European Crisis Live: Spain's Bankia Plunges, Drags European Markets Lower

- Spain dominates headlines as state-owned Bankia shares plumment on bank run concerns

- ECB confirms market speculation that is has cut-off lending to certain Greek banks as depositors flee

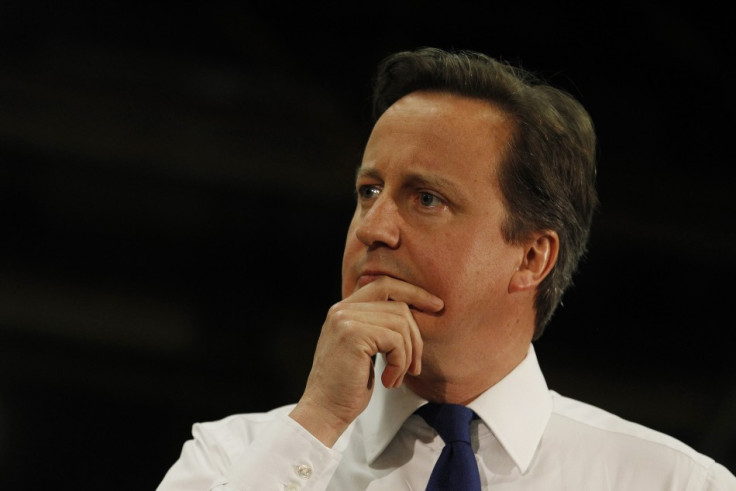

- Britian's Prime Minister David Cameron says Eurozone at the crossroads

- Weak US maufacturing data keeps European shares in the red

1455 GMT: That's it for me!

Thanks again for following along our new liveblog experiment. I'll leave you with a quick overview and see you at the start of trading tomorrow:

FTSE Eurofirst 300 -9 points, or 0.92 percent, to 983.71

Euro trading at 1.2709

German 10-year Bund yields touch record low 1.42 percent

1440 GMT: IMF set for post-election visit to Greece

Business or pleasure? We're not sure but Reuters is reporting that IMF officials will visit Athens following the 17 June vote. IMF rules stipulate that funds can only be disbursed if controlling governments are in compliance with previous loan commitments. Clearly, if Syriza's poll numbers translate into an Alexis Tsipras-led government, IMF folks will be island hopping as opposed to number-crunching.

IMF officials also said the European Central Bank had "room for further easing" given the Eurozone's balance at the edge of recession.

1425 GMT: QE - British style

Paul Fisher of the Bank of England tells Dow Jones Newswires that another expansion of the BoE's £325bn asset purchase programme would only be necessary if the current UK recession deepens significantly, a scenario he feels is unlikely.

"We've had a couple of quarters of negative growth, but we haven't really had a fall back into a deep recession," he said. "If I saw that risk re-emerging, then personally I would want to think again about restarting ... if there is not that serious possibility of deflation down the road, then I think there is less impetus behind doing more asset purchases."

1420 GMT: Greece Must Exit

... well, at least according to Dr. Doom himself, Nouriel Robuini

1400 GMT: An early answer to my "will US set the tone for Europe" question:

A key component of the Philadelphia Fed Index, a gauge of business activity around the north eastern United States, fell to -5.8 in May, a full 14 points shy of the market's expectations. The employment index reading was also dismal, falling to -1.3 versus a 17.9 reading in April.

Non stock market reaction is fairly mechanical: investors bet the weakness, particularly in the employment component, will compel US Federal Reserve to examine another round of quantitative easing. This lifts bond prices (because that's what the Fed will buy) and weakens the dollar (because the "textbook" says more QE is inflationary, even if there is nothing but Ouiji board data to support that view).

Euro benefits marginally as a result, trading past 1.27 against a weakening greenback. FTSE Eurofirst 300 off 11 points now to 981.44

1350 GMT: More from the JPMorgan conference call on the Eurzone crisis:

Foreign claims on European banks amounst to around $5tn, 25 percent of which are in the United States. Barclays, which has the biggest Spanish exposure of any UK bank, is down 3.12 percent.

London's FTSE 100 off 1.04 percent at 5,349.00

1335 GMT: US equity markets open in the red.

First kick at the markets for US investors starts with a fall: the Dow ticks down 3.37 points to 12,595.18 while the broader S&P 500 opens little changed at 1,324.79

It will be very interesting to see if US momentum leads or lags the pace of European trading over the next few hours as the headlines dry-up. Mind you, there is still the Moody's decision on Spain's banks, but if media reports are accurate, that won't be until after the close of European trading - but still within an hour of the US close.

