named in the leak.

Sueddeutsche Zeitung, the German newspaper that first obtained the leaked documents, has published a short trailer video introducing how the story came about.

All information on the biggest data-leak: https://t.co/KsSuPDHG3F #panamapapershttps://t.co/Glg7u0LnQl

— Süddeutsche Zeitung (@SZ) April 3, 2016

The daily obtained 2.6 terabytes of data comprising 11.5 million documents related to 214,000 shell companies from a whistleblower.

It then shared the material with an international coalition of more than 100 media outlets - the International Consortium of Investigative Journalists (ICIJ).

In terms of quantity the leak is simply huge as it includes more data than four major previous leaks combined.

2600000000000 bytes of data - This is the leak: https://t.co/3esQRlBiHw #panampapers pic.twitter.com/Qgi8kFb1ft

— Süddeutsche Zeitung (@SZ) April 4, 2016

Established in 1977 by Ramon Fonseca and Jürgen Mossack – the son of a former SS soldier turned CIA spy – Mossack Fonseca boasts a global network employing more than 500 people in 42 different countries across the world.

You can read more about the secretive firm hit by the leak here.

UK Shadow Chancellor John McDonnell tweeted:

The Panama papers revelations are extremely serious. HMRC should treat this with utmost priority and urgently launch investigation

— John McDonnell MP (@johnmcdonnellMP) April 3, 2016

Cameron promised and has failed to end tax secrecy and crack down on 'morally unacceptable' offshore schemes, real action is now needed

— John McDonnell MP (@johnmcdonnellMP) April 3, 2016

Among world leaders tied to offshore wealth by the explosive leak is Chinese president Xi Jinping.

In 2009 Xi's brother-in-law Deng Jiagui reportedly set up two shelf companies in the British Virgin Islands that appeared in Mossack Fonseca's inventory.

According to the ICIJ the companies of which Deng was the sole director and shareholder became "dormant" after Xi was appointed president in 2013.

So far 149 of the more than 11.5 million documents leaked have been uploaded online on the open-source platform DocumentCloud.

Following the leak, tax authorities in Australia and New Zealand have opened investigations for possible tax evasion into local clients of Mossack Fonseca.

The Australian Tax Office (ATO) told Reuters they were probing more than 800 individuals, while New Zealand's tax agency said it was at work to identify New Zealanders involved in potentially unlawful tax schemes.

© Copyright IBTimes 2024. All rights reserved.