Tate & Lyle FY 2011 Profits to Rise on Soaring Demand for Corn Sugar

Driven by higher volumes and sales growth across all product categories, Tate & Lyle Plc, the provider of specialty food ingredients and solutions, expects profits for the FY 2011 to be more heavily weighted towards the first half than usual, mainly due to the exceptionally strong performance from co-products during the first half.

The group is scheduled to report its trading update for the year ended 31 March, 2012 on Friday and is expecting to deliver good profit growth for the full year. Profits are expected to be weighted towards the first half as a result of Splenda Sucralose volumes reverting to more normal levels and the costs associated with restarting the McIntosh facility in the second half.

In Bulk Ingredients, the group expects the strong demand for corn sugar in the US and Mexico to continue, subject to normal seasonal patterns, and stable demand in its other food markets. Industrial starch, particularly in Europe, is expected to perform better than the prior year. As usual, the outcome of the 2012 calendar year sweetener pricing rounds will influence performance in the final quarter of the financial year.

"Sugar has become the UK's leading Fairtrade-branded product, accounting for a third of the entire sugar market, and is likely to extend its dominance over other commodities such as bananas, coffee and cocoa", says the head of the Fairtrade Foundation. Major U.K. sugar supplier Tate & Lyle sells Fairtrade retail sugar after having brought smallholder sugar growers in Belize into the Fairtrade system.

The group continues to maintain full silos given the continued tight corn supply. The majority of the corn it is purchasing to keep its silos full through to the end of the harvest year has been paid for in January and at higher prices than the prior year. As a result, and based on current corn prices and exchange rates, it is currently anticipated that this will drive a net cash outflow in the final quarter of the financial year and continue to expect that net debt at the end of 31 March 2012 will be somewhat higher than the £464 million at the end of the last financial year.

"Corn prices are reported as higher, so the profit upside here might not be as good as we thought," says analyst Martin Deboo of Investec Securities, adding that consensus estimates for net debt in financial year 2013 are much lower. The company's net debt stood at £410 million as on Dec.31, 2011.

Deboo adds that margins in US ethanol contracted in December on the removal of blender tax credit, which will impact the Q4 FY 2012 and FY 2013 profits. The broker has a "sell" rating on the stock and places his target price under review and says the caution sounded by management feeds concerns.

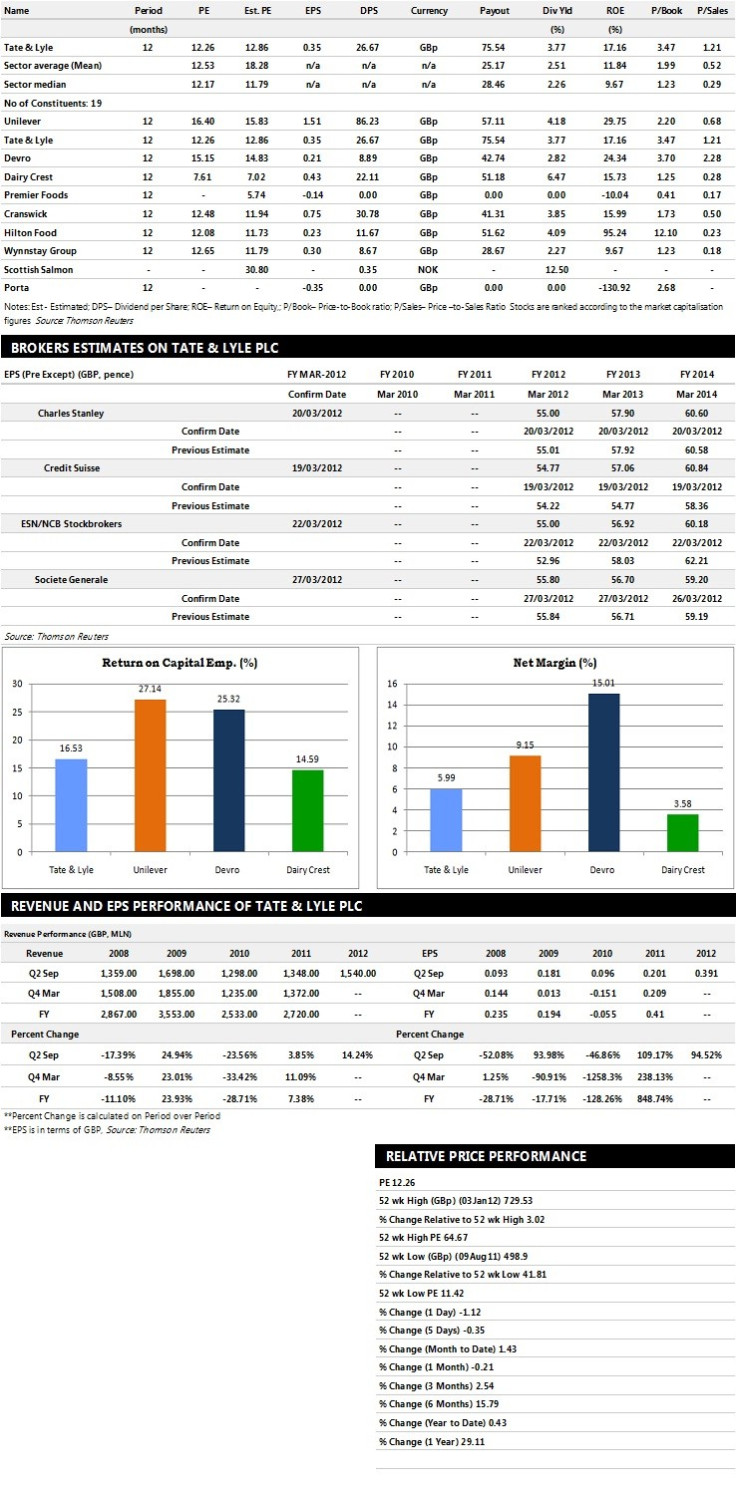

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Societe Generale recommends 'Under Perform' rating on the stock

- Charles Stanley recommends 'Out Perform' rating

- ESN/NCB Stockbroker assigns 'Buy' rating with a target price of 780 pence per share

- Credit Suisse assigns 'Hold' rating

Earnings Outlook:

- Societe Generale estimates the company to report revenues of £3,050 million and £3,230 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £319 million and £298 million. Earnings per share are projected at 55.80 pence for FY 2012 and 56.70 pence for FY 2013.

- ESN/NCB Stockbroker projects the company to record revenues of £3,063 million for the FY 2012 and £3,112 million for the FY 2013 with pre-tax profits (pre-except) of £353.21 million and £318.12 million respectively. Profit per share is estimated at 55.00 pence and 56.92 pence for the same periods.

- Charles Stanley expects Tate & Lyle to earn revenues of £2,903 million for the FY 2012 and £2,971 million for the FY 2013 with pre-tax profits of £315 million and £334 million respectively. EPS is projected at 55.00 pence for FY 2012 and 57.90 pence for FY 2013.

© Copyright IBTimes 2024. All rights reserved.