The Year of Less: What one woman learned by banning herself from shopping for a year

KEY POINTS

- Cait Flanders was in $30,000 debt when she realised she had to make a drastic lifestyle change.

- She decided to only buy groceries, petrol, and toiletries for 365 days.

Finding herself saddled with $30,000 (£22,000) of credit card debt before the age of 30, Cait Flanders decided she needed to make drastic changes.

In her early 20s, she had chosen to ignore her credit card statements. When she finally confronted the state of her finances, she saw that she was tens of thousands of pounds in consumer debt.

To make matters worse, she had only $200 left to her name and six weeks until her next paycheck. Realising it was time to transform her spending habits, she documented her journey on her blog Blonde on a Budget. After two years of strict budgeting, she began to loosen up but felt ashamed when she had to explain to her readers why she couldn't hit her savings goals.

So Flanders, 32, set herself a challenge: to let a year pass without buying a single item. She detailed her experiences in her new book, The Year Of Less. IBTimes UK spoke to Flanders to find out more about the rules she set herself and what she learned along the way.

How have people responded to your book so far? Have you received any particularly touching responses?

One response I didn't expect to get was from a friend who told me she hadn't had a drink since she finished reading the book, and that's because I was really open about my tendencies to binge consume a lot of things in the book, including alcohol.

How did you decide on the shopping ban rules?

Essentially, I just walked around my home, looked at the things I owned, and also tried to identify the things I used most often. From there, I came up with three lists. The first was a list of things I was allowed to buy, and that included groceries, gas for my car, toiletries when I ran out of them, and gifts for others. For the list of things I wasn't allowed to buy, I basically just wrote down the things I owned enough of or wanted to stop wasting money on, which included clothes, shoes, books, magazines, home decor and so on.

I also decided that I wouldn't be allowed to buy takeout coffee, because I wasn't happy with the fact that I was working from home and still spending $100 on it each month. Finally, I wrote a short list of things I could look into the future and think I might need that year. One example was an outfit for the five weddings I had to attend.

How did you stick to it? Wasn't it hard not to simply give in and buy the coffee?

It was hard at first, yes! I didn't realise how many habits I had around buying coffee and books and a few other small things. So every time I found myself in a situation where I would have habitually bought something, I had to change my reaction.

One of the things that helped was taking inventory of how many books I owned that I hadn't even read yet. Creating that kind of awareness has helped me stick to a lot of the goals I've set for myself. It also helped that I was putting $100 into a savings account every month, for the money I was saving on takeout coffee, and it felt good to finally see my money start to grow rather than always disappear.

What are the biggest lessons you learned about yourself when you didn't spend money?

The most meaningful lesson I learned came when I decluttered and realised how many aspirational purchases I used to make. I used to buy clothes for the more "put together" version of myself and books for the smarter version of myself and creative projects for the more talented version of myself. And I never used any of it, because the real me didn't want to.

That year, I had to let go of that ideal version of myself and accept myself for who I was. It wasn't easy, but it's so much easier to buy things for the real me now.

How can a person hold themselves accountable if they don't have a blog?

I think it's really important to tell the people in your daily life—especially anyone you live with or spend a lot of time with. But almost even more than that, I think it's important to identify the one person who you know will encourage you to stay on track. We all have people in our lives who will try to convince us to give up, treat ourselves, and so on.

But hopefully we also have at least one person who will encourage us to make the good choice and to keep moving towards what we want. They do it from a place of love, not judgment. That person is key. The more people will tell, the more people we have to stay accountable to. But we really just need that one person.

Not shopping for a year can be a bit daunting for the average person. What are some simple tips they can incorporate into their lives?

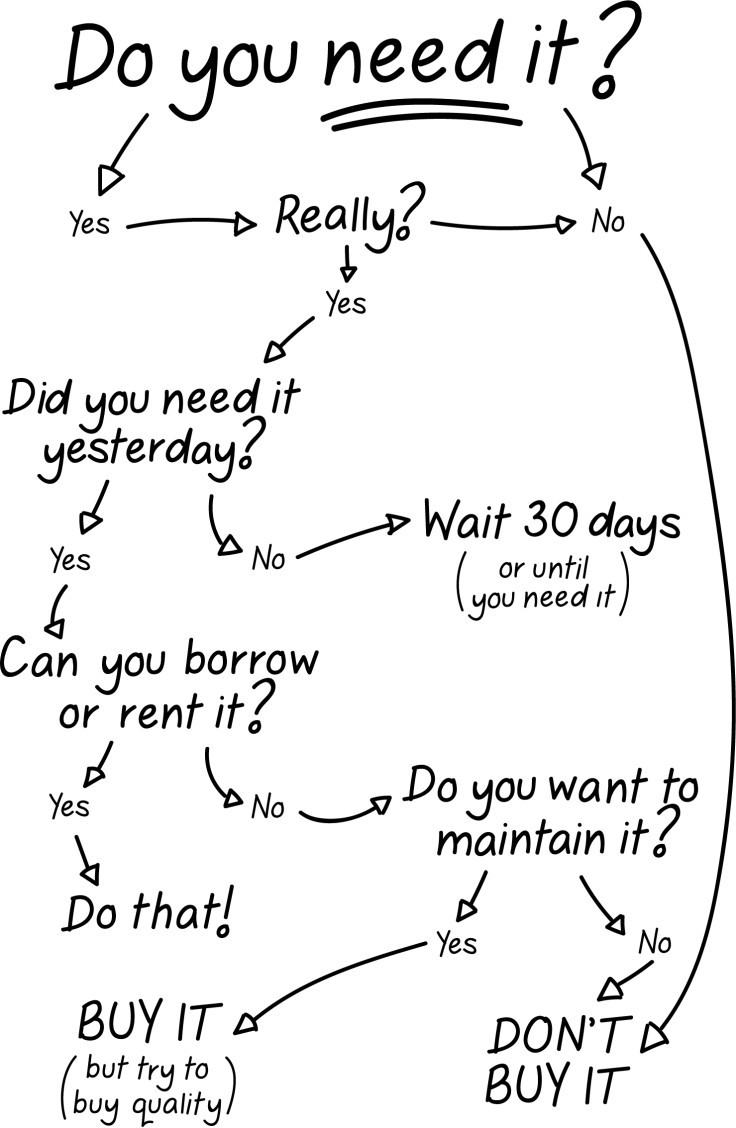

I don't think it makes sense to just jump into a shopping ban, without having an understanding of how much money you're spending right now. First just tracking your spending for a month or two. Write down every penny you spend and what it went towards. That simple exercise creates a lot of awareness, and can also help you slowly start to recognise which things you're happy to spend money on and which things you might want to naturally cut back on.

From there, you could decide which things you might want to cut out altogether for a while. Or maybe you just want to challenge yourself to cut out your vices for a month.

What do you want readers to take from the book?

I would say that my biggest intention for writing the book was to show people that whenever you're thinking of binge consuming something, it's usually because something else is going on in your life—and it's better to work on that instead.

I always turned to shopping, alcohol and food—but it didn't get me anywhere, and instead only hurt me and my life. If the book could prevent people from making just one impulse purchase or impulse decision, I would be happy with that.