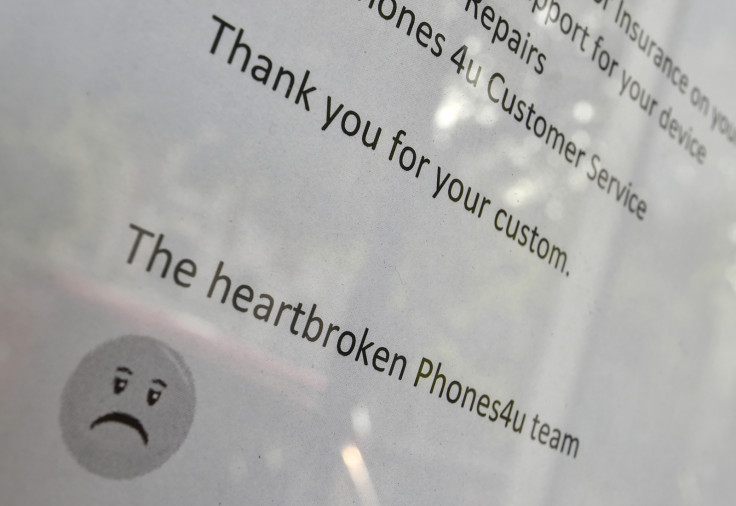

Phones 4U: How Vodafone and EE 'Got Their Prize' at a Firesale Price

Thank goodness for the magnanimous saviours of scuppered mobile seller Phones 4U - its contract suppliers, Vodafone and EE, as well as one-time competitors (Carphone Warehouse) and concession partners (Dixons).

And damn those evil, rapacious Gordon Gekko-like private equity owners, BC Partners, who paid themselves dividends and saddled the firm with a load of debilitating debt.

Well, that was the judgement passed by the Financial Times (FT) on 22 September.

It pointed out that while Vodafone had announced a drive to open 150 more retail outlets, BC Partners failed to sufficiently invest in spreading the retailer's footprint.

Phones 4U's owners did increase the numbers of outlets to 700, but had refused to go the whole hog of buying up premises and so on, and instead chose to open concessions inside Dixons stores.

These arrangements were slated for expiry the moment a merger of Carphone Warehouse and Dixons was announced, obliterating 20% of Phones 4U's sales pitches.

Meanwhile, BC Partners extracted £200m (€254m, $327m) of rather costly debt from the firm last year, with which it paid investors a special dividend.

This left Phones 4U unable to compete on the high street - as Vodafone was quick to point out- once the mud-slinging began.

Vodafone said: "Phones4U was offered repeated opportunities to propose competitive distribution terms to enable us to conclude a new agreement, but was unable to do so on terms which were commercially viable for Vodafone in the current UK market conditions."

However, there are two sides to every story. Sometimes there are several.

A source close to boardroom discussions, alluded to above by Vodafone, told IBTimes UK that between June and August this year Phones 4U reached an agreement with Vodafone for a deal to renew contracts.

This culminated in Vodafone UK making a presentation to Vodafone Group on 14 July which was about the commercial terms of the deal.

"However, Vodafone Group said, 'hold on – we might be interested in buying Phones 4U'," according to the source.

The source said EE was also involved in discussions about the possibility of buying the group together.

There were never any issues with the capital structure of the business, or commercial terms. The sudden derailment of the renewal agreement was driven by Vodafone's "Project Spring" - the retail expansion plan cited by the FT.

"It seems they'd decided to open their own stores. The way we see it, they took a good look at what they wanted to buy, and realised they didn't have to pay a premium for it," the source added.

"It's of course very convenient for Vodafone to say it was all down to the debt/dividend. But Phones 4U had a £100m in cash after paying out the dividend, which incidentally was agreed upon prior to the announcement of the Carphone Dixons tie-up."

According to this side of the argument, Vodafone did everything short of breaking the law to get its way, but to make it clear, no regulator has voiced any concerns yet over wrongdoing.

But who are the real losers at the end of the day?

Vodafone and EE - whether they intended it or not - are buying up Phones 4U at fire-sale prices; Dixons Carphone is scooping up its share; BC Partners, once the dividend is factored in, walked away with a 30% return on initial investment; and PwC is picking over the remains.

That just leaves the 1,700 people who have lost their jobs.

Vodafone and EE had not responded to calls for comment by the time this article was posted.

© Copyright IBTimes 2024. All rights reserved.