Bitcoin breaks through $2,100, trades at $2,500 in Japan

The Japanese have given bitcoin the green light as a currency.

Bitcoin has broken through the $2,000 mark after a strong bull run with a fleshing out of the crypto ecosystem where positive regulatory moves, specifically in Japan, have prompted a large inflow of fiat in the last couple of months.

The Japanese have given bitcoin the green light as a currency and are looking to increase the rigour that their exchanges are subject too - all in all positive for the industry as it moves more mainstream.

Meanwhile, Chinese exchanges switching back online after the People's Bank of China (PBoC) halted withdrawals due to AML and KYC concerns in January this year. These exchanges have been trading at a steep discount for the past couple of months as money has essentially been trapped by the PBoC's diktats.

Interest in other cryptocurrencies has also brought money to the table due to various ebbs and flows from Bitcoin for a variety of reasons, such as increased transaction fees.

Bitcoin has rallied following recent revelations of its involvement with the WannaCry global ransomware attack. It was the currency of choice for a ransomware attack which struck 200,000 organisations.

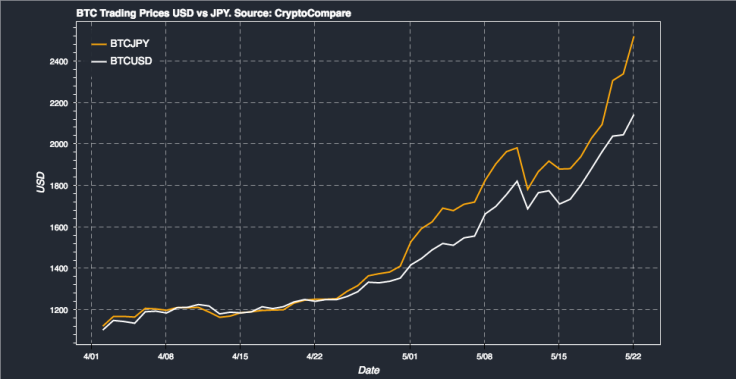

Charles Hayter, CEO, CryptoCompare, provided some analysis of the latest bounce: "Bitcoin trades across multiple fiat pairs in a range of local and global exchanges. These pairs often trade at different prices due to fees, entrance and exit routes, and various perceptions of the safety of the exchange. For example on the USD market exchanges have traded at up to a 5% difference. This can be exacerbated by various factors.

"When these inefficiencies occur there are opportunities to arbitrage the difference. So large discrepancies or rises on one particular pair - for example the JPY BTC pair - can drag up the USD BTC pair as demand on one markets prompts opportunities on another."

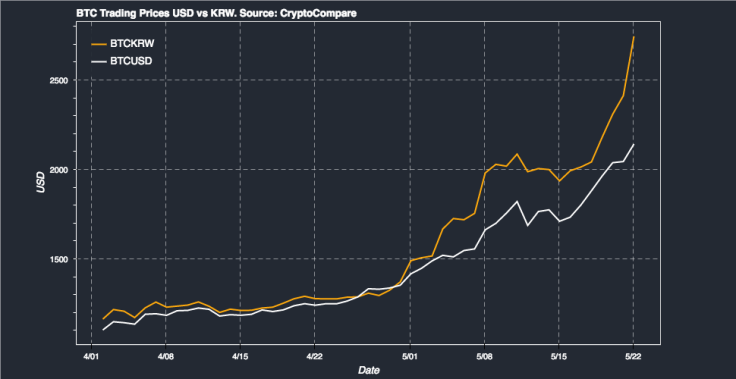

Charts below showing the JPY Premium over time and price differential to the USD markets.

Bitcoin, which is often described as digital gold, tends to increase in times of geopolitical uncertainly, which can result in periods of high correlation for Bitcoin and gold. Bitcoin traditionally moves with a higher beta than gold so spikes higher to the upside and at the moment Bitcoin is defying its gold relationship and subject to its own internal machinations. Gold has traded between 1240-1280 USD/oz whilst bitcoin has doubled in the last three months.

Other interesting points to note are that Litecoin has taken up an avant-garde position for out Bitcoin's segwit upgrade and early moves towards adding a lightening network for faster transactions.

With regard to scaling, a proposal has been put forward by Digital Currency Group CEO Barry Silbert that cherry picks various elements to attempt to assuage both side of the political debate, there are no clear indications of a solution as of yet.

Meanwhile, a brave new blockchain industry seems ready to fund itself by selling tokens in yet to be built infrastructure - and the words "cryptocurrency bubble" are being mentioned. The ICO factor is undoubtedly also pushing up prices of existing coins and tokens.

Ethereum has been the other big driver across the ecosystem; and this is now more pronounced with news, for example, that the Ethereum Enterprise Alliance just added 80-plus companies.

EEA has more than tripled in size, with the group announcing 86 new members, including South Korean manufacturer Samsung, pharmaceuticals giant Merck, automaker Toyota, investor communications platform Broadridge, financial markets firm DTCC, and the Illinois Department of Financial and Professional Regulation, which oversees licensed businesses in the state.

"Ethereum is is also seeing its markets dislocate as the Korean won takes a large premium. New fiat onramps into the cryptocurrency are distorting market prices but the fundamental levels of adoption and use by industry have been key in igniting price momentum," said Hayter.

© Copyright IBTimes 2025. All rights reserved.