UK House Prices Rise on Scarcity and London Effect: Hometrack

British house prices rose 0.2 percent for the first time in 20 months in March on the back of increased demand, activity and a scarcity of housing for sale, according to the latest figures released from Hometrack.

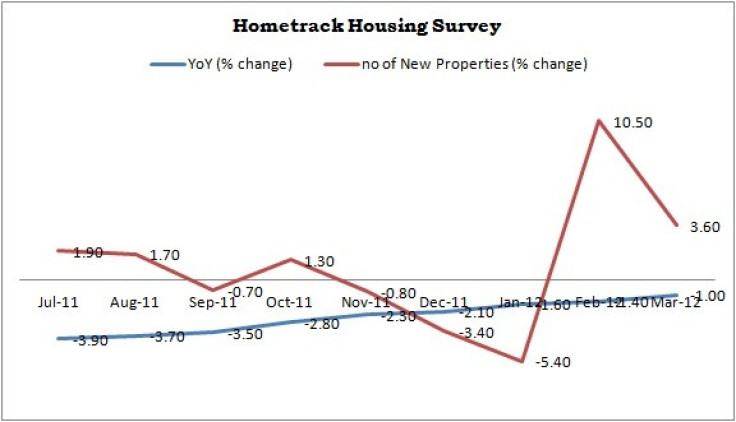

The year-on-year change for the month was -1.0 percent compared to -1.4 percent in February and change in number of new properties listed was 3.6 against 10.5 in the last month.

Hometrack's survey revealed that the ending of the first time buyer stamp duty holiday may have boosted demand but London, where prices rose by 0.5 percent, the largest monthly increase in the capital since April 2010 (0.6 percent), continues to drive the national headline figure.

The property analytics business firm said the time to sell averages just less than three months is 11.6 weeks in the midlands and north, less than six weeks in London and 8.4 weeks across the regions of southern England. While there was a 4.4 percent increase in new buyers registering with agents, compared to 18 percent in February, growth in demand over the last 2 months has created a momentum in market activity and sales to support firmer pricing.

The proportion of the asking price being achieved has increased by 0.5 percent to 93 percent from January 2012. As an indicator of the strength of pricing between markets, the tightest differential is to be found in London and the south east where the percentage is over 94 percent. In contrast the proportion is less than 92 percent in the north east and north west.

"House prices posted a monthly price rise for the first time in 20 months in March on the back of increased demand, activity and a scarcity of housing for sale according to the latest house price survey from Hometrack, the property analytics business. The survey of 1,500 agents and surveyors across the country shows that while the ending of the stamp duty holiday has boosted demand, the driving force behind the national increase was London where prices rose by 0.5 percent over the month. This is the highest monthly increase in prices in the capital since April 2010 (0.6 percent).The small rise in prices reduces the annual fall to one percent, from the 1.4 percent in the year to February and 1.6 percent in the year to January," said Richard Donnell, Director of Research at Hometrack.

Looking ahead all the evidence points to a continued firming in prices in the next few months as demand increases and supply remains suppressed, said Hometrack.

© Copyright IBTimes 2024. All rights reserved.