1330 GMT: JPMorgan hosting a conference call as we speak on its views of the European finacial crisis

Sadly for everyone, live coverage of the event is impossible! (I'd much rather hear this than the prepared remarks of David Cameron). Blogger ZeroHedge Tweets that JPM says risk markets have *not* priced-in a Greek exit. Others Tweeting JPM says Spain and Italy could lose capital market access in a post-Grexit scenario.

1325 GMT: Fundamentals clearly aren't having much of an impact on today's European session.

There's been some stabilistion in equity markets and the single currency following a tepid jobless benefit claims report from the United States (weekly little changed at +370,000; four-week moving averge down marginally to 367,000).

The FTSE Eurofirst 300 is down about 8.8 points, or 0.89 percent, to 984.00. The Euro has climbed from a session low against the US Dollar to trade little-changed on the day at 1.2715

1300 GMT: Bankia shares resume trading, now down net 10 percent on the sesson

Chairman Jose Ignacio Goirigolzarri speaking to the media: says depositors can be "absolutely calm" and that deposit flows are "seasonal". He expects to see no substantinal change in balances in the coming days.

UPDATE (1320 GMT): Bankia Statement:

IBEX down 1.57 percent on the day to 6545.3

1155 GMT: Some clarity on the Spanish downgrade rumour.

Spain's Expansión newspaper says the Moody's move on its banking sector will be released today at 1900 GMT. It doesn't appear to indicate a corresponding downgrade for Spain. A move to cut around 21 bank ratings has been anticipated for some time, and would follow swiftly from Moody's earlier change in assessment on many of Italy's most important lenders.

IBEX down 2.5 percent. FTSE MIB down 2.5 percent.

UPDATE: Spain's Economy Secretary Fernando Jimenez Latorre tells Reuters: "It's not true that there is an exit of deposits at this moment from Bankia".

11:45 GMT: European banking shares accelerate declines on Spanish debt downgrade speculation.

Spain's IBEX now down 2.42 percent to 6,450.1, falling about 0.5 percent after talk of Moody's move hits social media and the domestic press. FTSE MIB is down 2.51 percent, or 330 points. Euro STOXX Banks down 3.38 percent to 78.22.

"Moody's has assumed that the Spanish government has a high propensity to provide system-wide support, even if doing so could undermine the government's own credit profile. Consequently, it has so far been possible for systemic support -- calculated using Moody's Joint Default Analysis methodology -- to lift Spanish banks' ratings above that of the government. This implies a lower probability of default for certain banks than exists for the sovereign, even though the standalone strength of those banks is at (or below) that of the sovereign." - Moody's 7 May 2012

1127 GMT: BREAKING: Spanish media reports Moody's will cut Spain's debt rating later today. Moody's rates Spain's sovereign debt at A3 with a negative outlook.

Spain's benchmark 10-year bonds are falling fast, rising 11 basis points on the day to trade at 6.39 percent.

1125 GMT: Markets seem a tad subdued now that Bankia isn't playing the role of "dead weight" on the European banking sector, so let's get a tally of where were are at midday.

The FTSE Eurofirst 300 is down around 0.94 percent to 983.56

In Britain, the bank-heavy FTSE 100 leads the major bourse declines, falling 51.86 points to 6,332.47. France's CAC-4- is just behind, shedding 30 points, or 1 percent, to 3,018.35. Germany's DAX is .8 percent down to 6,333.23

In the bond markets, 10-year German Bunds hit another all-time low of 1.43 precent this morning while the Euro fell to 1.2674, with most of the declines coming after the collapse of Bankia shares.

German Bund futures for June delivery hit a record 143.79 after rising 61 ticks on the session.

1055 GMT: Bankia shares suspended in Madrid after 30 percent plummet.

Plunge takes Euro STOXX Banking index to all-time low 78.53 and pulls IBEX 1.7 percent lower. Both indices stablise as shares cease to impact benchmark

Reports of several major banking shares in Italy being suspended, as well, as FTSE MIB dips 2 percent and approaches 13,000 threshold.

Spain's benchmark 10-year bond yields rise to 6.34 percent and trade 489 basis points over German Bunds.

1030 GMT: Euro falls below 1.2700 against the US Dollar as banking shares around the region tumble. Trading at 1.2699

Single currency falls to three-month low 101.867 against the Yen.

FTSE 100 declines accelerate as Britain's benchmark passes five-month lows. Now down 1.05 percent to 5,347.81: Lloyds (-3.7 percent) RBS (-3.98 percent) and Barclays (-4.05 percent) lead banking sector decliners.

1025 GMT: IBEX now down more than 2 percent as bank stocks plumment following Bankia free-fall

Euro STOXX Banking Sector Index now down 2.6 percent and within 2 pips of its all-time low (now trading at 79.04). Italy's FTSE MIB off 2.2 percent, reversing modest earlier gains, to trade at 12,990.05

1010 GMT: Bankia shares are now down more than 26 percent and are being auctioned in the Spanish market, Reuters is reporting.

