What to expect from the latest European Central Bank meeting

President Mario Draghi expected to announce extension to quantitative easing programme past March 2017.

The European Central Bank could expand its quantitative easing programme even further and is set to cut inflation and growth forecast when it meets for its latest monetary policy meeting on Thursday (8 September).

The financial conditions in the Eurozone have somewhat stabilised following the turmoil generated by Britain's decision to leave the European Union but growth and inflation remain stagnant, while the manufacturing and services PMI hit a three and 19-month low respectively earlier this month.

We have gone through the possible scenarios to explain what we can expect from today's meeting.

1) Will the ECB expand its stimulus programme?

Given the Eurozone's persistently anaemic inflation and growth, the ECB could, in theory at least, be forced into expanding its €80bn (£67.5bn, $90bn) monthly asset buying programme in the latest bid to shake the area's economy into life.

Some analysts, however, have suggested the ECB might be running out of options after printing out €1.2trn (£1.01trn, $1.35trn) worth of money in the past 18 months and might opt against pumping more money into the economy.

"The ECB is becoming increasingly constrained by the number of assets it can purchase under the rules of the quantitative easing program," said Oanda's senior analyst Craig Erlam.

"Therefore, before any increase in bond buying is announced, it must first alter the eligibility criteria, which is easier said than done."

2) Will the ECB extend its stimulus programme?

While an expansion of the bond-buying programme seems unlikely, its extension beyond the current deadline of March 2017 is very much on the cards, mainly as it is probably the easiest option for the Bank at the moment.

By extending quantitative easing (QE) beyond March next year, the ECB would give itself a bit more room for manoeuvre and would be able to pump more money into the Eurozone economy. The Bank had previously stated it would pull the plug on the programme by the end of the first quarter next year, but it remains far from achieving its target and extending the scheme for another six months might be the best course of action.

"We expect the ECB to switch back into easing mode after the summer break. We believe there is a strong possibility that the duration of the buying program will be extended to September 2017 or beyond," said Salman Ahmed, Chief Investment Strategist at Lombard Odier Investment Managers.

"This will be supplemented by some technical adjustments to the modalities of the easing program to relieve the constraints on buying more assets, especially, the shortage of German bonds."

3) What else can the ECB do?

While Europe's central bank is unlikely to expand its QE measures, it has a number of other options at its disposal, such as unlinking the quantity of bonds it purchases to the size of the economy or allowing the purchase of debt yielding below -0.4% – the deposit rate.

That, however, could impose large losses on the ECB – increasing the proportion of a countries issuance above 33% or adding bonds with maturities that don't fall under the current programme. The ECB could also add other asset classes to QE or choose to helicopter money – printing money to kick-start the economy – but both moves appear highly unlikely.

"The most likely option is expanding the QE deadline and increasing the issue limit for eligible bonds that local governments can buy," said Naeem Aslam, chief market analyst at Think Markets UK.

"Of course, removing the deposit rate limit will resolve the headache of what the ECB can buy and it would be one of the most powerful tools. But it may not be used, saving it for later."

4) Will the Bank cut its growth forecast?

In a word, yes. The ECB will release its inflation and growth forecast for the first time after Britain's EU referendum and while the Eurozone has weathered the Brexit storm, Frankfurt's policymakers are widely expected to slash their expectations for both inflation and growth.

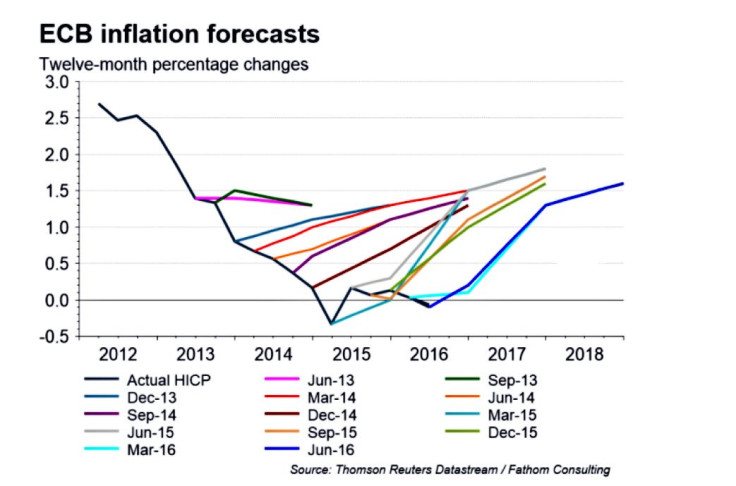

The former has missed the ECB's 2% target for the last three years in a row and is expected to fall short again for the next two years at least.

Craig Erlam, senior market analyst at Oanda, said the ECB finds itself between a rock and a hard place at the moment.

"Growth and inflation continues to elude the euro area and we're likely to find out today that Brexit has only made that situation more dire, albeit potentially less so at this stage than many would have thought a couple of months ago," he explained.

5) Will the ECB slash its interest rates even further?

No. If there's one thing analysts agree on is that Mario Draghi will announce the ECB will stay put on interest rates, keeping them unchanged at zero, with banks continuing to be charged 0.4% to leave cash at the eurozone central bank's vaults.

© Copyright IBTimes 2024. All rights reserved.