Sterling Hits New Highs Again But Seems up For Correction

The pound soared to a new multi-year high against the US dollar on 4 July with the market expecting rate hikes from the Bank of England sooner than the Federal Reserve. However, the rally coupled with steadily increasing buyside speculation in the GBP have raised the risk of a reverse.

Broad weaknesses in other major currencies such as the euro may also have helped sterling remain firm.

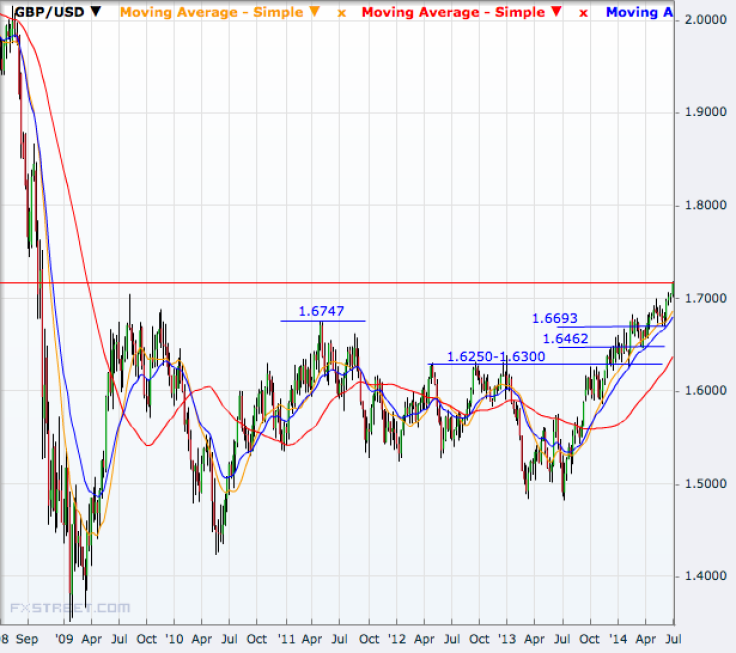

The GBP/USD rallied to 1.7181 on Friday, its highest since October 2008.

This is despite the previous day's data showing higher than expected non-farm payroll addition and a lower than expected unemployment rate in the US for June.

The US data release decreased the possibility of growth concerns preventing the Federal Reserve from carrying out additional policy tightening measures and driving the dollar broadly higher.

However, the market is concerned that sterling is now due for a correction, fundamentally as well as technically.

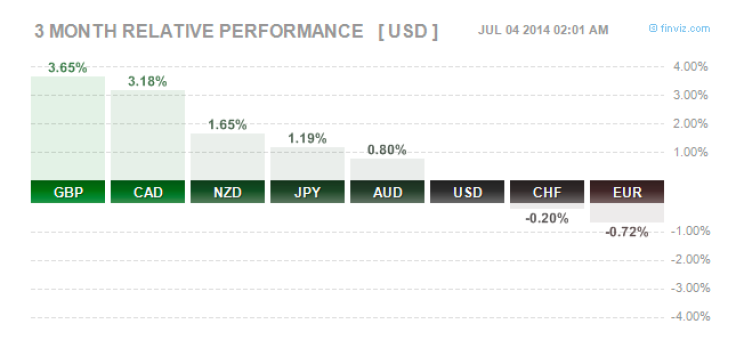

Relative Performance

The pound has rallied 3.65% against the US dollar in the last three months, the strongest among the majors, while the euro has weakened 0.72%, according to Finviz.com data. Sterling has fallen 0.2% against the Swiss franc and risen 1.19% against the Japanese yen during the same period.

In the last week, the GBP was the best performer, rising 0.82% against the dollar while the euro, franc, yen and Australian dollar all fell.

