Sir Philip Green faces grilling over 'enormous sums' taken out of BHS

Retail tycoon Sir Philip Green will face "enormous questions" about the "enormous sums" taken out of BHS in dividend payments as the high street chain headed towards a crash, according to Business Select Committee chairman Iain Wright. He said they would ask Sir Philip whether his stewardship of the firm and the sale to Dominic Chappell had been "appropriate".

"Something like £414 million was taken out of BHS in dividends over a four-year period and that's when the pension scheme was slipping into deficit," he told BBC Radio 4's Today programme.

"So it's a case of 'is it right that people can buy a company, strip it, in many respects, of cash in terms of dividends without real regard to pensions or to employees and then sell it for a pound to untried and untested people who then crash it into a cliff?'"

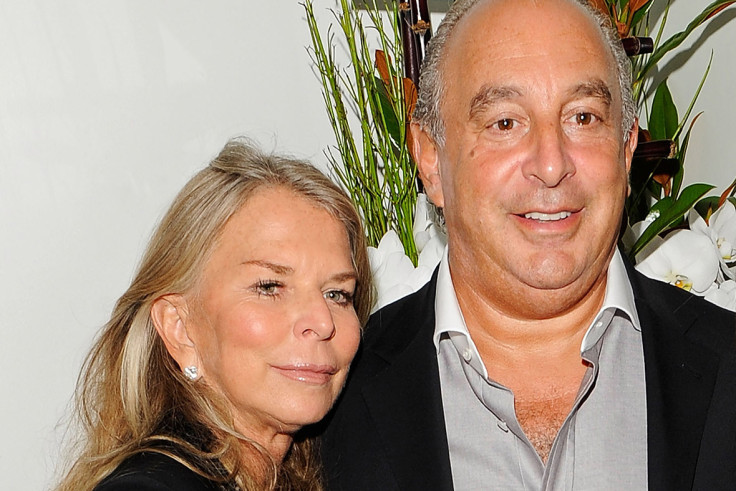

Both Sir Philip and his wife Tina Green have been asked to give evidence to Commons committees about the sale to Chappell, who has also been called to give evidence by MPs.

Chappell bought BHS for £1 from Sir Philip in 2015, taking on a £571 million pension deficit. The firm went into administration in April.

Wright said the panel would ask Sir Philip whether his stewardship of the firm and the sale to Mr Chappell had been "appropriate".

"We are keen to find out who knew what, when. This issue over the sale and acquisition of BHS raises enormous questions," he said. "Something like £414 million was taken out of BHS in dividends over a four-year period and that's when the pension scheme was slipping into deficit."

The question that they wanted to ask Sir Philip was: "You bought BHS, took enormous sums out of the business, the pension scheme went from surplus to deficit and then you sold it for a pound to somebody who was twice bankrupt and who had no experience whatsoever of the retail sector," he said. "Is that appropriate stewardship of a big, important company?"

He added that the Business Select Committee wanted to see whether the current system was "fit for purpose" when it came to creating "long-term value rather than making sure that people can extract value out of businesses to the detriment of employees and to the detriment, ultimately, potentially, of the taxpayer."

He said: "Does the system put in place a system of asset stripping rather than long-term value for a company? When you sell a business do you have any further responsibility or do you start to crash it into the cliff and then bail out just before it does crash?"

Sir Philip, who bought BHS for £200m in 2000, has also been asked to appear before the work and pensions committee, along with his wife Tina, who he once paid £1.2bn to in order to avoid paying corporation tax in the UK.

Mrs Green, who lives in the French tax haven of Monaco, owns Arcadia, the umbrella organisation that operates the British high street empire run by her husband, which includes household names such as Topshop and Dorothy Perkins.

Critics including Margaret Hodge, former chairwoman of the Commons' public accounts committee and Sir John Collins, a former chairman of Dixons who headed the Whitehall honours committee which proposed Sir Philip's knighthood, have called for him to be stripped of his title if he is found to have abused his position.

More from IB Times UK

© Copyright IBTimes 2024. All rights reserved.