The move will hopefully stop the free-fall which has taken more than 37 percent from the state-owned lender's share price in less than two days. Together with the capital flight stories coming from Madrid and news last night that the ECB will no longer fund technically insolvent banks in Greece, we're beginning to see how contagion from the political turmoil in Athens may play out across the region.

Spain's banks are sitting on as much as €323bn in real estate loans, according to RBS research, a good portion of which could be impaired by the deepening recession reported by the Economy Ministry earlier this morning. Capital needs of the seven biggest lenders (which includes Bankia) could be anywhere between €68bn and €98bn, RBS adds, in order to bring them into line with EU and Spanish government objectives.

These figures would, of course, need to be added to the €240bn Spain's government will need to raise over the next two years if the banks were unable to access capital markets in wake of a Greek exit from the single currency. With Spain's borrowing costs already elevated well past 6 percent (6.33 percent as we speak), further burdens on state funding would be nearly impossible to bear if the market walked costs closer to the 7 percent level.

1005 GMT: More from Cameron in Manchester:

Without Germany the Eurozone would be in a recession, the PM says factually, adding that the debt crisis in the Eurozone is the "backdrop against which we have to work".

"It's only right that we set out our views. We need to be clear about the long-term consequences of any single currency. In Britain we have had one for centuries. When one part of the country struggles, other parts step forward to help. There is a remorseless logic to it.

He says a "painful and prolonged adjustment" is the only way to resolve the internal imbalances within the "rigid" euro system that "locks down each state's monetary flexibility while limiting fiscal transfers between the

1000 GMT: I'm seeing trust-worthy reports on social media that Bankia shares are down 22 percent from yesterday's close in Madrid. The IBEX is now down more than 1 percent and well into a 9-year low of 6,542.4.

Bankia, the newly-nationalised lender and the fourth-largest in Spain, last night declined to release its first quarter earnings statement until auditors clear the figures of its parent company, BFA, which is now 45 percent State-owned. Reuters reported this morning that Deloitte has identified a €3.5bn gap in BFA's valuation of its Bankia stake.

The news agency also said that more than €1bn has been taken out of the lender over the past week, citing domestic media reports.

0940 GMT: Timing is everything: PM brags about his fiscal record as his Debt Management Office reports the highest-every demand recorded in a Gilt sale:

"Since we took office two years ago, we have cut the deficit by more than a quarter. Yesterday we had encouraging news on unemployment too. The number of people in work is up by one hundred thousand in the last quarter.

"The number of business start-ups last year was one of the highest in our history ... Now more than ever is a time to stand firm."

The DMO re-opened a 5 percent Gilt maturing in 2014 for a £1.5bn sale. The fat coupon attracted 3.67 times more in bids than was on offer, a record "bid-to-cover" ratio for a conventional Gilt sale. The yield on the bonds after pricing was a record-low 0.351 percent.

As Nobel Laureate Paul Krugman had said many times, debt servicing costs are far more important that nominal debt levels if you're running persistent budget deficits.

0935 GMT: More from Britan's Prime Minister in Manchester:

"We are living in perilous economic times. Turn the news on TV and you will see the return of a crisis that never really went away."

"Faced with this I have a clear task - to keep Britain safe. Not to take the easy course, but the right course ... My message today is that it can be done. We are well on the way in this journey."

0930 GMT: Cameron vows to stick to deficit reduction strategy in the face of Eurozone debt crisis during his Manchester speech.

Given the mix of economic performance and outright incompetence being displayed across the Channel, it's probably not terribly surprising the Prime Minister feels emboldened enough to "stay the course" despite the constant attacks on his government's economic record at home.

Cameron says he want the ECB and the Eurozone to do more to stimulate demand (if €1tn in LTROs didn't do the trick, one wonders what might) and he likes the idea of "project bonds" floated by new French President Francois Hollande (take *THAT* Merkozy!)

0925 GMT: UK Shadow Chancellor Ed Balls fires a few shots across the bow of the Good Ship David Cameron ahead of the Prime Minister's speech to business leaders in the Northeast of England.

"When countries like France and Germany have avoided recession despite the Eurozone's problems, it's clear Britain's double-dip recession was made in Downing Street."

0855 GMT: Early investor reaction to Spanish auction is broadly positive: demand was solid for the smaller, earlier-maturity tranches, but funding costs rise across the board as expected.

Spain now says aroud 56 percent of its gross funding needs for the year have been completed (to date it's raised €48bn). Spain's benchmark 10-year bonds "tighten" (ie fall in yield, rise in price) by around 4 basis points to 6.30 percent post-auction.

Euro little changed at 1.2717 against the US dollar after the results hit the wires.

