Scottish Independence: Economists Worry About Political Schism on No Vote Devo Max Pledges

Experts across the financial industry have warned markets about how an independent Scotland would detrimentally impact the economy for the last few months.

However, economists are now warning that politicians' pledges to grant Scotland more power over setting income tax rates and controlling pensions, if voters opted against independence, could lead to instability in Whitehall and the wider political landscape.

Speaking to IBTimes TV, Deutsche Bank's chief UK economist, George Buckley said that even if Scotland stays part of the UK, there are still some major concerns over the future of the UK.

"There would be enormous repercussions if Scotland becomes independent but I still think we won't get a Yes. There are only two polls that have shown this," said Buckley.

"However, [as economists] our biggest worries, in the event of a No vote is that, politically, Scotland would be offered powers to move income tax. This would lead to devo max and then have knock on effects within the government.

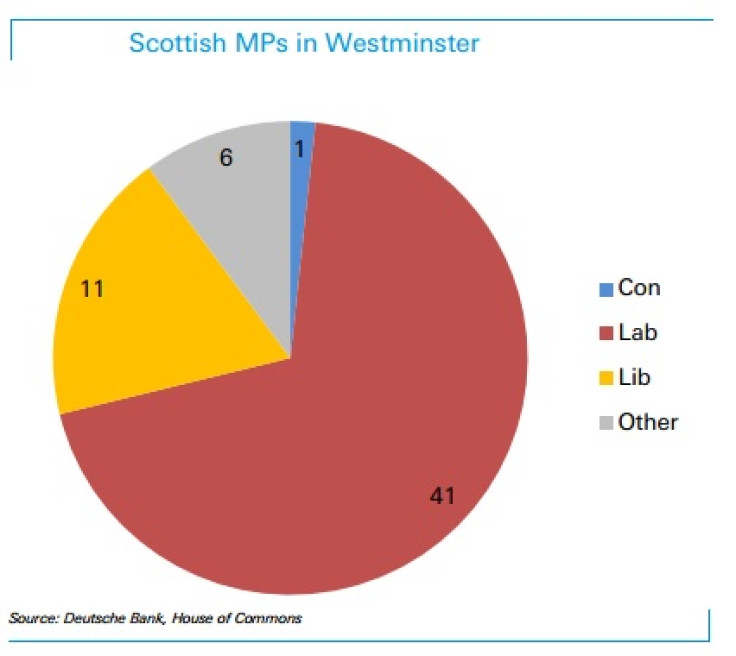

"If it does move to devo max, it would lead to questions over whether Scottish MPs should have a say over English legislation and vice versa. David Cameron may even find MPs calling a vote of no confidence, if they don't support the devolved powers."

Maximum devolution - dubbed devo max - is when a country, such as Scotland, is given the power to control and create laws over everything other than defence and foreign affairs.

While Scotland has the ability to create its own laws over over 12 aspects of society, such as education, environment, social services and others, while Westminster retained the power to control major areas, such as benefits and social security, immigration, employment, and the energy industry.

Only two days before the vote, leaders of the three main parties at Westminster signed a pledge to devolve more powers to Scotland, if voters reject independence.

This includes "extensive new powers" for the Scottish Parliament "delivered by the process and to the timetable agreed" by the three parties. Final say on funding for the NHS will lie with the Scottish government too "because of the continuation of the Barnett allocation for resources, and the powers of the Scottish Parliament to raise revenue".

© Copyright IBTimes 2024. All rights reserved.