Zimbabwe targets diaspora money amid worsening economic crisis

States hoping to tap into billion dollars in remittance three million in disapora send back each year.

Zimbabwe's cash-starved authorities have announced the Central Bank will set up a "diaspora remittance system" to make it easier for the diaspora to send money back home, in a bid to alleviate the economic crisis in the country.

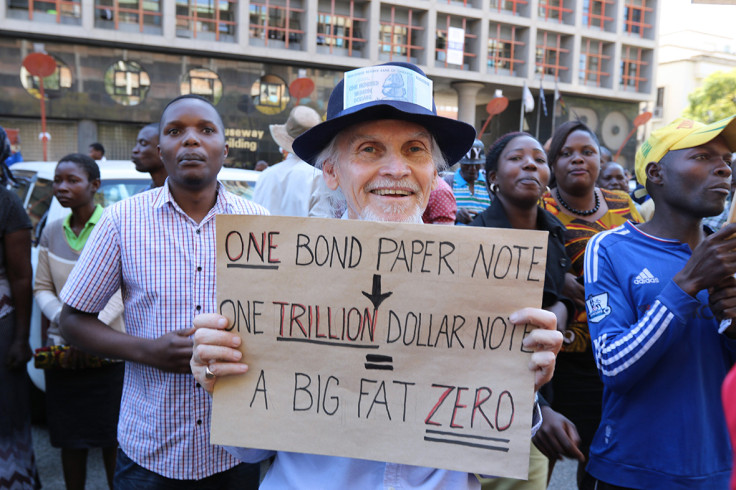

In May Zimbabwe's central bank said it would print its own version of the US dollar – effectively introducing bond notes, a form of domestic currency – to ease an acute shortage of hard currency in the crisis-hit African country. However, this measure has come under fire and protesters using the hashtags #NoToBondNotes and #RejectBondNotes have said they would resist the bond notes issuance.

Zimbabwe in recession

Facing a cash shortage for months now, Zimbabwe's Finance Ministry has also been forced to delay pay for civil servants – including doctors and the military - and authorities have imposed strict limits on the amount that ordinary people can withdraw from bank accounts.

Budget allocation failures come in the context of massive structural challenges arresting the Zimbabwean economy:

- Output and production have dropped and the estimated growth rate in 2016 is -3.8%, down from -1.1% in 2015

- Weak commodity prices and severe drought have weighed heavily on a now unsustainable current account deficit - and current budget deficit of 12% of GDP

- An uncontrollable wage and pensions bill has prevented the government from paying both regularly and on time since May 2016

- Low productivity and/or non-performance of the agriculture sector, now means at least 4.3m people are being fed by the international community, and the state is almost totally dependent on imports

As President Robert Mugabe's government faces increasing fiscal pressures, the Central Bank said it is planning to set up a "diaspora remittance system" to tap into the billion dollars in remittance 3 million Zimbabweans living in South Africa, Canada, Australia, the United States and the United Kingdom (UK) send back home to sustain their families each year.

The UK is thought to host the biggest diaspora population, with over Zimbabweans 400,000 living in the country in 2015.

"Diaspora resources remain a critical source of liquidity in the market and the RBZ [Reserve Bank of Zimbabwe] will continue to place effective systems to encourage people to use formal channels by citizens living outside Zimbabwe," the Central Bank's exchange control director, Morris Mpofu, told the Herald.

While he declined to confirm the identity of the body, Mpofu said the RBZ was in talks with another regional central bank to help set up the system.

The new system – dubbed the new Diaspora Remittances Incentives Scheme (DRIS) - is intended to entice the diaspora to use formal channels to send money back home by reducing the cost of diaspora remittances into the country, one of the reasons remittances have dipped of late.

"Regrettably, it has not always been easy for Zimbabweans outside the country to send money home. Many have been forced to send via cross border buses and other risky and unreliable methods which resulted in many customers losing the money," Mpofu said.

According to the official, a Zimbabwean delegation has recently met Indian counterparts to assess which channels the Indian diaspora use to send money back home, and incorporate systems into the DRIS.

"Sometime this year a team of officials went to India with the aim of understanding how the Indian system on diaspora remittances works. The visit does not necessarily mean that we will end up with a system exactly the same as that of India. Yes there are some good things that we might end up incorporating but the trip to India was just to understand how their systems operate," Mpofu explained.

© Copyright IBTimes 2024. All rights reserved.