0845 GMT: Spain's bond auction hits the tape: the biggest of the three sales, a €1.1bn four-year, priced to yield 5.106 percent, an increase of 172 basis points from the last sale. The bid-to-cover ratio was very poor, falling to 2.4 from 4.1, meaning investors bid €2.1 for every €1 for sale.

Increases across the board for the two three-year tranches, as well. The Jan 15 2015 bond (€372m) cost Spain 4.375 percent (+186 basis points from prior sale) and the July 2015 piece (€1.024bn) was 4.876 percent (+84 basis points).

0800 GMT: European markets are all in the red now as the first hour of trading winds up and investors settle in for what could be a long session.

Banks are in focus as the Euro STOXX Banking Index slips 0.51 percent to 81.02 - just a few ticks away from yesterday's all-time low 79.02. FTSE Eurofirst 300 is down about 0.25 percent, or 2.44 points, to 990.37

Germany's benchmark 10-year bunds are trading at 1.466 percent. Spain's 10 year bonds are bid at 6.33 percent or 487 basis points over Bunds ahead of the 0830 GMT auction.

0750 GMT: When in doubt, schedule a meeting. Media reports say David Cameron will link-up with Mario Monti, Angela Merkel, Francois Hollande and Herman Von Rompuy at 1530 for an emergency vidoeconference.

What this might achieve, however, is unknown and certainly unstated. World Bank President Robert Zoellick said it best last night: (paraphrasing) it's not really about Greece anymore. It's about Spain and Italy.

They've got a *minimum* of €780bn in combined financing needs over the next two years. If capital market access if cut off because of contagion from a Grexit, those needs simply cannot be met by the existing facilities of the Eurozone or the European Central Bank.

Politicians can do many things. What they rarely do is engender confidence. At this stage, it's hard to see what else will stop the rot.

0735 GMT: Bankia shares now down 11 percent after re-opening following a trading halt. Decline pulls the IBEX down 0.4 precent and past 9-year lows into 6,548.8.

Athens stocks are down 1.3 percent in early dealing (delayed quote) with focus again on banks and depositor flight.

0720 GMT: Markets looking at bit mixed as the first numbers roll in Spain's IBEX 35 is holding on to slim gains of 0.55 percent but that might be difficult to maintain given the weight of the decliners - all of which are banks.

Bankia, the country's fourth-biggest lender, is down 5 percent after saying last night it will delay publishing it first quarter results. Bankia is effectively 45 percent owned by the Spanish taxpayer after the government converted a earlier loan into a 45 percent equity stake in its paretn, Banco Financiero y de Ahorros (BFA).

Reuters reported earlier this morning that Bankia depositors have withdrawn more than €1bn from the bank since it was nationalised.

FTSE Eurofirst 300 gives back first minute gains to trade at 991.1, down 1.71 points or 0.17 percent. London's FTSE 100 is down about 16 points or 0.3 percent to 5,387.51, a five-month low.

Sterling slipped to a one-month low against a resurgent US dollar. Cable, as the sterling/dollar trade is known, is now trading at $1.5888

0710 GMT: British Prime David Cameron is set to make a statement on the Eurozone crisis later this morning (0900 GMT) during a speech to business leaders in the Northeast of England. He's expected to repeat concerns expressed yesterday during Prime Minister's Questions in the House of Commons that the spiralling crisis is hurting Britain's economic prospects.

0700 GMT: Spain's recession deepens as first quarter GDP comes in at -0.4 percent year-on-year, a 0.1 percent decline from the previous reading. On a month-to-month basis, the figure remains unchanged at -0.3 percent.

As expected, broader European stocks are opening stronger with the FTSE Eurofirst 300 rising 0.05 percent to 993.32. Similar gains for domestic bourses in Germany, France and Spain.

0650 GMT: Good Morning!

Europe looks set to open a little bit stronger this morning after a solid session in Asia following some surprising growth figures from Japan. The MSCI Asia Pacific Index marked a 0.7 percent advance in a cautious session which snapped a 6-day losing streak and got its biggest boost from Japan's 4.1 percent GDP print for the final three months of last year.

Today's European calendar is thin but focused: Spain will report the final reading of its first quarter GDP figures 0700 GMT and test the bond markets about ninety minutes later with a two-part €2.5bn bond auction. Market prices for Spain's existing 10-year bonds are firmer this morning but still indicate a yield-to-maturity of 6.27 percent.

Greece is also likely to dominate the newsflow after the European Central Bank confirmed late Wednesday the persistent market speculation that it had withdrawn lending to some Greek banks until it was satisfied with thier progress on recapitalisation. Greek stocks, which had already closed at a 22-year low 555.42 will be likely be under immense pressure at the opening bell.

© Copyright IBTimes 2024. All rights reserved.