Shanks Group Upbeat on Full-Year Growth Potential, Bags Major Contract

With the continued emphasis on cost control and PFI margin improvements coupled with its distinct strategy, Shanks Group, the provider of recycling and energy recovery solutions and technologies is scheduled to release its pre-close trading statement on Wednesday.

Despite the market conditions remain challenging, Shrank's trading in the final quarter and early new financial year gives the group encouragement that the market for its services is improving and remains confident to take advantage of its significant growth potential.

On Monday Shanks announced its majority owned joint venture with SSE, 3SE Limited has signed a 25 year contract worth in excess of £750 million with Barnsley, Doncaster and Rotherham Councils for the treatment of black bag waste.

Shanks will operate the facility over the 25-year period of the contract until 2040. Under the agreement, SSE will use around half of the SRF produced at a new multi-fuel plant at Ferrybridge to generate electricity. When the facility at Bolton Road is operational it will lead to a saving equivalent to 114,000 tonnes of CO2 every year.

"We are delighted that our joint venture, 3SE, has reached financial close on the BDR PFI contract. This contract combines Shanks' established expertise in advanced and sustainable waste processing with SSE's leadership in sustainables energy generation. Working together with the three councils we will maximise recycling and green energy production from waste," commented CEO Peter Dilnot.

Overall Shanks anticipates the trading for FY 2011-12 to be in line with the board's expectations.

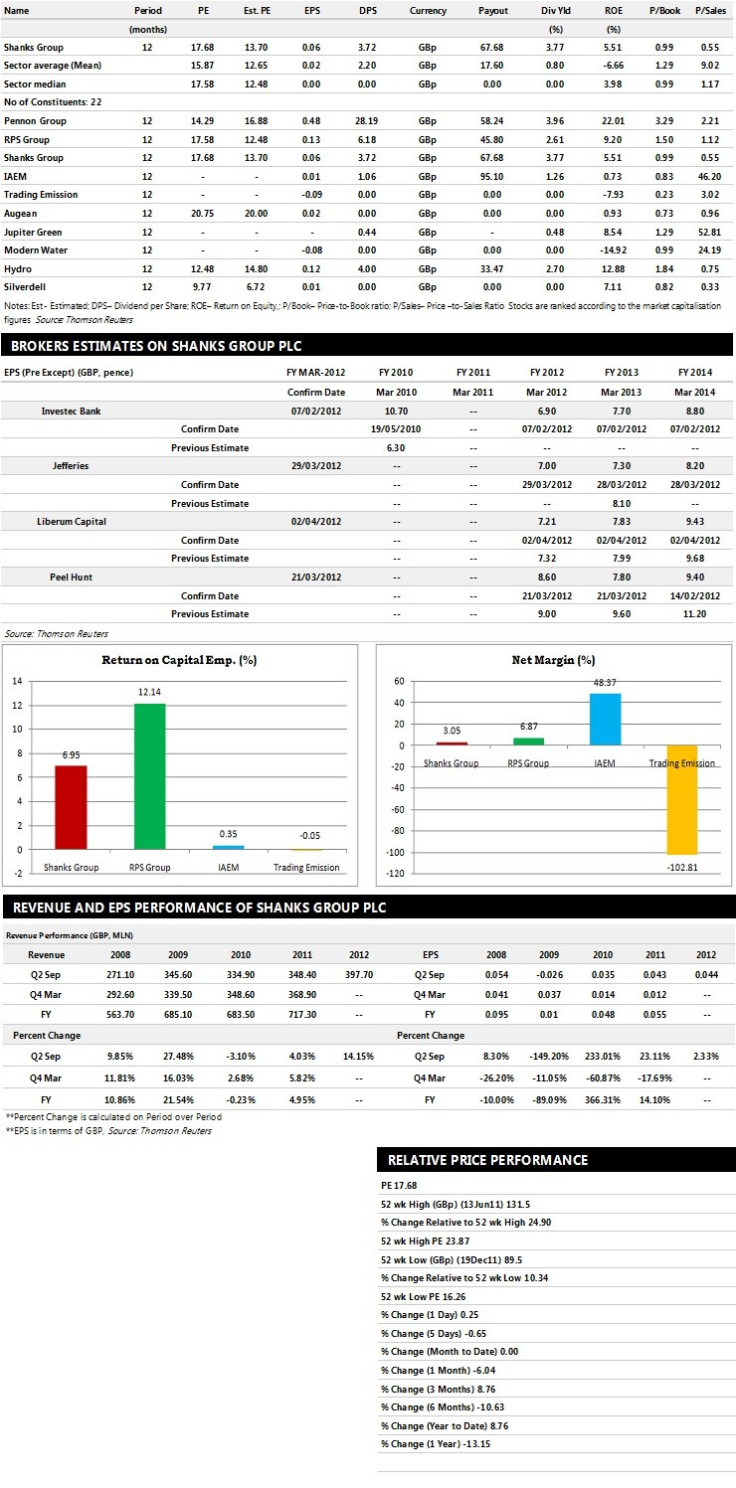

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents tencompanies based on market capitalisation.

Brokers' Views:

- Liberum Capital recommends 'Buy' rating on the stock with a target price of 160 pence per share

- Jefferies recommends 'Buy' rating with a target price of 133 pence per share

- Peel Hunt assigns 'Buy' rating with a target price of 126 pence per share

- Investec Bank assigns 'Out Perform' rating with a target price of 150 pence per share

Earnings Outlook:

- Liberum Capital estimates the company to report revenues of £760.71 million and £794.45 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £38.67 million and £41.44 million. Earnings per share are projected at 7.21 pence for FY 2012 and 7.83 pence for FY 2013.

- Jefferies projects the company to record revenues of £764.20 million for the FY 2012 and £785.90 million for the FY 2013 with pre-tax profits (pre-except) of £37.80 million and £39.00 million respectively. Profit per share is estimated at 7.00 pence and 7.30 pence for the same periods.

- Peel Hunt expects Shanks Group to earn revenues of £755.10 million for the FY 2012 and £757.00 million for the FY 2013 with pre-tax profits of £39.00 million and £42.00 million respectively. EPS is projected at 8.60 pence for FY 2012 and 7.80 pence for FY 2013.

© Copyright IBTimes 2024. All rights reserved.