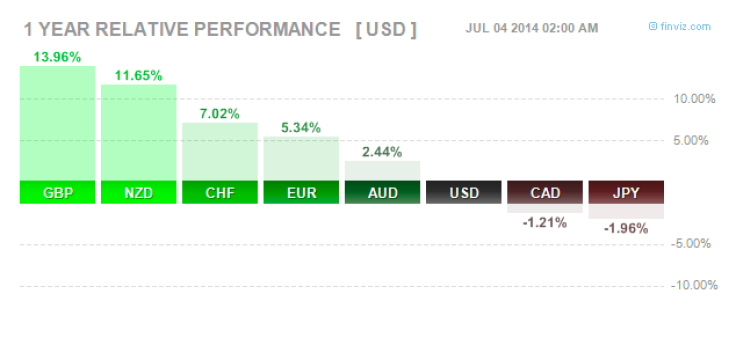

In the year to 4 July, the pound has strengthened more than 14% against the greenback.

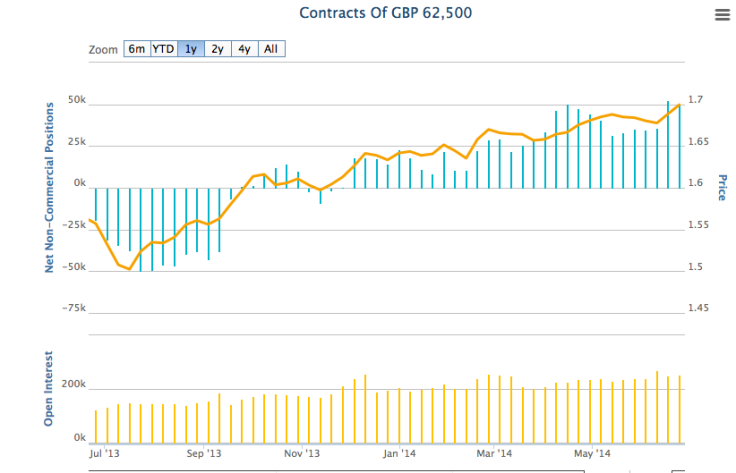

Speculative Positioning

According to the Commitments of Traders (COT) report by the Commodity Futures Trading Commission (CFTC), net non-commercial positions in the GBP have increased to 52,596 in mid-June, the highest since mid-February 2011.

There was a marginal drop the folowing week, but the number is still close to the 50,000 mark.

It was in negative territory in the seven months to September last year and after bouncing back above the zero line in October, has been steadily increasing.

In the euro, the net surplus has been for sell requests for the past seven weeks.

Mixed Rate Signals

Over the past few months, economic data releases from the UK have been surprising on the positive side thereby increasing speculation for sooner rate hikes by the BoE.

The central bank chief, Mark Carney, fuelled the speculation in his 2014 Mansion House speech, saying the rate increases may be sooner than market expectations.

However, at his next opportunity he was cautious to tone down the hawkish mood created by him. Carney spoke about the need to address the slack in the economy before any definite rate hike.

And there are more policy makers sounding similar.

Raising interest rates would be an effective but "very blunt" way of tackling risks to financial stability from booming asset prices, BoE's deputy governor Jon Cunliffe said, according to Reuters.

"Using interest rates to deal with financial stability risks can carry a high cost. It is a very blunt instrument that affects the economy as a whole. So although it is an effective line of defence, it should be seen as one of the last lines of defence," he told business people in Liverpool.

What Charts Say

Above 1.7181, the GBP/USD will target 1.7350, the 50% retracement of the November 2007 to January 2009 downtrend, ahead of the 61.8% level of 1.8265.

A break of that will open 1.8700, 1.9000 and 1.9480 ahead of the 2.0 mark, last touched in November 2007.

The pair has its first support at 1.6920 ahead of the 1.6738-1.6693 area. Then comes the 1.6554-1.6462 zone.

In the broader picture, 1.6743-1.6693 is the nearest main support visible and after that 1.6462. Then comes the 1.6300-1.6250 area, a break of which will reverse the long-term uptrend.

© Copyright IBTimes 2024. All rights reserved.