Summer budget 2015 as it happened: George Osborne introduces Living Wage and commits to Nato defence target

Chancellor George Osborne used today's budget to announce plans to raise the 40p income tax, introduce a new National Living Wage and commit to Nato's defence spending requirement of 2% of GDP.

In a sweeping budget statement, Osborne also gave Iain Duncan Smith breathing space to find cuts in the welfare budget as part of the first all-Conservative budget in 18 years.

He also:

- Committed to spending 2% of GDP on defence

- Said pensions could soon become more like ISAs

- Capped public sector workers' pay increases to 1% for four years

- Changed rules giving landlords higher tax bills

- Announced there would be a memorial in Tunisia for the murdered Britons

- Reduced corporation tax to 18% from 2017

- Introduced a surcharge on bank profits of 8%

- Scrapped nom-dom statuses

- Committed to £12bn welfare cuts and a budget surplus 2020

After a rousing reception form Tory ranks in the House of Commons, Osborne has been installed as the favourite succeed Cameron as both party leader and prime minister.

Ravender Sembhy provides a round-up of the day the chancellor became the man to beat at the 2020 general election.

More reaction, this time from Stuart Thomson, Public Affairs Consultant at Westminster based law firm Bircham Dyson Bell, who said Labour had been "floored" by the budget. However, he warned of a sting in the tale for the chancellor.

"There are four real losers from today's Budget – Andy Burnham, Yvette Cooper, Liz Kendall and Jeremy Corbyn. The Chancellor has played an absolute blinder in delivering a truly Conservative Budget full of tax reductions, welfare tightening and measures to support business – whilst also flooring Labour and its main leadership candidates with the announcement of a Living Wage.

"However, Osborne's budgets often receive great initial headlines followed by unfavourable comment in the days afterwards once the impact of all the measures are added together.

"Small businesses and young people may be feeling particularly worried about the cumulative impact of the measures announced in the Budget. Changes to rents could also cause unexpected shifts in the housing market."

After more than an hour at the dispatch box, Osborne ushered in radical changes to welfare, pay and housing. Read his speech in full here.

In its assessment of the budget, the OBR has said "loosened" its grip on public services.

"The new Government has used its first Budget to loosen significantly the impending squeeze on public services spending that had been pencilled in by the Coalition in March.

"This is being financed by welfare cuts, net tax increases and three years of higher government borrowing. The Government has delayed the expected return to a budget surplus by a year to 2019-20, but is then aiming for a slightly bigger surplus in the medium term."

To read the full 221-page report, click here.

Two years ago, the Chancellor was 16/1 to be next Tory leader. However after today's budget speech, Osborne is now 5/2 to succeed Cameron, overtaking Mayor of London Boris Johnson as favourite, according to Ladbrokes.

The bookmaker also makes Osborne the favourite to become the next prime minister.

Next Prime Minister:

11/4 George Osborne

3/1 Boris Johnson

8/1 Andy Burnham

10/1 Theresa May

10/1 Sajid Javid

14/1 Yvette Cooper

20/1 Liz Kendall

50/1 Jeremy Corbyn

One policy that will grab headlines is Osborne's abolition of the non-dom status. From 2017, non-doms who've spent 15 of the last 20 years in the UK will pay UK tax.

But while the reforms are expected to land the Treasury £1.5bn, James Hender, partner and head of the private wealth group at Saffery Champness, said individuals could simply spend longer outside the UK.

"Abolishing the non dom status from April 2017 for long term residents will raise money for the Treasury, but I hope he hasn't killed the goose that lays the golden egg," Hender said.

"There is a risk that people affected will simply drop their number of days in the UK to ensure that they are not resident at all."

"New measures announced will also stop individuals who are born in the UK from inheriting non-dom status."

"Bringing UK properties held in offshore structures into the IHT (inheritance tax) net will unpick years of careful planning by non-doms, but it should level the playing field across the board."

Sundays might never be the same again after proposals were launched to loosen Sunday trading hours.

Sue Goble, CEO of accountancy software company KashFlow, said: "Many small businesses throughout the UK struggle to compete with the online goliaths and often restrictive Sunday trading hours continue to put SMEs on the back foot.

"Change has been long overdue and we fully support the move to even the playing field for the small businesses which should be the growth engine of the UK economy."

Landlords beware. Osborne said he would end the tax relief that allowed them to offset the interest on their monthly repayments against their income tax bills.

Here is our story on the green paper that could pave the way to making pensions more like Isas.

Labour's acting leader Harriet Harman has been on the attack.

So far she has said:

- cutting tax credits for working people will leave them worse off

- changes to inheritance tax were not as important as getting people on the property ladder

- the new Living Wage will not be enough to live on once tax credits have been removed

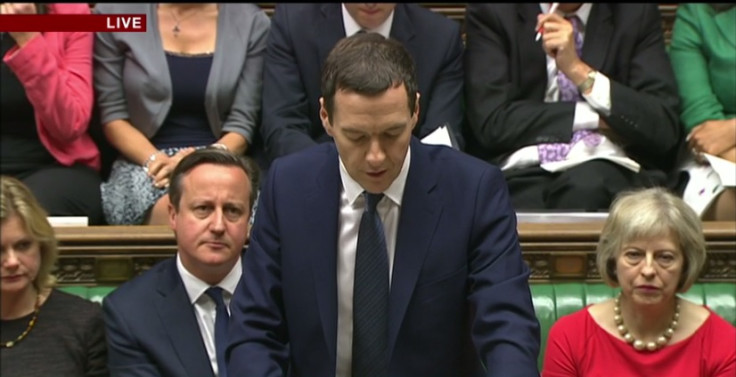

Osborne sits down to a pat on the back from Cameron.

