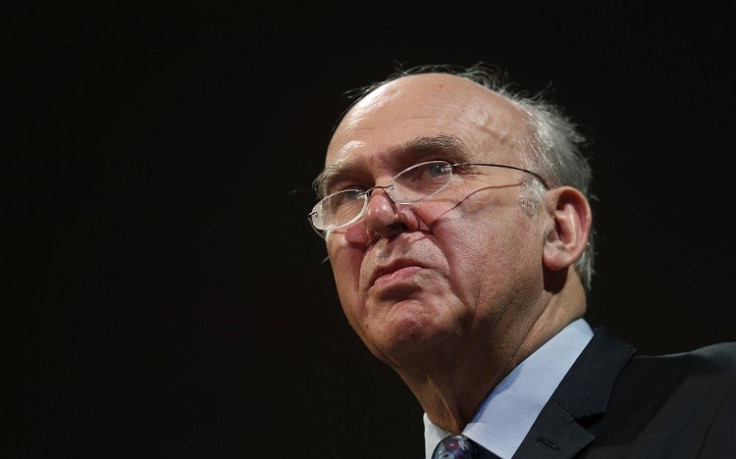

Royal Mail Shares: Vince Cable Faces Parliamentary Grilling on IPO Price

Britain's business secretary Vince Cable is set to face a grilling in parliament today over whether he priced Royal Mail shares too low and therefore short changed the taxpayer.

Cable will be quizzed by politicians over whether he and the banks, which helped broker the sale, should have priced the UK delivery company's initial public offering (IPO) stock price higher.

Royal Mail's controversial flotation on the London Stock Exchange has seen its share price soar well ahead of the government's 330p offer price. On 19 November it was at the 550p mark, amid accusations the government blundered by seriously undervaluing the 500-year-old communications firm.

Last week, a number of bankers who advised the government on the Royal Mail privatisation defended the 330p IPO price.

According to one of the senior bankers, Royal Mail's industrial dispute with the Communication Workers Union was "the major risk factor" weighing down on the iconic firm's IPO price.

James Robertson, managing director at UBS, said Royal Mail bosses had privately warned the Swiss investment bank in September during its pricing work ahead of the flotation that a pay deal with the CWU was unlikely and that industrial action would probably take place.

"Up until September we were hoping to get a pay deal and hoping to do the IPO on the backdraft of a positive industrial relations scenario," Robertson told MPs on the business select committee at a hearing on the Royal Mail privatisation.

"From September onwards, [industrial relations] was the major risk factor."

Rising Prices

One leading City of London analyst, David Jones of IG, told IBTimes UK that Royal Mail shares could potentially hit double the 330p offer price because demand has remained so high.

Employees of Royal Mail were given 10% of shares, while the rest were offered to retail and institutional investors.

There was a £750 minimum investment set for retail buyers. There were 93,000 members of the public who had applied for the minimum amount of shares and received them in full. Those who applied for more than £10,000 worth did not receive any shares.

© Copyright IBTimes 2024. All rights reserved.