Pound Drops on Weak Industrial Output, Poised to Fall Further Given the Excessive Buy-Side Speculation

The British pound weakened on 8 July as the May industrial output numbers surprised on the lower side even as the market awaited the Bank of England rate decision scheduled two days later.

However, continued increase in the buy-side speculative positioning in the British currency underpinned the case for a stronger reversal unless there is an even more hawkish central bank to support.

Sterling traded lower for the third straight day against the Japanese yen and the Australian dollar and was down for the second consecutive day agains the greenback, on Tuesday.

The broad pound strength owing to upbeat growth outlook for the UK economy was curbed by mixed verbal signals from the BoE governor of late, and therefore, the data points ahead of the policy decision had gained significance.

Price Action

GBP/JPY had touched a near six-year high of 175.43 on 4 July but has fallen to a seven-day low of 173.87 on Tuesday.

GBP/AUD had risen to a three-and-a-half month high of 1.8374 on 3 July but dealt at a 4-day low of 1.8176 after Tuesday's UK data.

Against the US dollar, Sterling fell to 1.7085 from near 1.7140 following the industrial output data on 8 July. On 4 July, GBP/USD had touched a near six-year high of 1.7181 before turning lower on caution ahead of the policy decision.

EUR/GBP too rose on the data but soon reversed the losses as the focus shifted to inherent weakness of the euro. At 0.7940, the cross is not far away from the 7 July two-year low of 0.7914.

Data Points

UK industrial production growth slowed to 2.3% year-on-year in May from 2.9% in April, data showed on Tuesday. Analysts were expecting a stronger growth of 3.1%. Month-on-month, the output fell 0.7% after rising 0.3% in the previous month while the consensus was for a rise of 0.2%.

Manufacturing output growth slowed to 3.7% on year from 4.4% against market forecast of a higher 5.6%. On a monthly basis the manufacturing production too fell, by 1.3% after rising 0.4% in April.

Data earlier on the day had showed that the French trade balance has widened to EUR4.9 billion from EUR4.1 billion against the consensus of EUR4.5 billion.

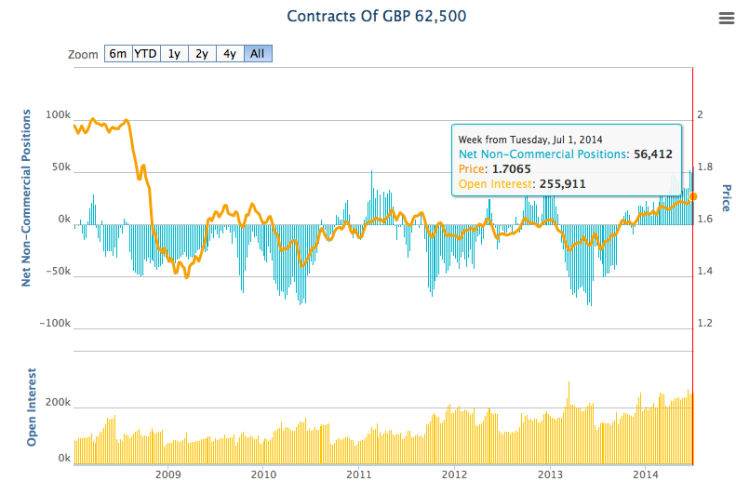

Speculative Positioning

Data from CFTC shows that net non-commercial positions in GBP has increased to 56,412, it highest in several years, in the week from 1 July. The average price has risen to a near six-year high of 1.7065.

It was in October 2013 the positions turned positive and since then, the price has rallied 5.75%. GBP/USD has rallied more than 6.1% during the same period.

Technical Outlook

The 1.7181 peak has now turned the immediate resistance for GBP/USD, and above that, the pair will target 1.7350, the 50% retracement of the November 2007 to January 2009 downtrend, ahead of the 61.8% level near 1.8250.

A break of that will open the regions 1.8515-1.8670 and 1.9180-1.9330 ahead of the 2.0 mark, last touched in November 2007.

GBP/USD has its first downside target at 1.6750 and then 1.6450, the 38.2% level. The next level will be 1.5850, ahead of the 23.6% level of 1.5330.

© Copyright IBTimes 2024. All rights reserved.