A sweeping budget statement from the chancellor included:

- The announcement that as of April 2016 there will be a new compulsory National Living Wage for over 25s

- Starting in April 2016, a new National Living Wage will be introduced, Starting at £7.20 an hour, it will rise to £9 an hour by 2020

- Tax credits were slashed, defence spending guaranteed to meet 2% of national income and devolution to Manchester, Sheffield, Liverpool and Leeds

- Inheritance tax threshold was raised to £1m and the public sector was given a 1% pay rise for the next four years

- Corporation tax will fall to 19% next year and 18% in 2017

- There will be an 8% surcharge on bank profits introduced from January 2016

- The personal allowance was raised to £11,000 and the 40p threshold sill start at £43,000

On tax credits, Osborne outlines that income threshold for tax credits reduced from £6,420 to £3,850.

There will also be similar reductions for Universal Credit work allowances. "Not easy, but they are fair," he says.

The benefits cap will also be reduced to £23,000 in London and £20,000 in the rest of the country.

More on that public sector pay-freeze

On the "Northern Powerhouse":

Ten councils of Greater Manchester handed powers over fire services, land commission as well as children services and employment services in return for elected mayor.

Mayors also proposed for Sheffield, Liverpool and Leeds. Oyster cards also planned.

Memorial planned for victims of Tunisia massacre

Selected lines from Osborne:

"Business investment 31.9% higher than it was in 2010."

"Need to match investment at home with exports abroad"

"Almost 1m more jobs will be created over the next five years."

"Jobs created when businesses have confidence...confidence achieved when Britain has its house in order."

"Our tax receipts are stronger than forecast, showing the recovery is firmly entrenched."

"Second - as a strong majority government we've been able to get on with making extra savings in this financial year."

"Third - we can make faster progress in returning our banks, including RBS, to where they belong - the private sector."

IBTimes UK writer Lydia Smith is concerned cuts in the chancellor's budget could hit women hardest.

"For thousands of women, a lack of flexible-but-secure work opportunities needed to balance a career and caring commitments has excluded them from the workplace," she writes.

"They are hampered further by changes already implemented, including cuts to child support and the carers' allowance. So far, austerity has hit women the hardest."

Prime Minister David Cameron is taking questions in the House of Commons.

So far Cameron has:

- Said the UK is currently meeting the 2% NATO defence spending requirement

- Defended the Olympic legacy, saying sports participation has gone up and the Conservatives will build on it.

- Spoke up for English votes for English laws and said the policy was currently being debated

As photos emerge of Osborne leaving Downing Street, IBTimes UK politics reporter Ian Silvera looks back at the chancellor over the years.

The shadow of Greece and a potential "Grexit" is likely to loom over parts of today's speech. IBTimes UK senior writer Shane Croucher believes Osborne would be wrong to point the finger at the Greeks as vindication for austerity.

"We shouldn't fall for Osborne's facile comparison between the Greek and UK economies. There is a fundamental difference between the two -- the UK has a sovereign currency. When we needed to, the Bank of England turned on the QE taps and bought up UK debt from the bond markets. It suppressed gilt yields and helped stimulate the economy. It was classic macroeconomic theory in play.

"Greece, on the other hand, is part of a 19 member currency union. It cannot unilaterally turn on the European Central Bank's taps. Sharply weakening the euro may well have been what it needed, but that would have been to the detriment of stronger economies, such as Germany, which has resisted such stimulus.

"So the ECB had to balance the interests of 19 different economies. The Bank of England only has to look out for one, so it has the flexibility to react in ways that the Greeks cannot. It wasn't just Osborne's austerity and reforms that spared us the fate of the Greeks. Most importantly, it was having our own central bank."

Here are some of the the items expected to be included in today's budget:

- £12bn welfare cuts to be achieved over three years, not two

- Raising of the 40p tax threshold

- Power handed to local councils over Sunday trading hours

- Scrapping inheritance tax on homes worth up to £1m

- Child tax credits will be limited to the first two children of new claimants

- A lower benefit cap of £23,000 in London and a lower ceiling elsewhere

- Maintenance grants for poorer students to be scrapped and converted into loans

Today's budget is the first Conservative one since 1996 and the first since the party won a majority at the general election.

In May, David Cameron vowed to follow through on his party's manifesto and the budget will see Osborne flex his muscles as a Tory chancellor.

Kathleen Brooks, Research Director at City Index, predicted there could be tax increases.

"Already there have been warnings that growth could suffer as a result of decisions announced during this Budget, so to cushion some of the blow, Osborne has already announced some sweeteners including a change to inheritance tax law," Brooks said.

"Typically the first Budget after an election can be see a Chancellor sneak in some tax increases, however he has promised not to increase income tax or corporation tax this year.

"Thus, watch out for stealth tax increases instead. We also expect a few surprise sweeteners, especially as £5bn is expected to be shaved off the budget deficit for this year on the back of a pick-up in tax revenues."

The Cabinet has this morning convened for its meeting at Downing Street ahead of today's budget.

George Osborne will address MPs in the House of Commons at 12.30pm following prime minister's questions.

The chancellor will continue with austerity as he looks to eradicate the structural deficit and build a surplus by 2020 before the general election.

The 40p income tax threshold, tax credits and other welfare cuts are set to dominate proceedings but there have been overnight reports of slowing the pace of cuts to the welfare budget as well as cutting maintenance grants for university students.

© Copyright IBTimes 2024. All rights reserved.