Prudential Positioned to Outperform in the Medium-Term

Prudential, an international financial services group, remains confident of delivering solid growth in earnings for the full year on Tuesday, its superior Q3 2011 earnings were driven by good performance in Asia.

Prudential's performance in the first half of 2011 was strong and it has continued to optimise the opportunities available to the group for profitable growth. Its focus on cash and capital underpin its financial performance.

The group reported a 14 per cent increase in new business profits to £1,535 million for the first nine months of FY 2011 with total insurance sales increasing 10 per cent to £2,704 million. Its prominence on writing profitable, capital-efficient business has allowed it to achieve an increased margin of 57 per cent across its insurance operations. Prudential's Asian operations posted growth in profit of 16 per cent in new business to £719 million and its sales grew eight per cent to £1,147 million.

While commenting on the outlook, Chief Executive Tidjane Thiam said: "Prudential has delivered strong results in the third quarter in a volatile and challenging environment. Our strong balance sheet, proactive risk management and our leading position in Asia have allowed us to continue to grow profitably. Our sizeable and unique presence in the growing and developing markets of Asia; our product, geographic and channel diversification; our risk management discipline across the group; and the strength of our balance sheet position us well to continue to outperform over the medium term".

On the other hand, UBS said, it is cautious on the British life insurance sector as volumes stagnate and the industry's prospects remain clouded by the Retail Distribution Review, a consumer protection plan launched by the Financial Services Authority, and possible further erosion of pension tax breaks. Against this backdrop, the broker highlights Prudential as an "internationally diversified, high-quality Asian play".

Prudential remains vigilant on the outlook in regions of US and eurozone, as the issues of sovereign debt and the associated fiscal difficulties have created macroeconomic concerns. While these issues may have some temporary adverse effects across the globe, the group continues to believe that its substantial presence in growing and developing markets across Asia puts it in a position to continue to deliver relative outperformance in the medium-term.

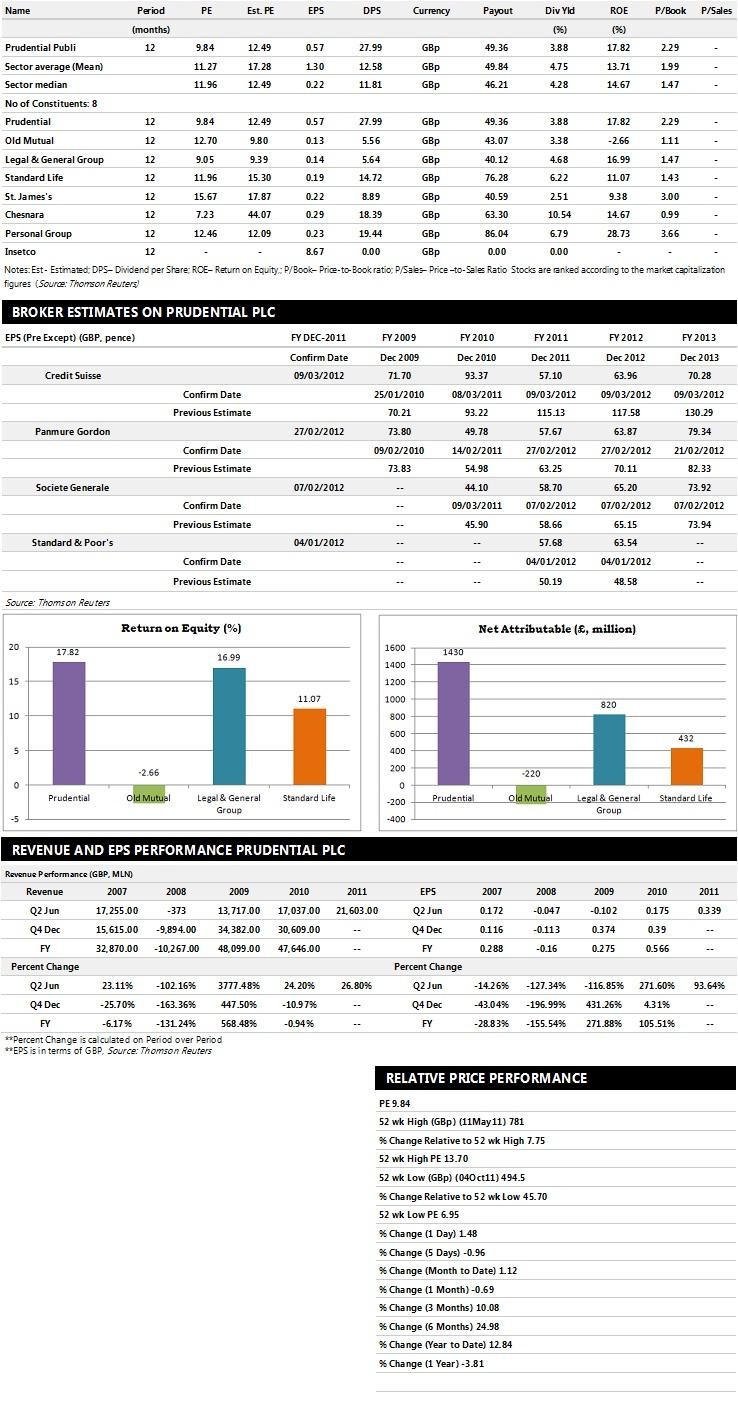

Brokers' Views:

- Panmure Gordon recommends 'Buy' rating on the stock

- Societe Generale assigns 'Outperform' rating with a target price of 750 pence per share

- Standard & Poor's gives 'Buy' rating

- Credit Suisse assigns 'Outperform' rating with a target price of 880 pence per share

- Numis Securities 'Buy' rating with a target price of 845 pence per share.

Earnings Outlook:

- Societe Generale projects the company to record revenues of £25,059 million for the FY 2011 and £27,565 million for the FY 2012 with pre-tax profits (pre-except) of £2,030 million and £2,321 million. Profit per share is estimated at 58.70 pence and 65.20 pence for the same periods.

- Standard & Poor's expects Prudential to earn revenues of £48,054.14 million for the FY 2011 and £51,703.95 million for the FY 2012 respectively with pre-tax profits of £2,043.24 million and £2,250.90 million. EPS is projected at 57.68 pence for FY 2011 and 63.54 pence for FY 2012.

- Panmure Gordon estimates the company to report pre-tax profits (pre-except) of £2,320 million and £2,475 million for the FY 2011 and 2012 respectively. Earnings per share are projected at 57.67 pence for the same periods.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top eight companies based on market capitalisation.

© Copyright IBTimes 2024. All rights reserved.