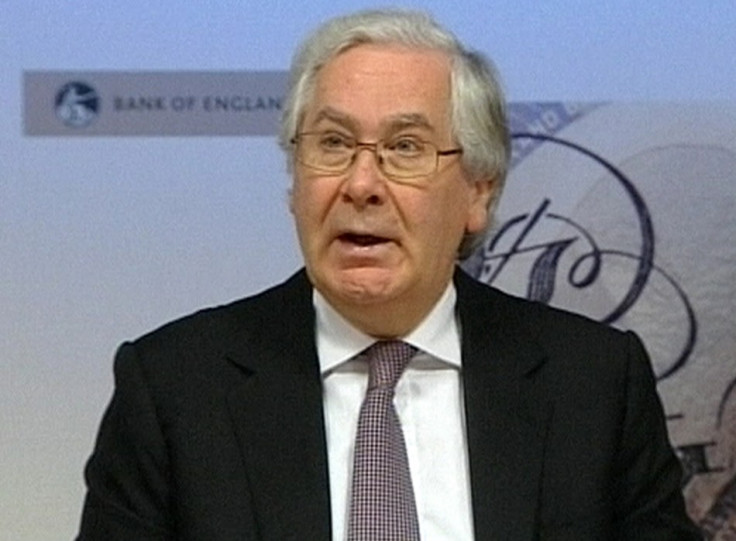

Sterling Surge Before Mervyn King Interview Raises Insider Trading Questions

UK regulators are unlikely to investigate claims that comments from Bank of England Governor Mervyn King, made during a pre-recorded interview with a UK broadcaster, may have been leaked to traders in the foreign exchange markets.

A source close to the Financial Services Authority told IBTimes UK Friday that currency trading does not fall under the watchdog's remit as a "qualifying instrument" within the market abuse directive and is largely an unregulated market in which proving a link between information and price is exceedingly difficult.

"It's nigh on impossible to prove that a particular piece of information, given during a television interview, would move prices in a market of that size," the FSA source, who asked not to be identified, told IBTimes UK.

"The burden of proof involving insider trading is whether the defendant knew the information would influence market prices."

Foreign exchange markets were alive with speculation that the governor's comments, which essentially said that the recent fall in sterling had gone too far, had been leaked following a pre-recorded interview with ITV's economics editor, Richard Edgar.

"The pound started rallying hard at around 1:30pm [London time] in a manner that was totally out of kilter with all the other markets and had its strongest day since July last year while nothing else [in the market] was moving" said one London-based trader who spoke anonymously to IBTimes UK.

"It's as clear as day that the [interview] was known by someone at a fund or a bank before it was released."

Sterling rose more than 1 percent against the US dollar during the Thursday afternoon session, hitting a one-week high of $1.5074 after the biggest single-day gain since July.

"We're certainly not looking to push sterling down," King told ITV. "[Sterling is] at the same level we were after the impact of the financial crisis. The markets judged then that was the right level for the UK. Looking ahead and they seem to judge that now," he said.

"We just have to accept that and adjust. Without the fall in the exchange rate that did occur from before the crisis to now, our export industry would not be growing as [it is] and unemployment would be a good deal higher."

King's interview was recorded at around 4:30pm London time, an TV News spokesperson said. The interview, which took place in the West Midlands, was then fed to the London newsroom at around 5:15pm and broadcast at around 6:20pm.

"His words were the most hawkish he has been since the start of the credit crunch," said the trader. "Questions need to be asked about who at ITV had access to the interview and who did they have lunch with."

Pinpointing currency orders

A spokesperson for the Bank of England confirmed Governor King's interview time with ITV and told IBTimes UK that there had been no pre-submitted questions from the broadcaster.

"They'll have trouble pinpointing the currency orders, and we won't ever know their findings as the process is opaque," said the trader, referring to officials at Liffe, the London-based futures exchange owned by the NYSE Euronext.

"It's their job to pass the suspect activity to the FSA."

James Dunseath, a spokesperson for Liffe, said the exchanges market operations and surveillance teams found no unusual activity in the market for sterling interest rate futures during the Thursday session.

The FSA's definition of insider information, according to a statement on its website, is that which is "not generally available and that a reasonable investor would use to help them make investment decisions. It is also information that, if generally available, would be likely to significantly affect the price of an investment.

"Information from research or analysis is deemed to be generally available, and is not inside information," the statement adds.

The Bank of England's most recent Quarterly Bulletin, published at around 11:00am London time Thursday, noted a "particularly large fall in the pound, with the sterling exchange rate index (ERI) falling by 5 percent over the review period.

"Some of that decline may also have been due to the impact of UK-specific factors, including the outlook for growth and the country's sovereign credit rating ... but the pound also fell against the currencies of all of its major trading partners except the Japanese yen reflecting moves toward looser monetary policy by policymakers there," it added.

The FSA does have the power to prosecute individual traders - those who are registered members - for acting dishonestly or behaviour deemed outside the bounds of the watchdog's "fit and proper person" definition that would impact markets for other regulated investments.

This was largely the basis upon which the FSA, along with regulators in the United States, took enforcement action against Barclays, the Royal Bank of Scotland and UBS for their role in the alleged manipulation of another unregulated market - Libor.

Regulatory action

"At present neither submitting to Libor, nor administering Libor, is a regulated activity under the [Financial Services and Markets] Act," the Wheatley Review of Libor said in September.

"As a result, while the FSA is taking regulatory action in relation to attempted manipulation of Libor by firms, this action is proceeding on the basis of the connection between Libor submitting and other regulated activities, and there is no directly applicable specific regulatory regime covering these activities.

"This affects the FSA's ability to supervise and take enforcement action in relation to these activities, even when carried out by a firm that is regulated in respect of its general business activities."

Currency markets, however, pose a significantly greater regulatory problem in that its massive size - the Bank for International Settlements estimates the daily global turnover at more than $4tn - makes examining the data needed to mount a successful prosecution almost impossible.

Some traders too may not fall under the FSA's supervision even if they are working in the front office of a regulated institution doing business in the United Kingdom.

© Copyright IBTimes 2024. All rights reserved.